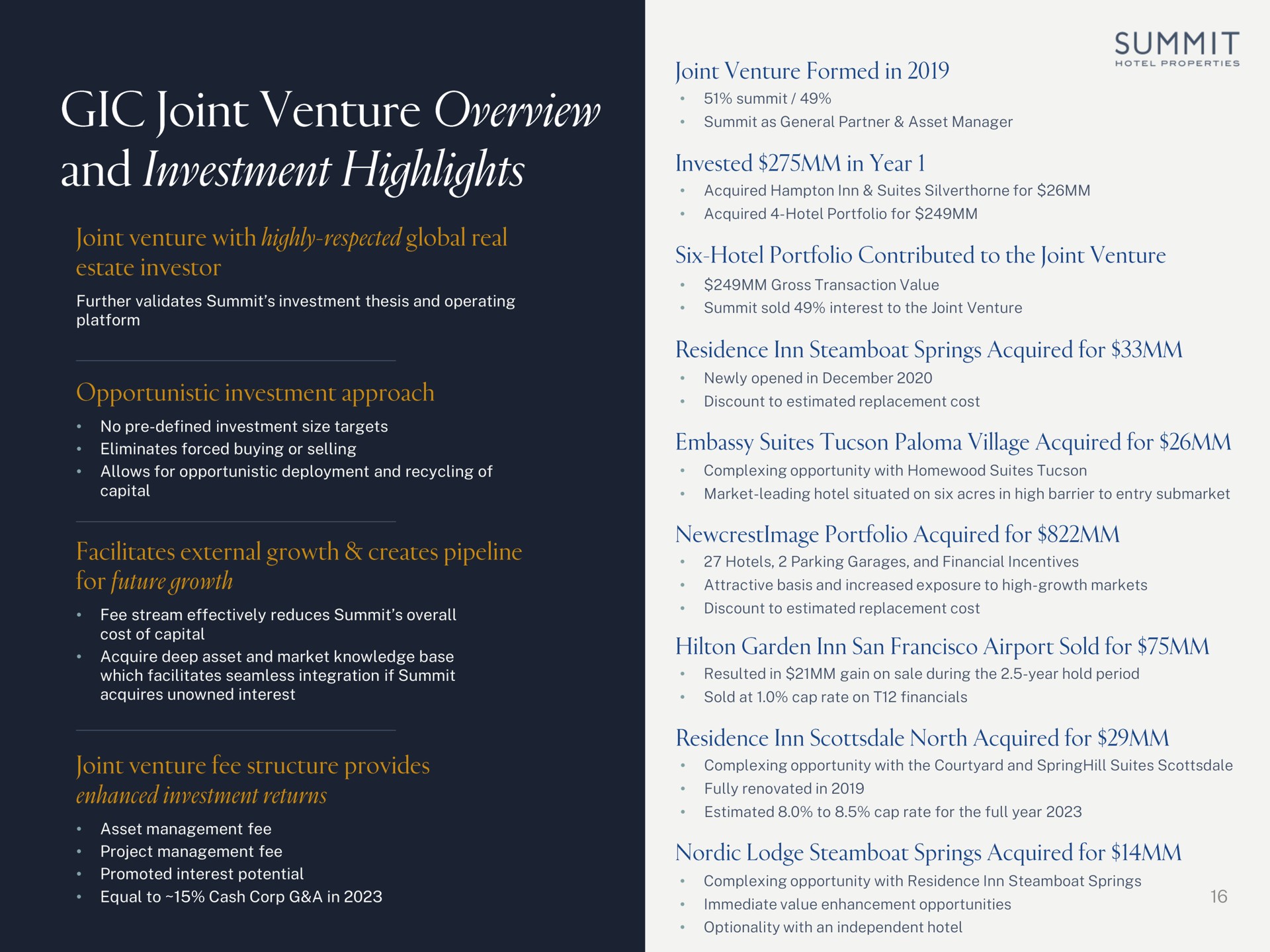

Summit Hotel Properties

Company

Deck Type

Sector

Industry

Deck date

June 2023

Slide

16 of 35

Similar slides by Summit Hotel Properties

Related slides by other companies

Results

August 2020

SPAC

July 2020

Investor Presentation

May 2022

Investor Presentation

February 2023

Other recent decks by Summit Hotel Properties

Search Thousands of Presentations by World Leading Companies

Stay in the loop

Join our mailing list to stay in the loop with updates and newest feature releases

© 2021-2023 Slidebook.io