Contents

Both investor presentations and pitch decks started to gain traction in the 1990s, going through rapid transformation after introduction of PowerPoint and Keynote. Initially, these presentations were utilized primarily to convey basic financial information. However, with time, there was a notable shift towards emphasizing the storytelling and vision behind a company and its products.

Pitch decks, in particular, gained prominence in Silicon Valley, where startups were constantly in search of funding from venture capitalists. The unique challenges of this environment necessitated a concise, yet impactful way of communicating business ideas. This led to the development of the pitch deck format, characterized by its brevity and focus on a compelling narrative.

On the other hand, investor presentations have their roots in the visual aids used for corporate communication purposes, such as during investor calls, product launches, and major corporate events (like IPOs and acquisitions).

A pivotal moment in the evolution of both formats was Steve Jobs' introduction of the iPhone. His presentation style, marked by clarity, simplicity, and a strong narrative, set a new benchmark for product launches and presentation decks in general.

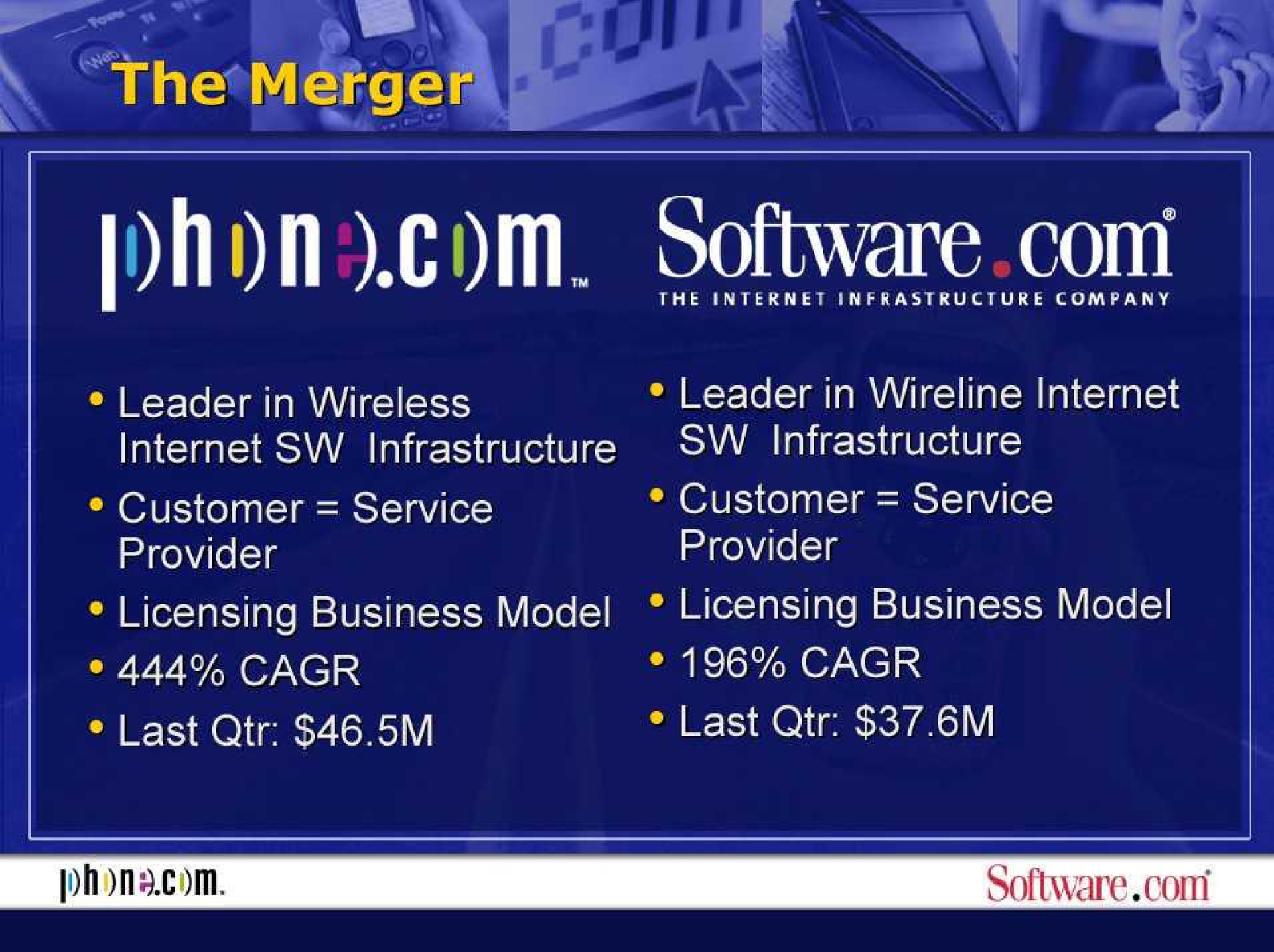

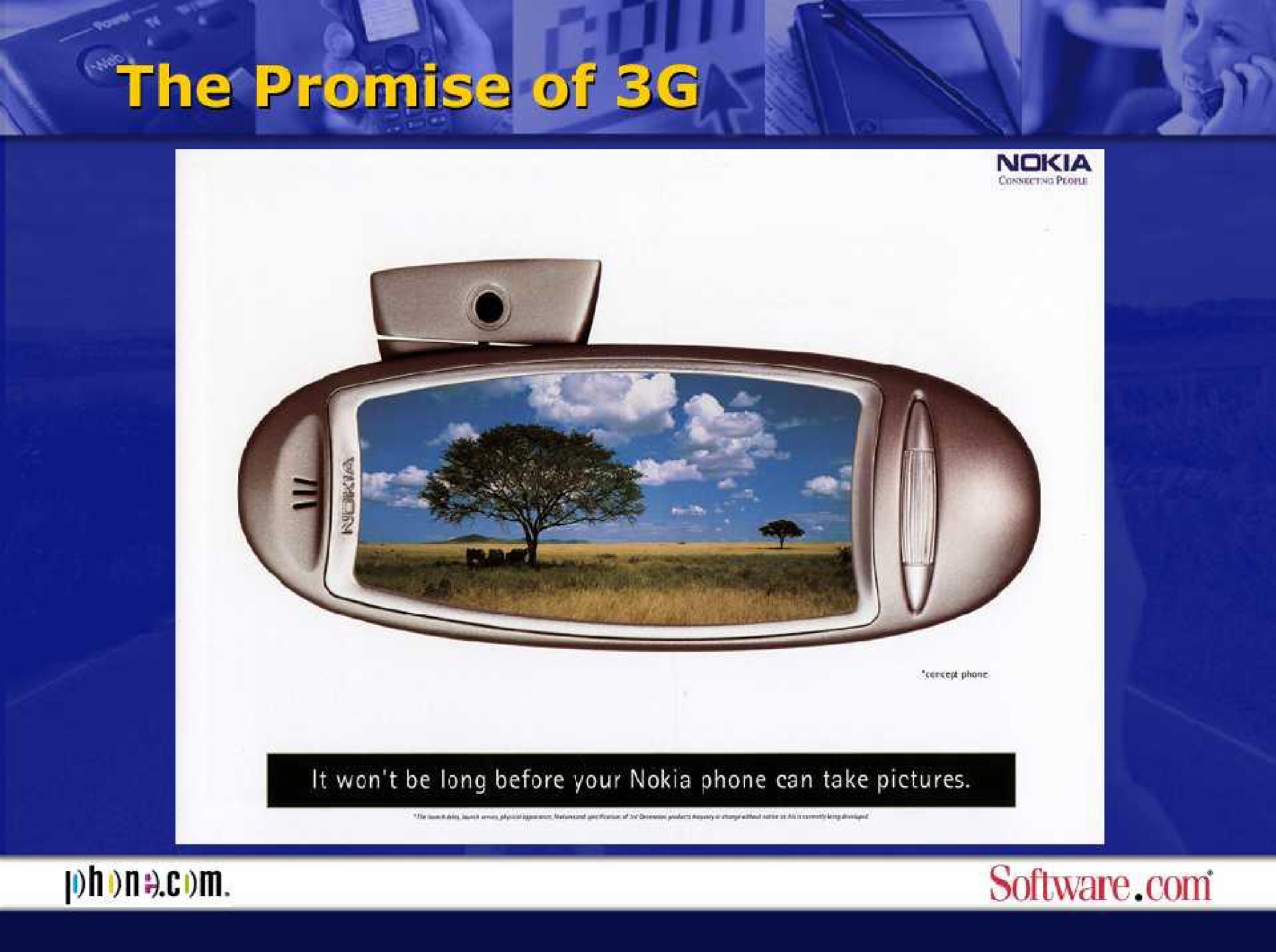

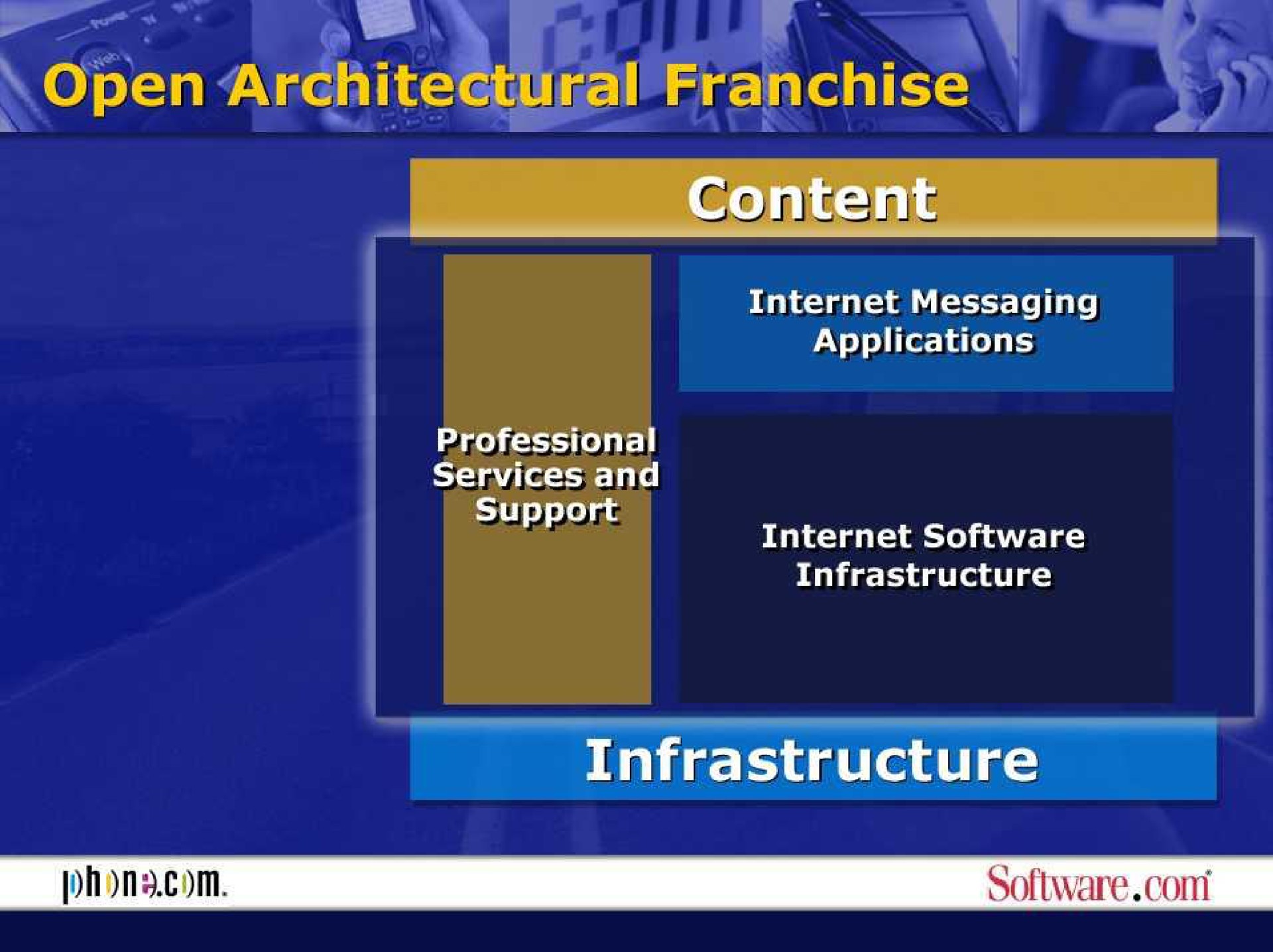

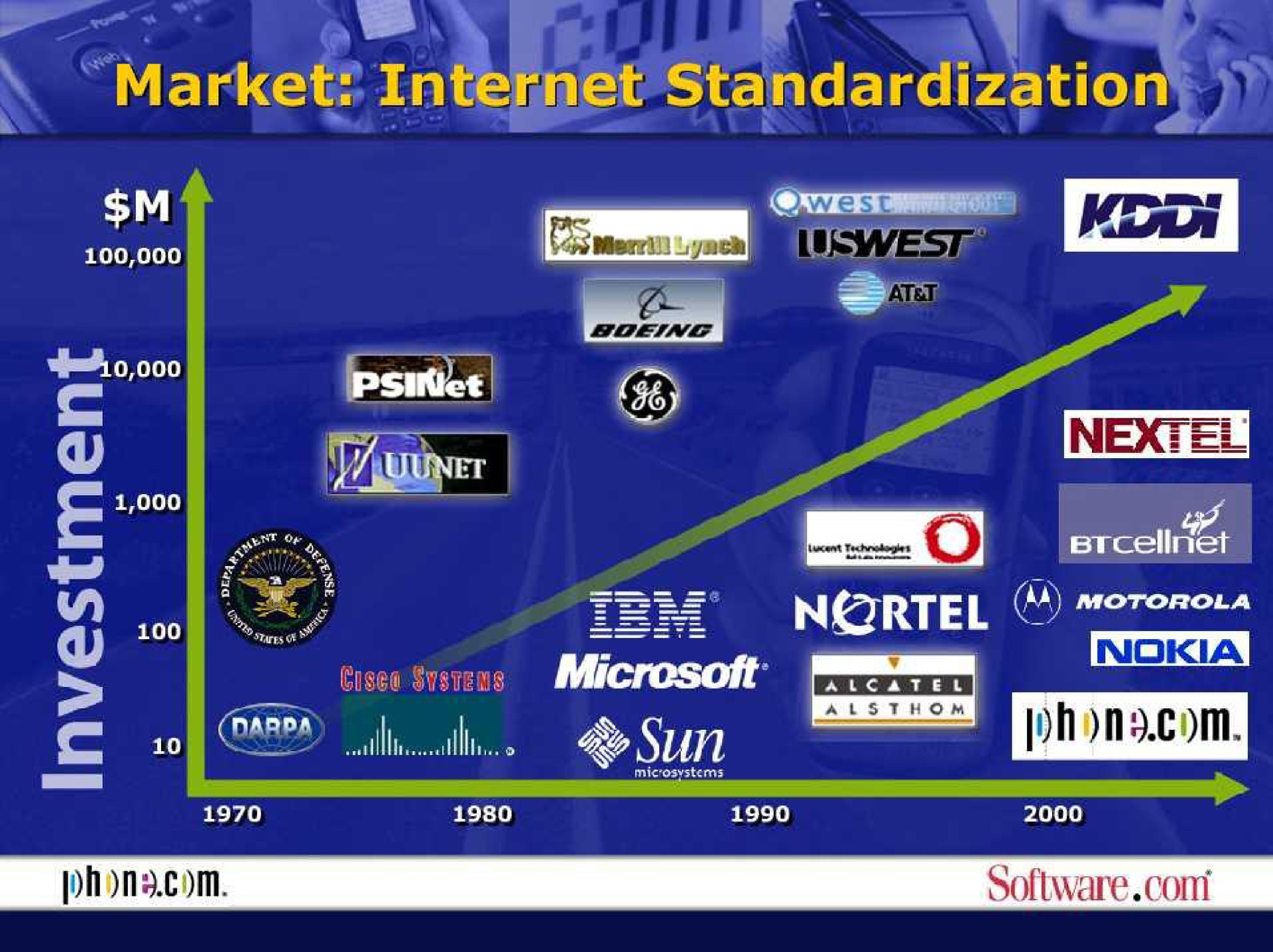

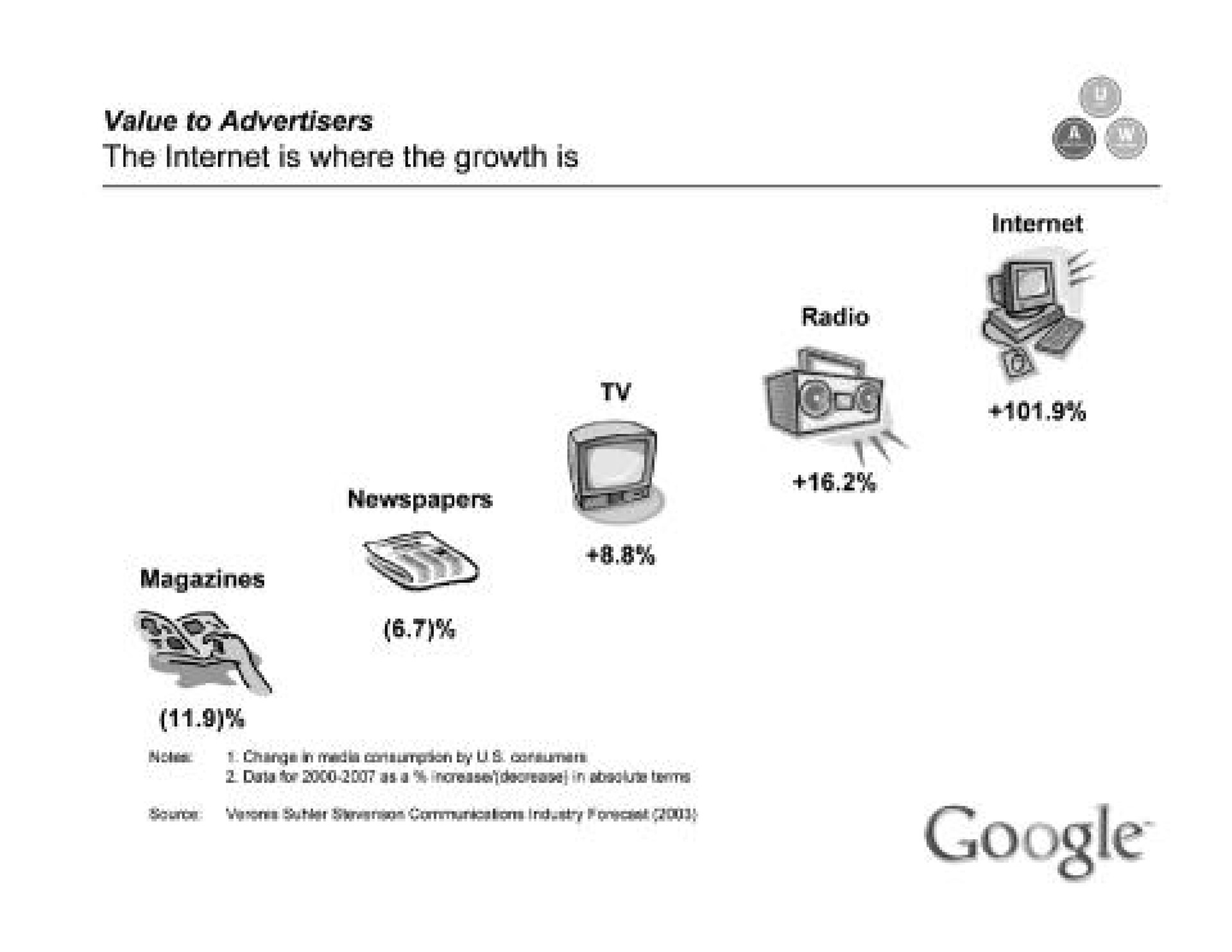

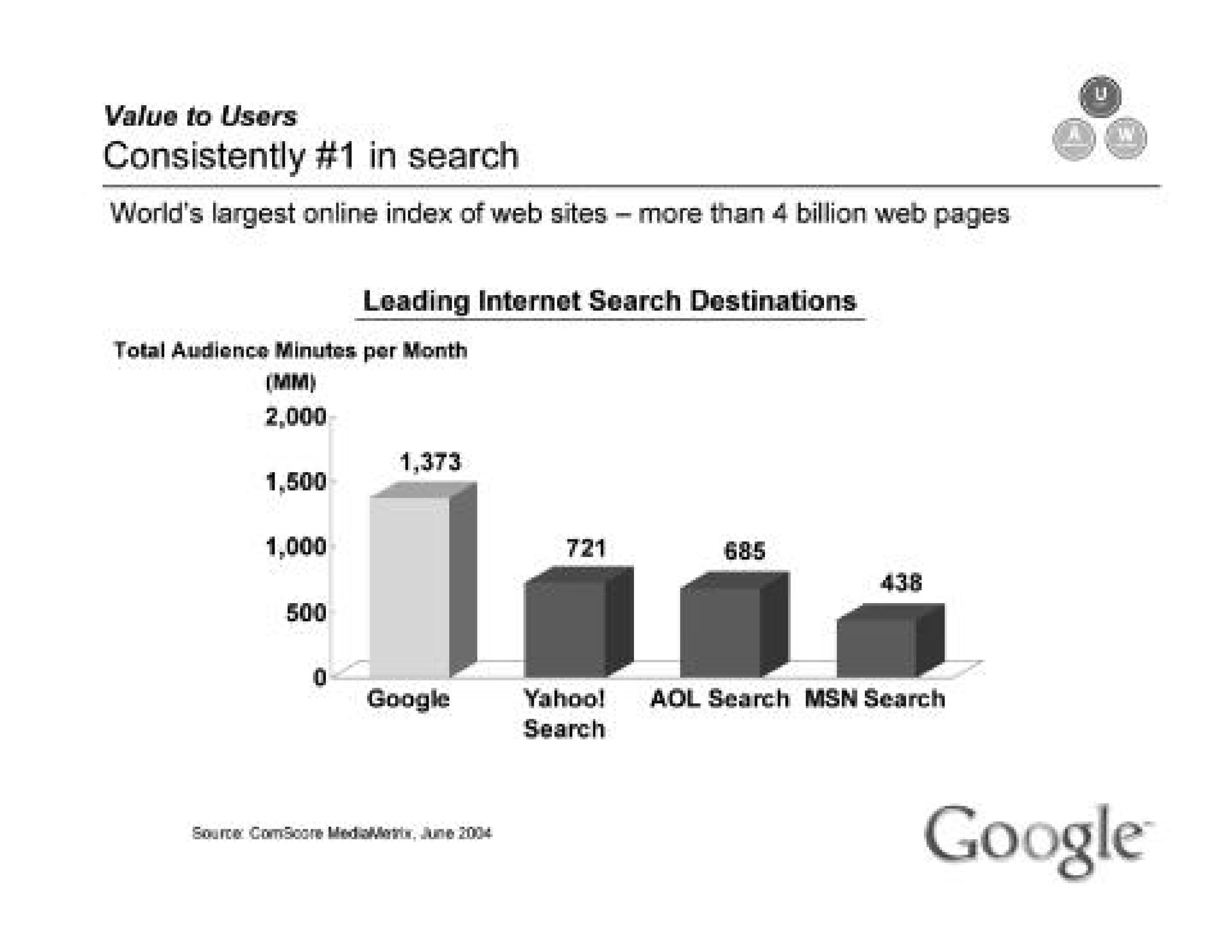

Below are examples of tech decks from the early days of the internet. These early versions often featured dense text and complex charts, a stark contrast to the more refined and visually driven decks of today.

1. Phone.com + Software.com (2000)

2. Apple / iPod (2001)

As of 2001, prior to the introduction of the iPod, Apple Inc. was primarily known as a computer and software company. Apple had gained recognition for its Macintosh line of personal computers, which featured a user-friendly graphical user interface. Apple's Mac OS operating system was well-regarded for its design and ease of use.

While Apple had experienced success with its computers, it faced strong competition from Microsoft's Windows operating system in the PC market. The company was also known for its software products like the Mac OS and creative applications like Final Cut Pro and Adobe's collaboration on Photoshop. However, its foray into the consumer electronics and music industry with the iPod, iTunes, and later the iTunes Store marked a significant shift in Apple's business strategy and contributed to the company's transformation into a global technology and entertainment powerhouse.

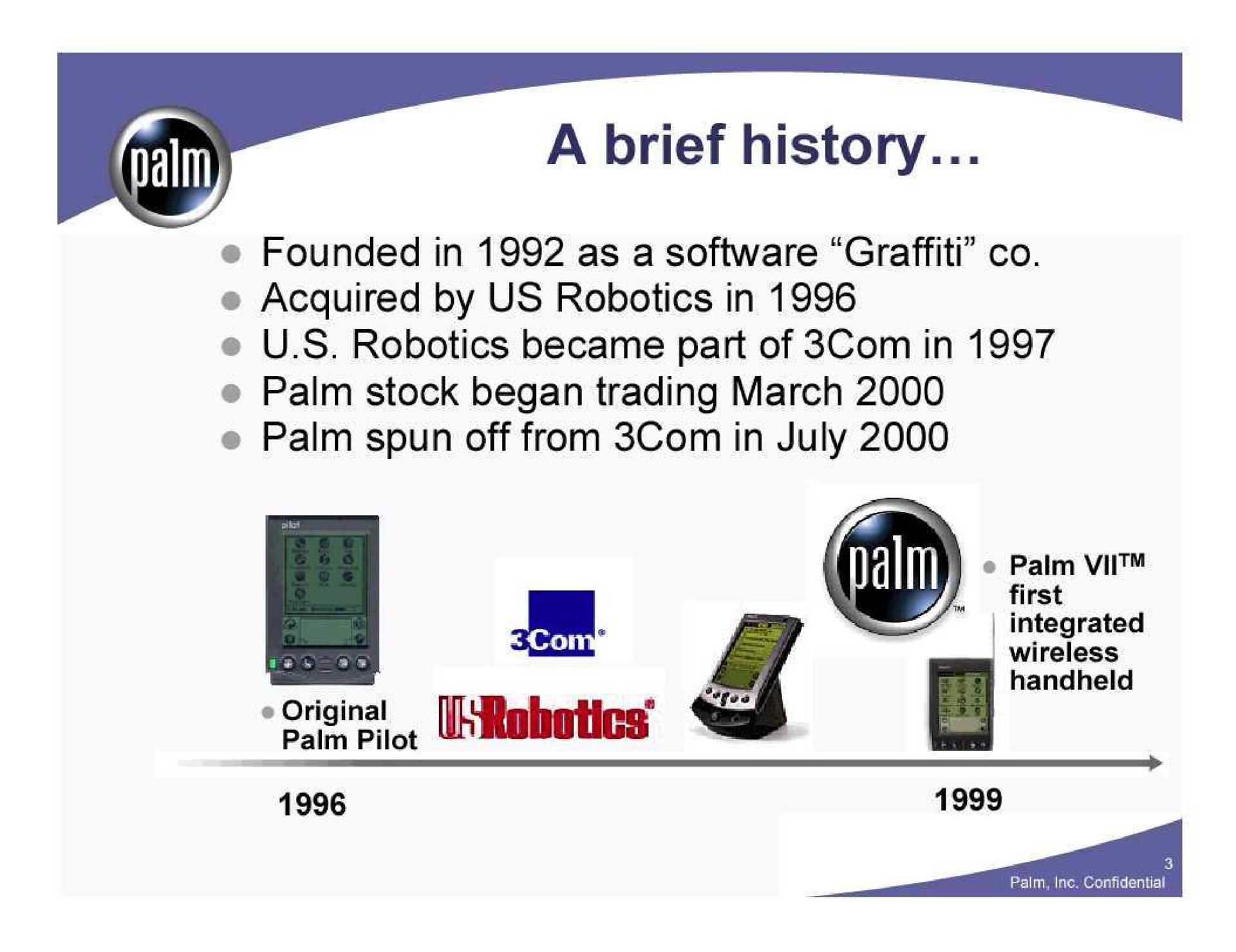

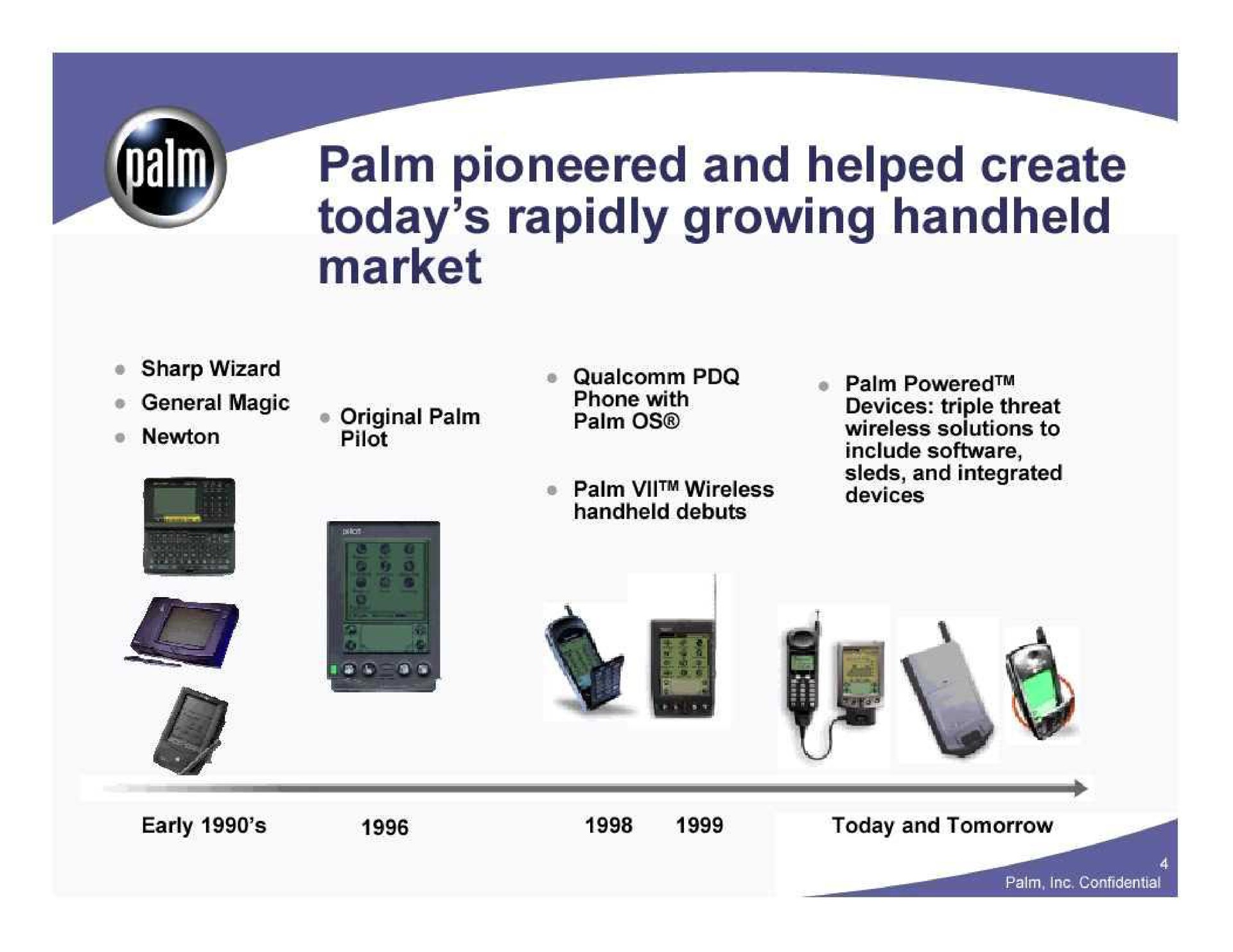

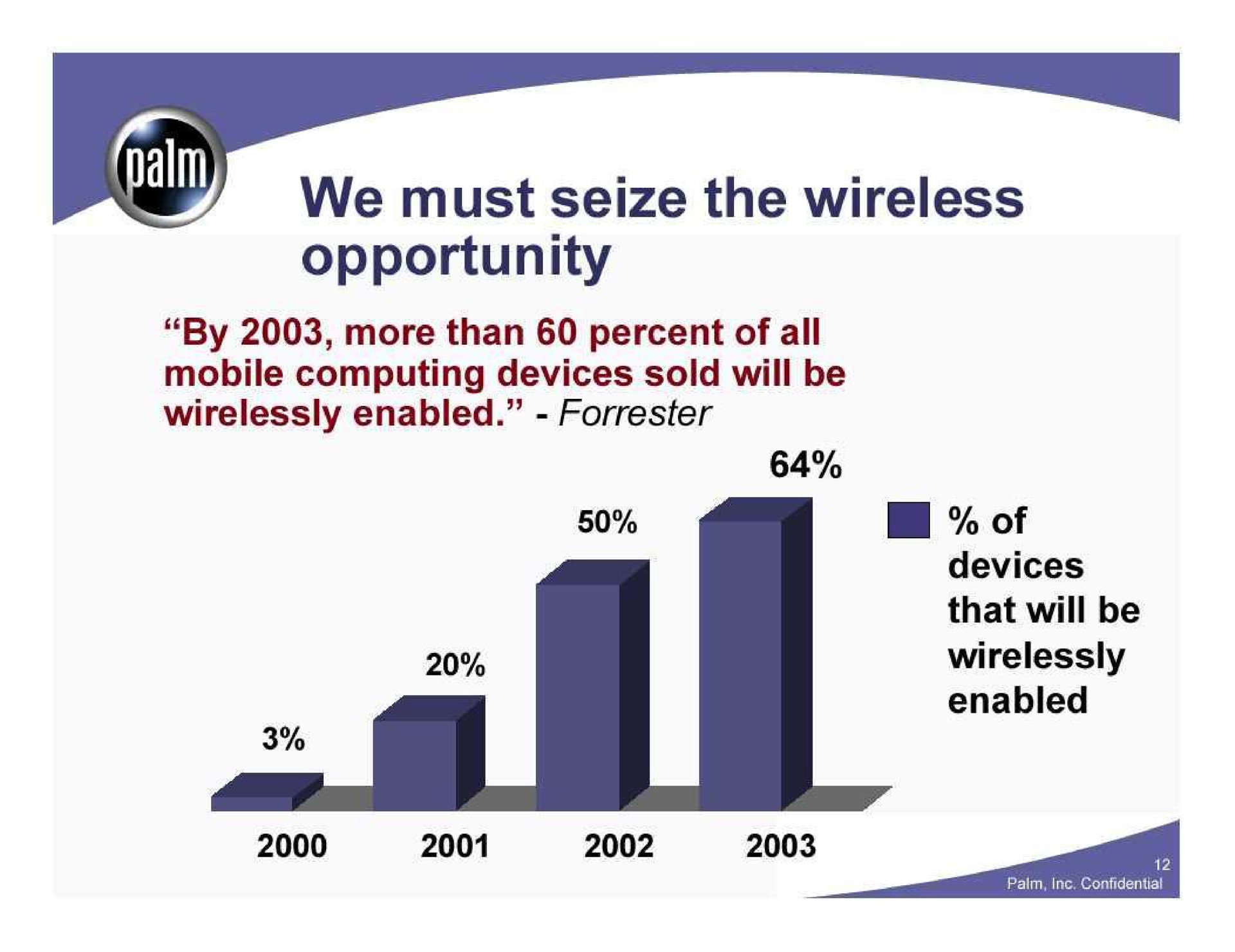

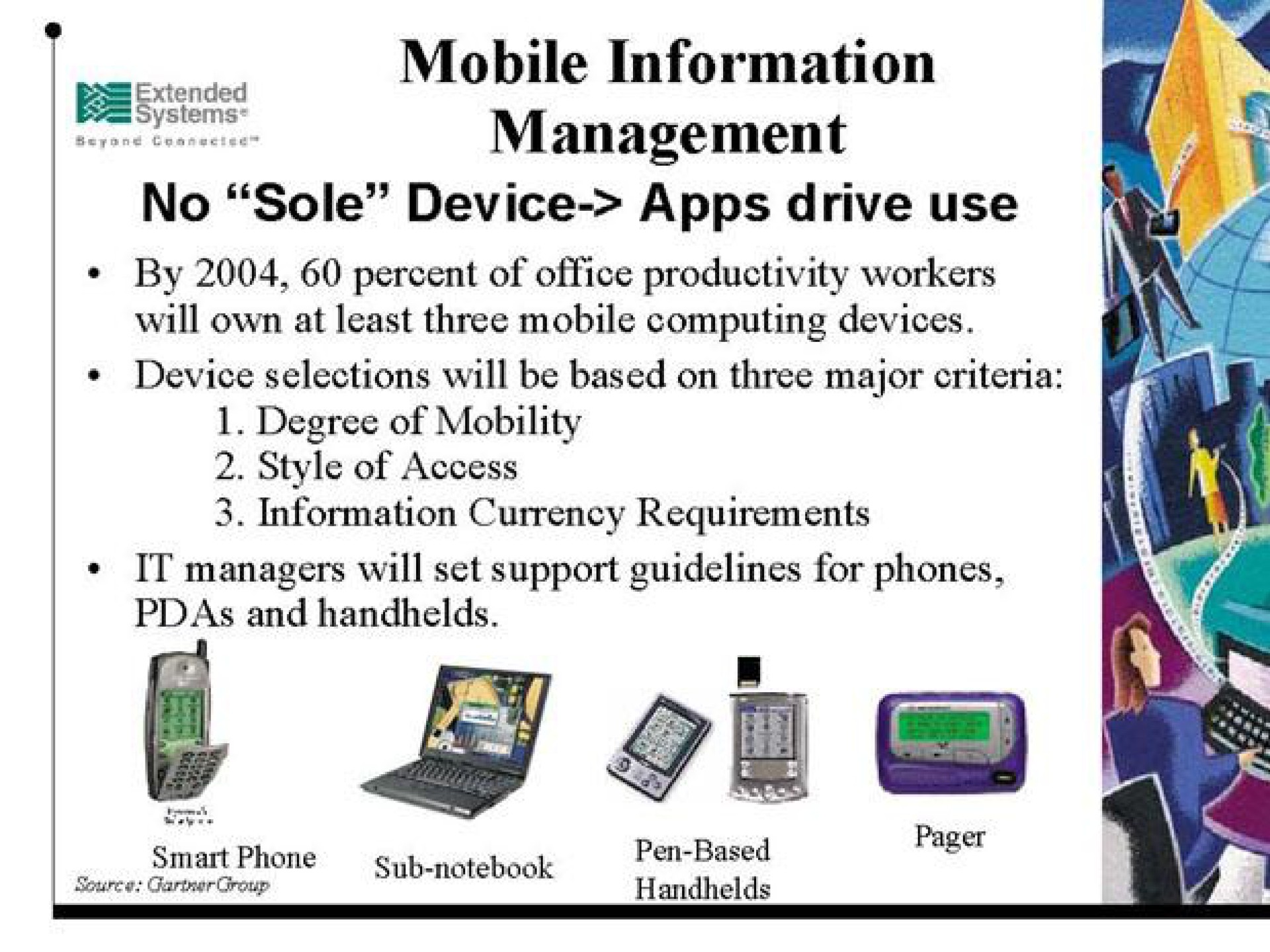

3. Palm + Extended (2001)

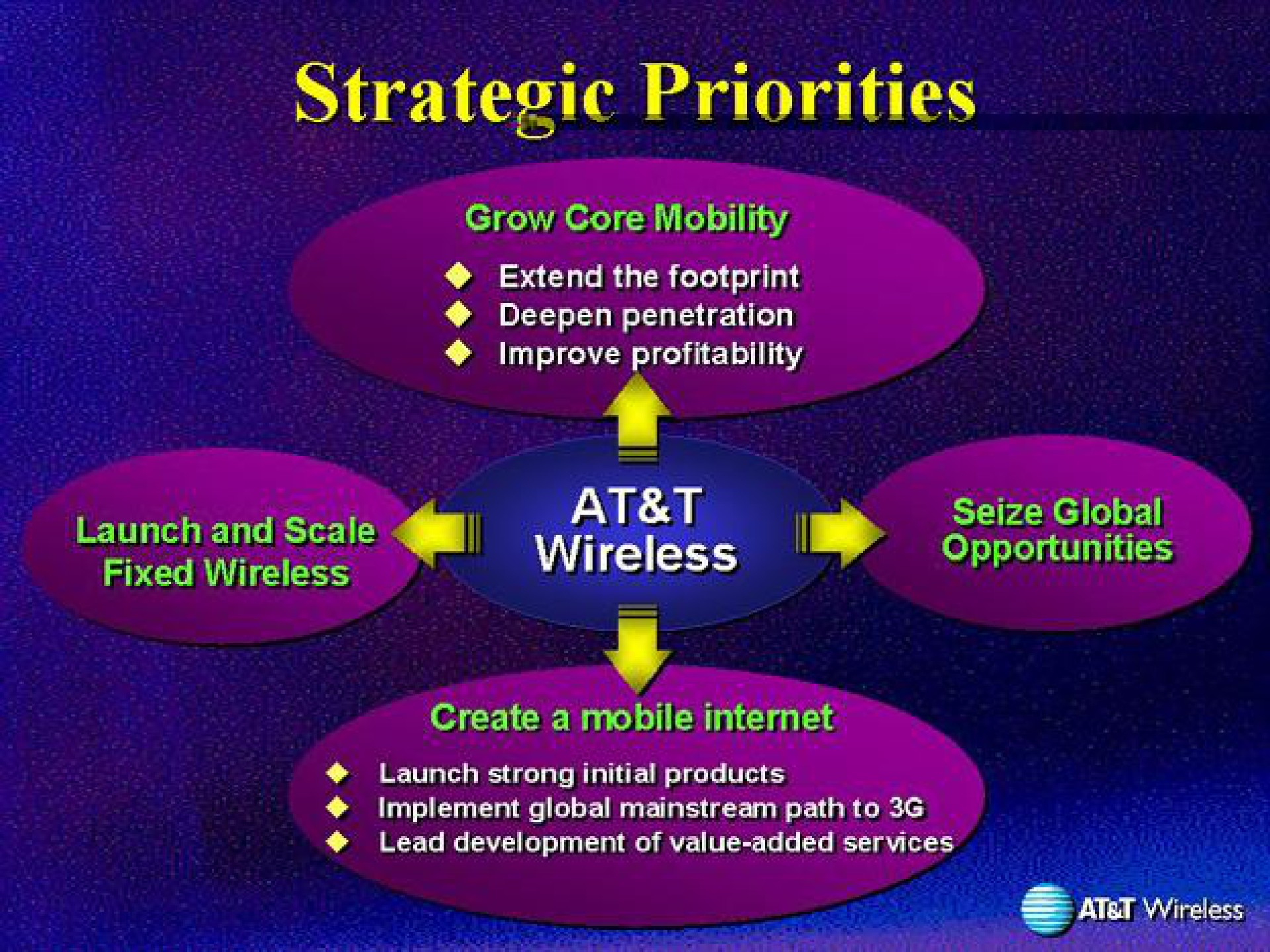

4. AT&T Wireless (2001)

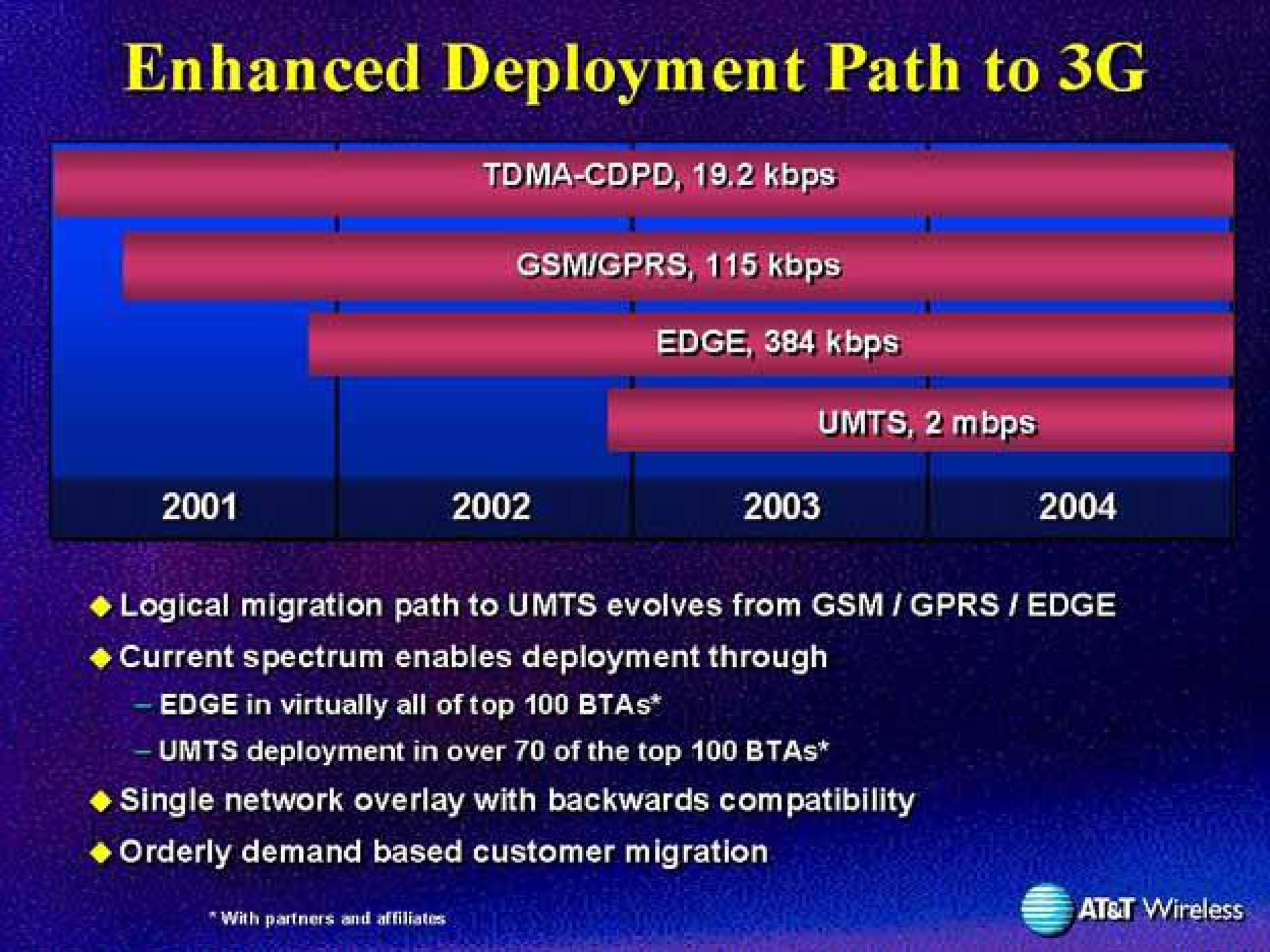

As of 2001, AT&T was one of the largest and most influential telecommunications companies in the United States and around the world. It had a rich history dating back to the late 19th century and was a key player in the telecommunications industry.

During this time, AT&T was actively involved in the rollout of 3G (third-generation) wireless technology. The company was investing heavily in upgrading its network infrastructure to support 3G services, which aimed to provide faster data speeds and improved mobile internet access. AT&T, like other major telecom operators, was positioning itself to meet the growing demand for mobile data and pave the way for the future of wireless communication. This strategic move was part of AT&T's efforts to adapt to the changing landscape of telecommunications and embrace the potential of mobile technology.

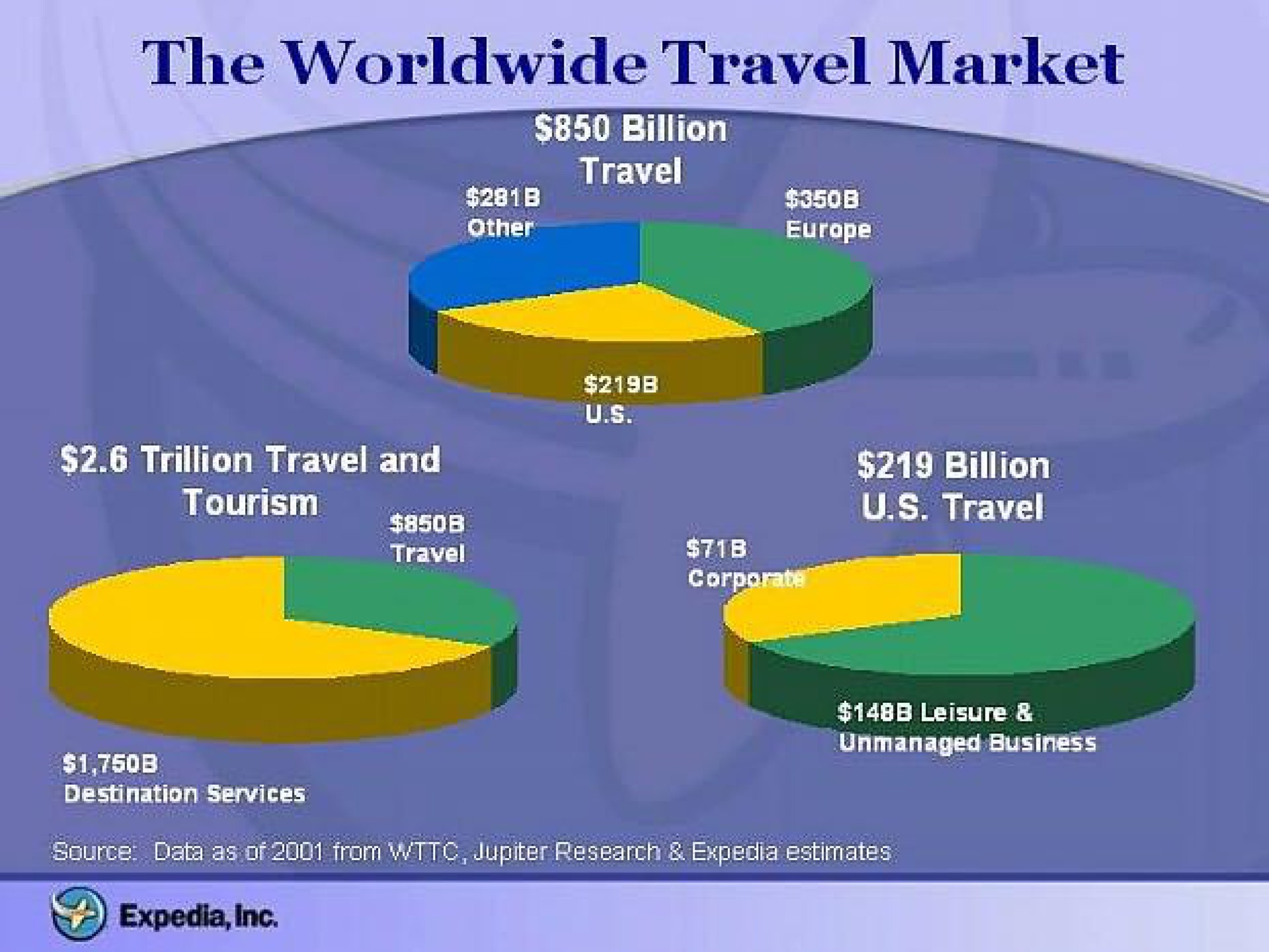

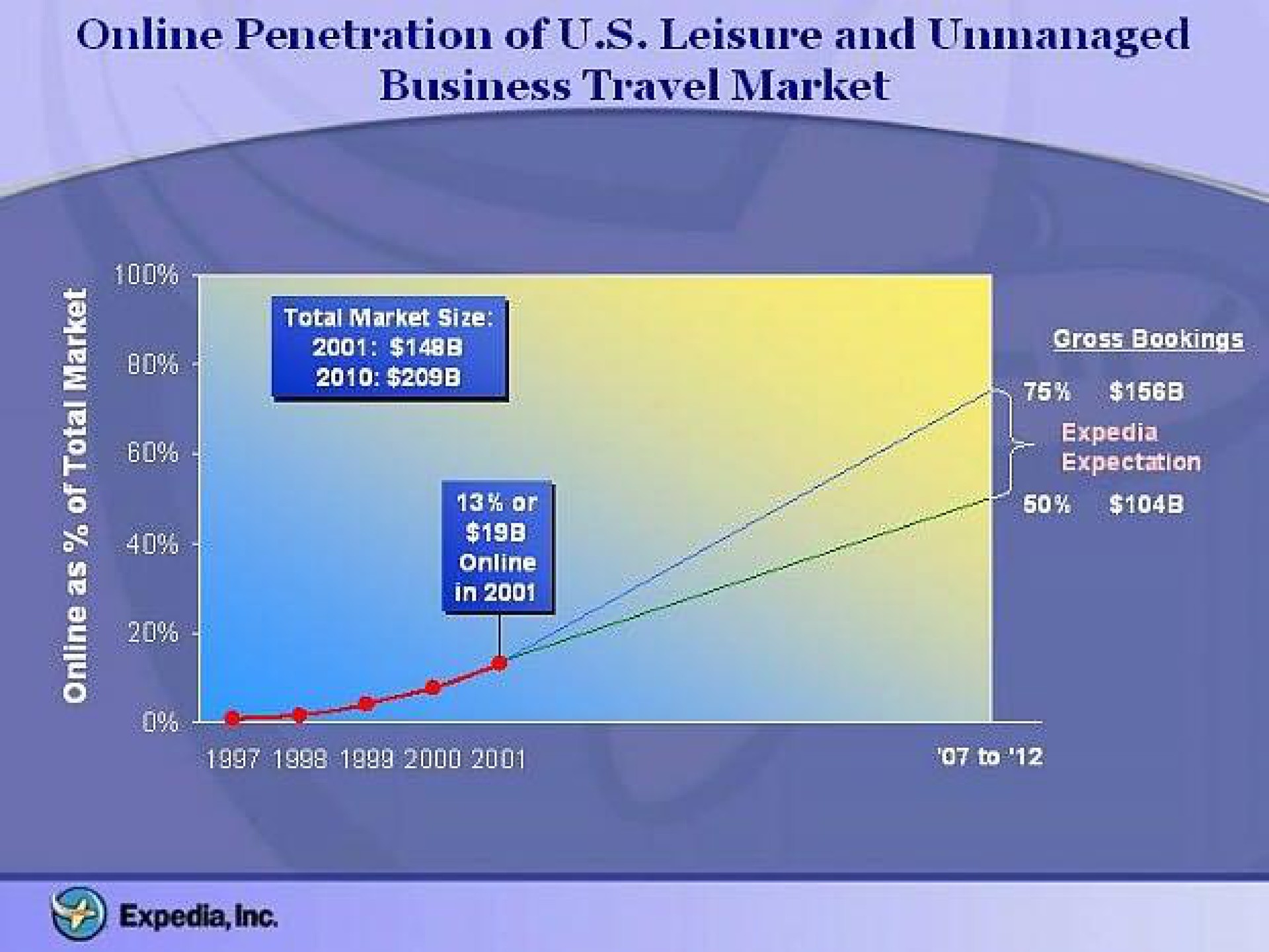

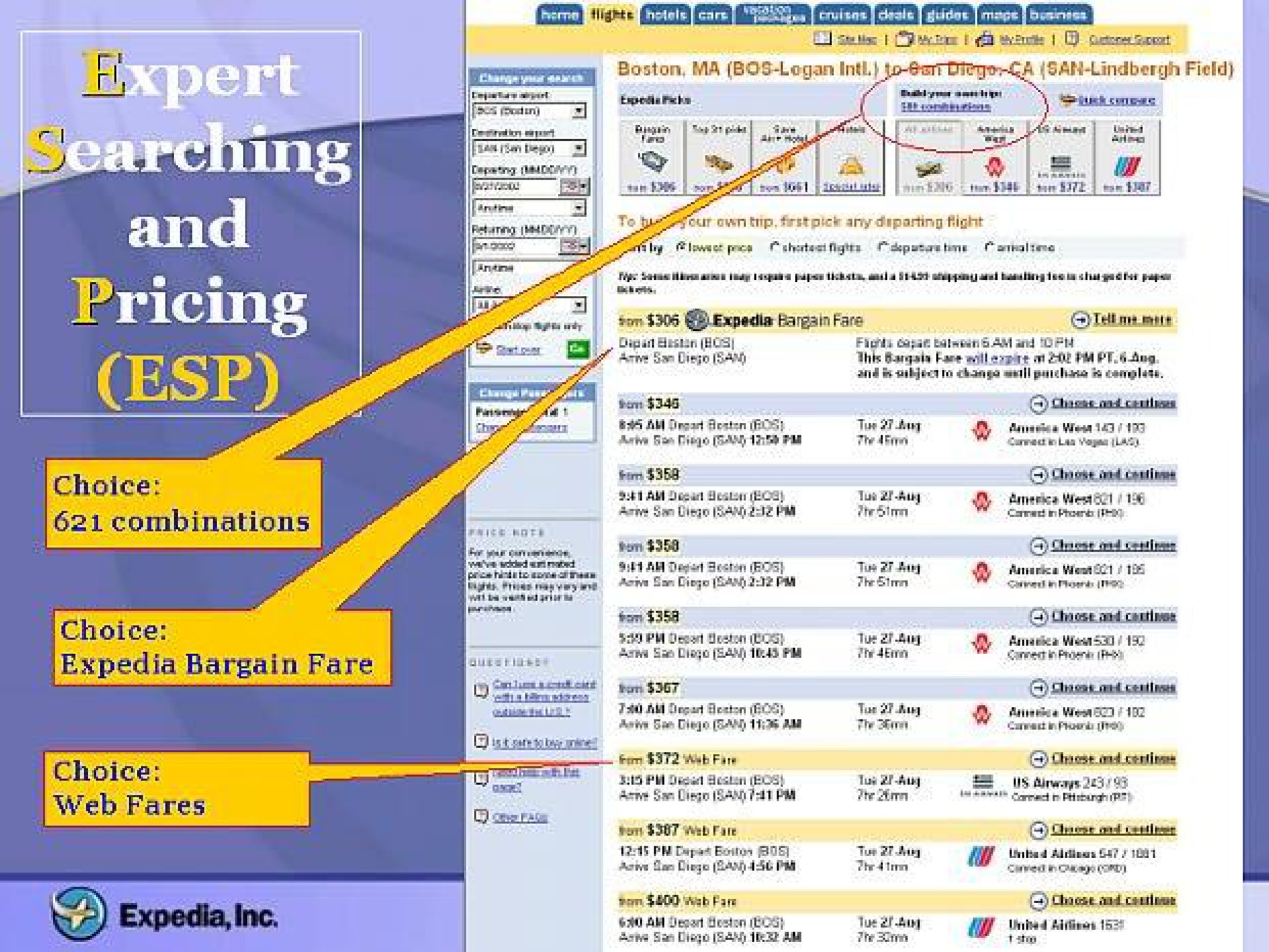

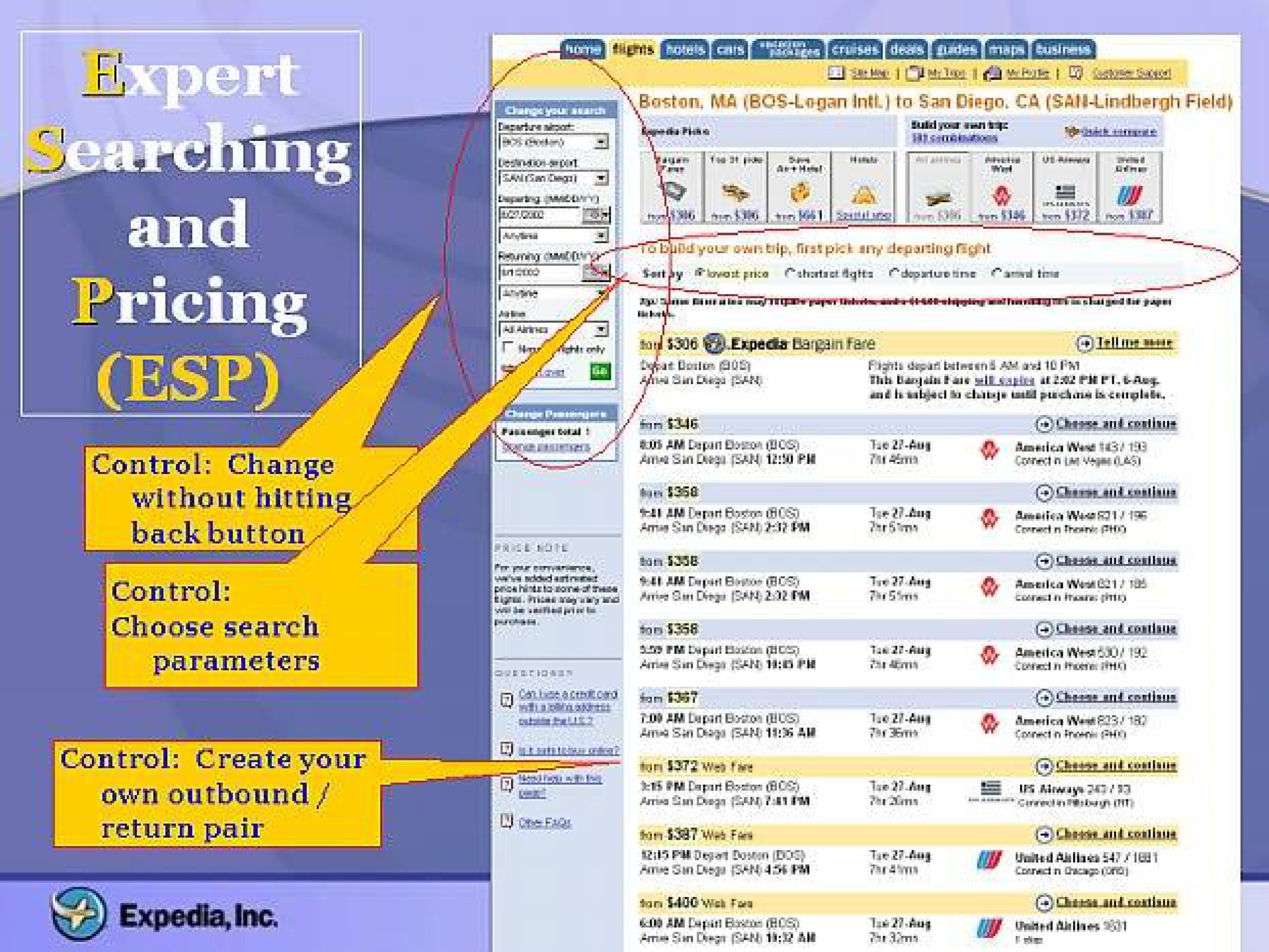

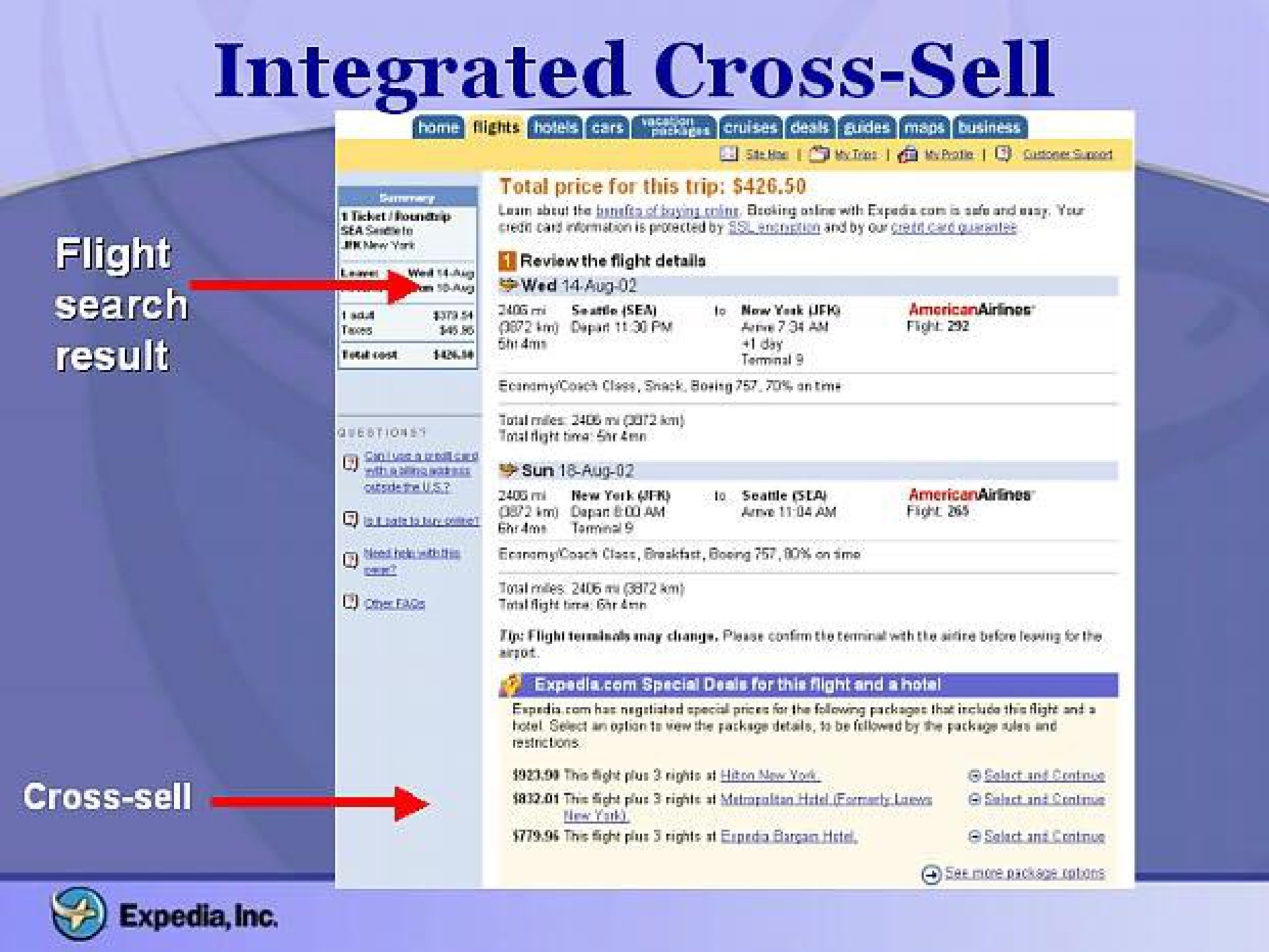

5. Expedia (2002)

As of 2002, Expedia was a well-established online travel agency and one of the leading platforms for booking flights, hotels, car rentals, and vacation packages. Expedia was part of the larger Expedia Group, which also included brands like Hotels.com, Hotwire.com, and TripAdvisor.

During this time, Expedia was leveraging the growing popularity of the internet to provide travelers with a convenient way to research and book their trips online. Expedia's website offered a wide range of travel-related services, competitive pricing, and user-friendly tools for planning and managing travel itineraries. The company was known for its extensive partnerships with airlines, hotels, and other travel providers, making it a go-to choice for many travelers looking for a one-stop destination to plan and book their trips online.

6. Universal + mp3.com (2001)

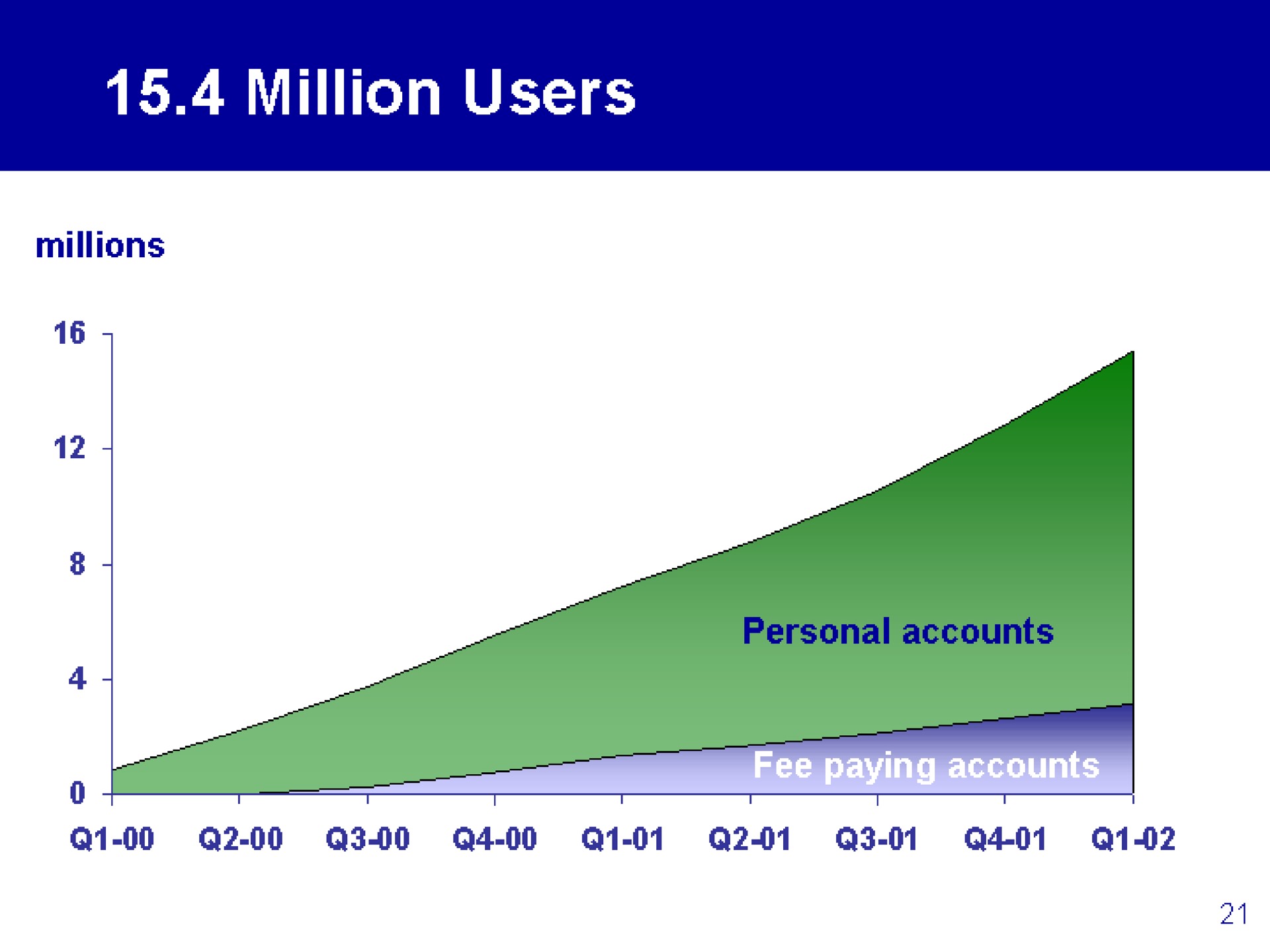

7. eBay + PayPal (2002)

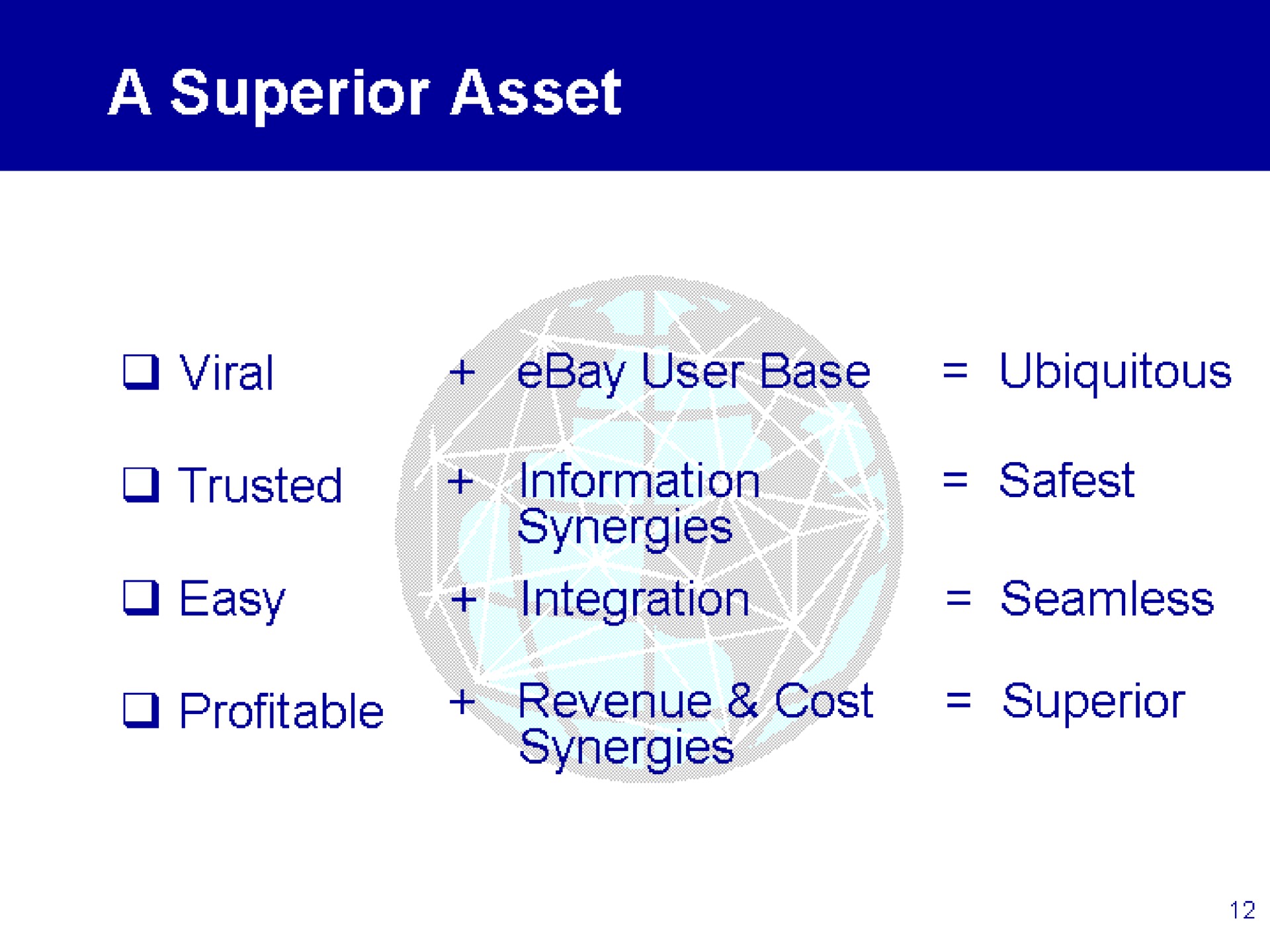

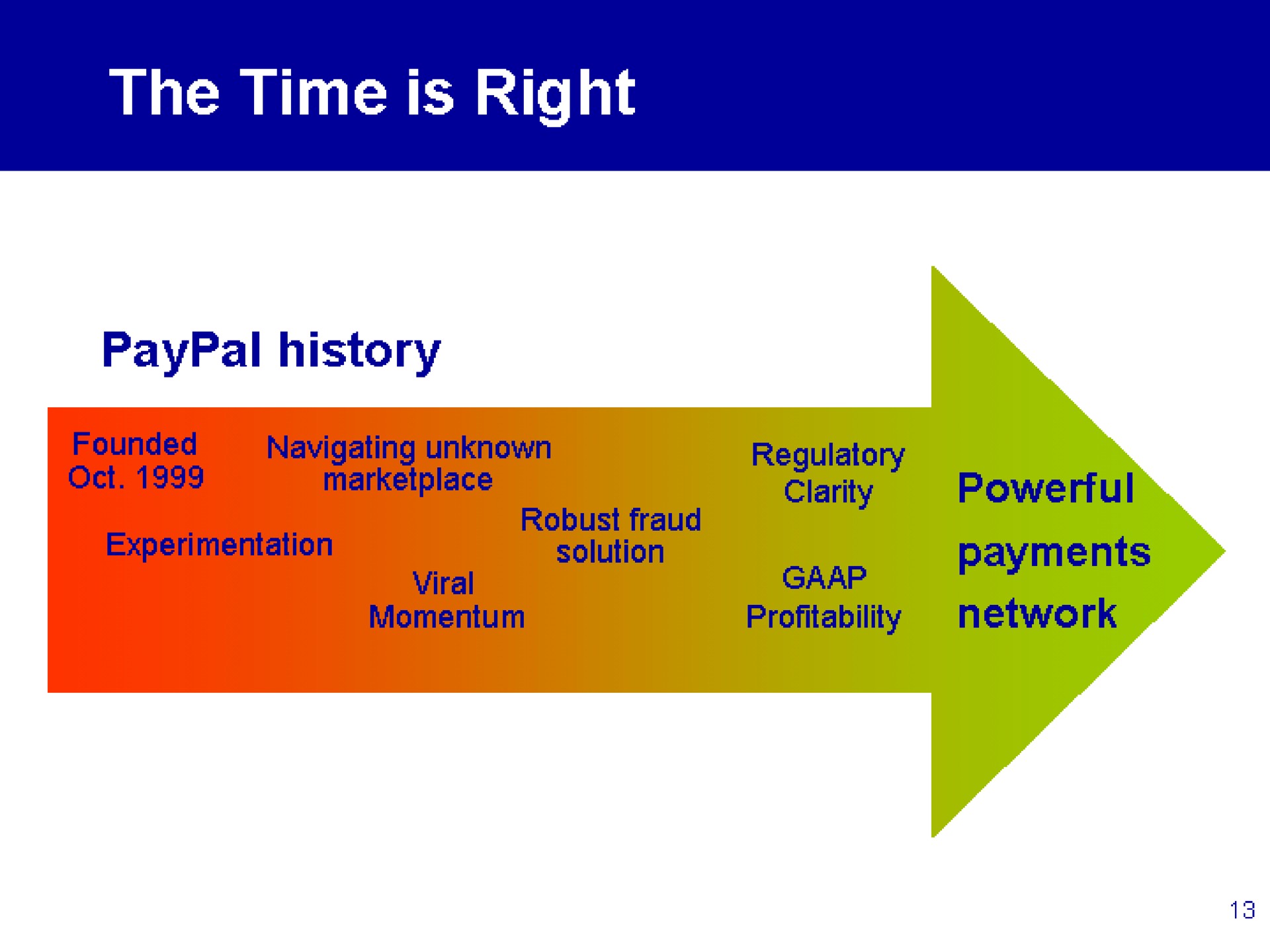

In 2002, eBay acquired PayPal, a popular online payment service, for approximately $1.5 billion. The acquisition was driven by eBay's desire to provide a more seamless and secure payment solution for its online auction platform, as PayPal had gained significant traction as a trusted online payment method.

The acquisition of PayPal by eBay had a transformative impact on the e-commerce industry, making online transactions more accessible and convenient for millions of users. Additionally, several former PayPal employees, known as the "PayPal Mafia," went on to become successful entrepreneurs and investors in the technology sector. Notable members of the PayPal Mafia include Elon Musk, Peter Thiel, and Reid Hoffman, who played key roles in founding and scaling other influential tech companies such as Tesla, SpaceX, LinkedIn, and Palantir, further contributing to the innovation and growth of Silicon Valley.

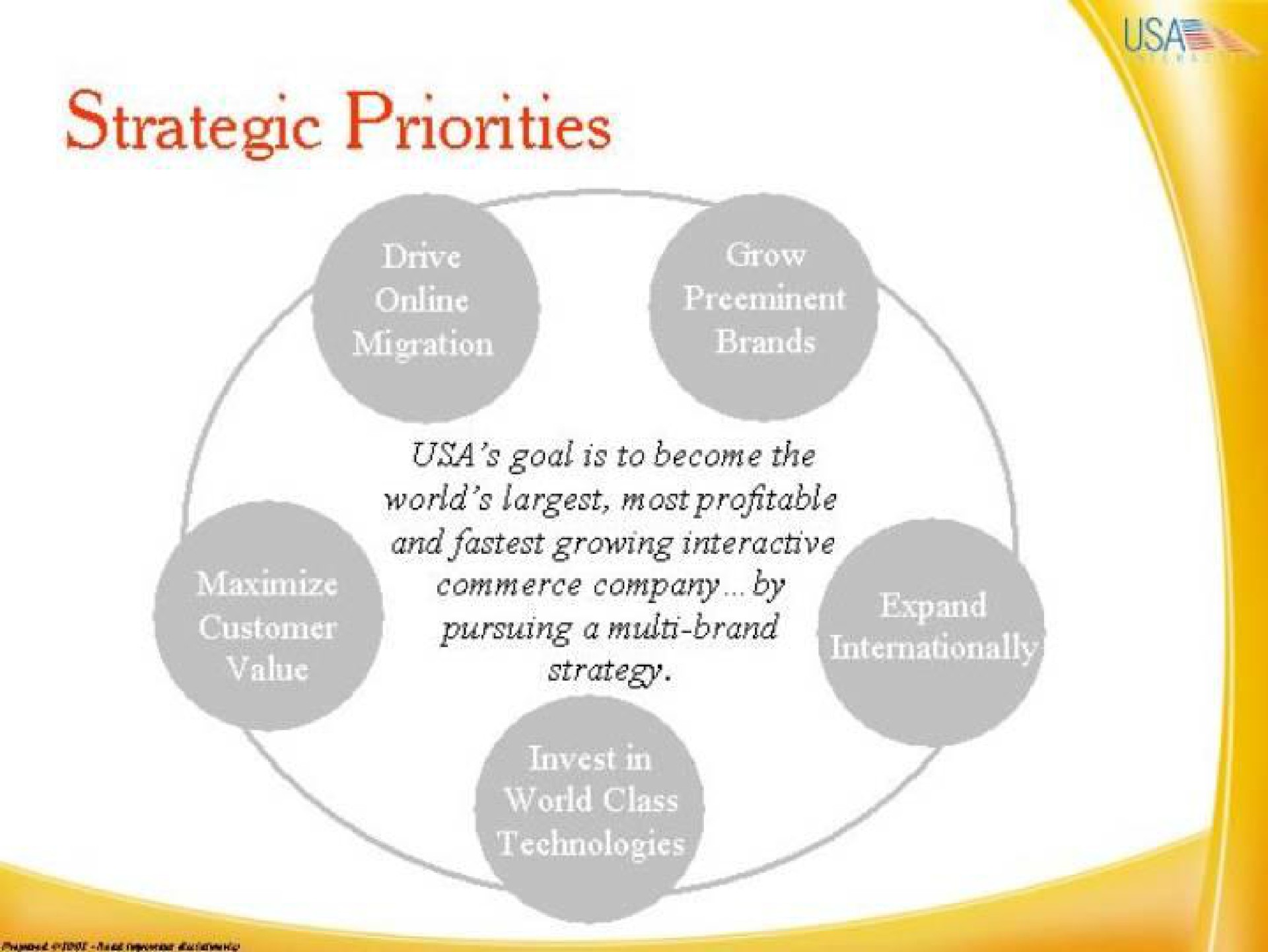

8. USA Interactive (2003)

As of 2003, USA Interactive, now known as IAC (InterActiveCorp), was a diversified media and internet company with a wide range of digital assets and investments. It was founded by Barry Diller and had significant holdings in various online businesses, including Expedia (an online travel agency), Home Shopping Network (HSN), Ticketmaster (event ticketing), and Match.com (online dating), among others.

USA Interactive was known for its strategy of acquiring and consolidating online businesses across various industries, making it a major player in the digital landscape at the time. Barry Diller's leadership and vision played a pivotal role in shaping the company's portfolio and its presence in e-commerce, online services, and digital media.

Fun fact: the presentation was given by Dara Khosrowshahi who is now CEO of Uber (at the time he served as EVP at USA Interactive)

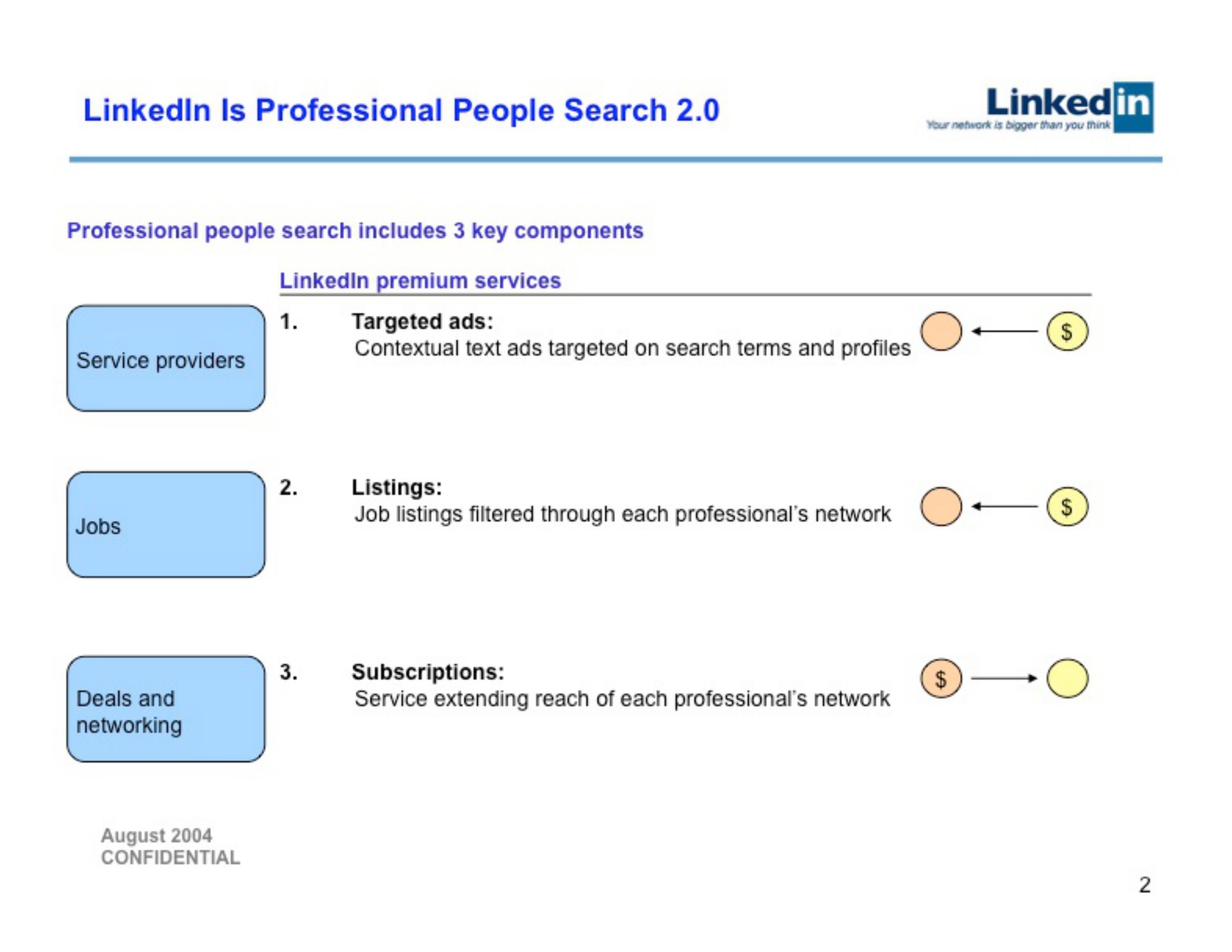

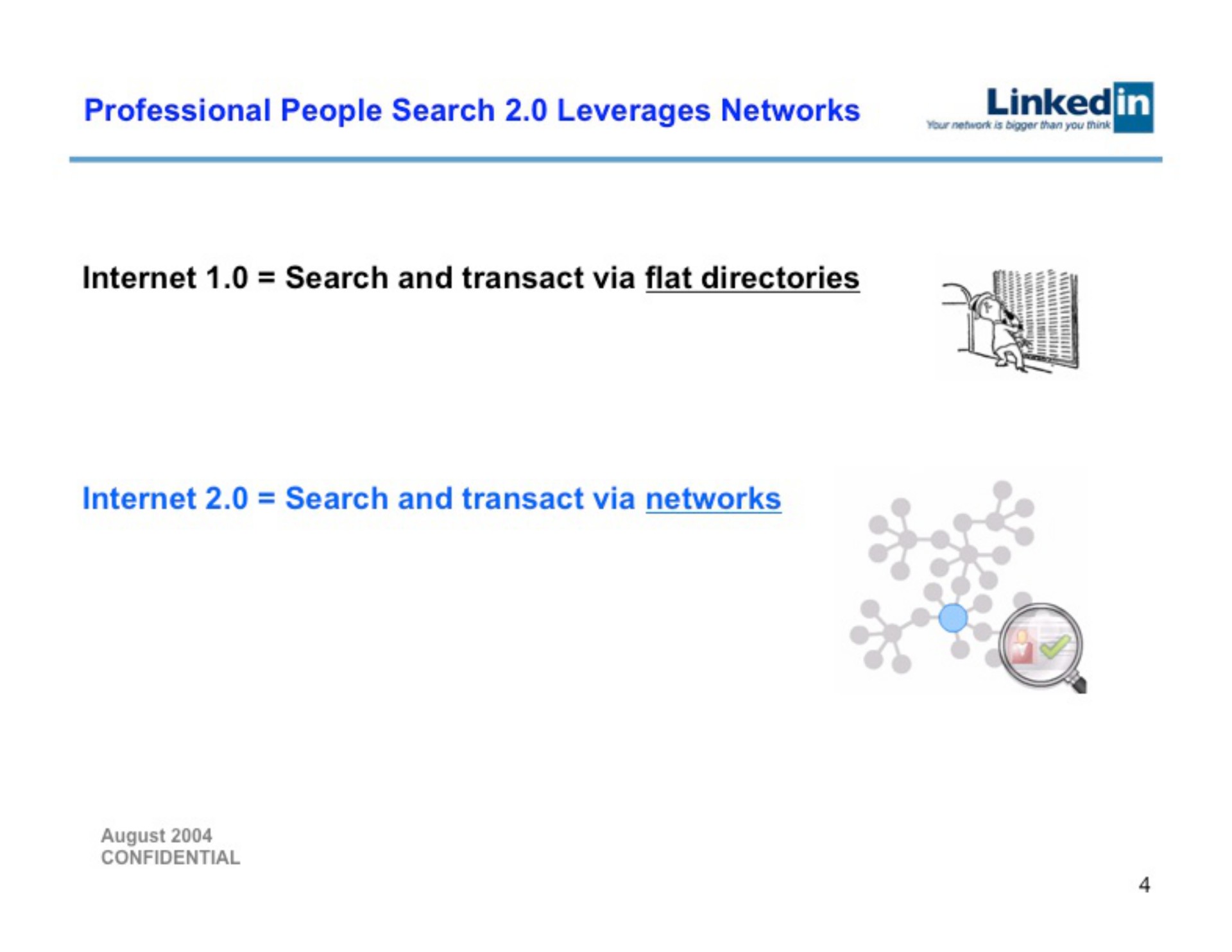

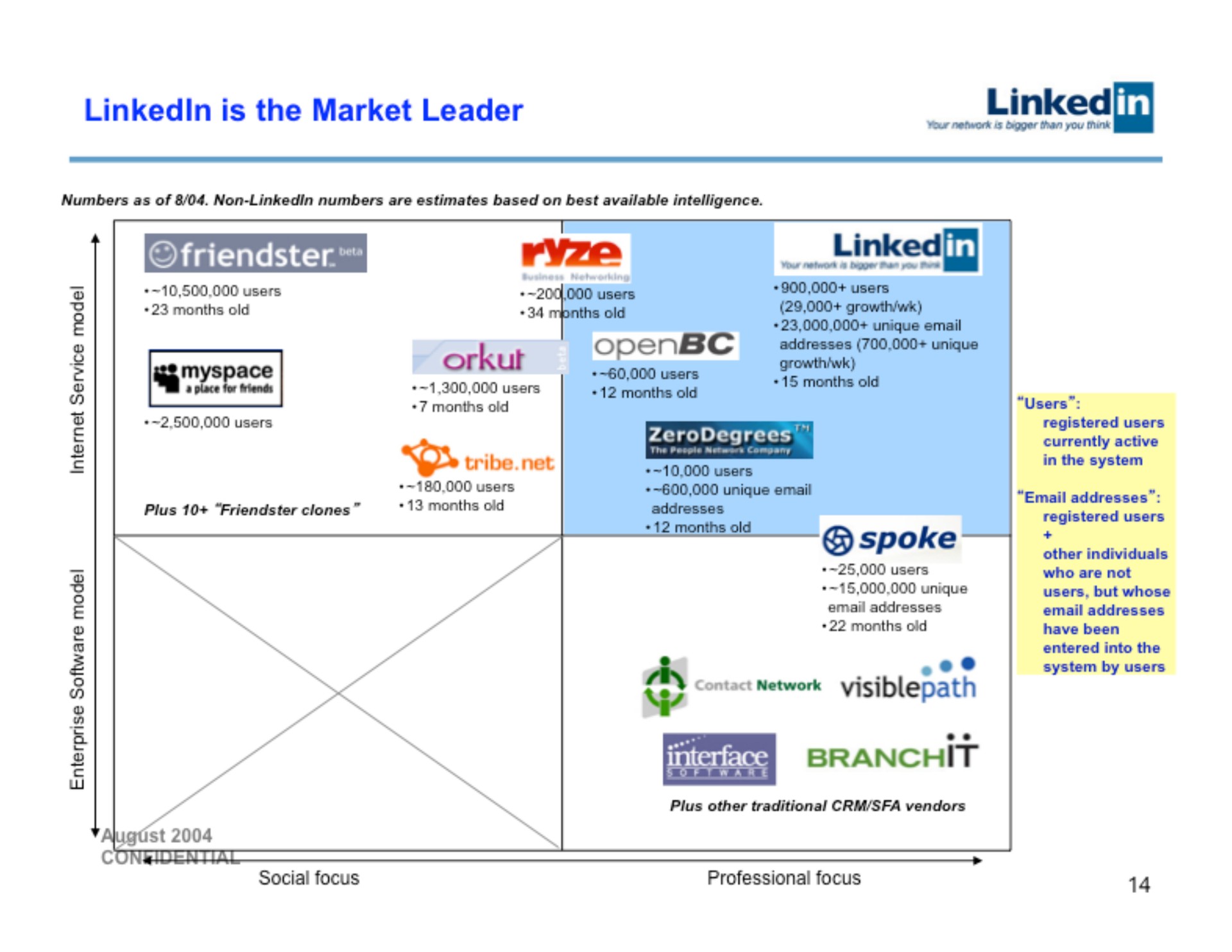

9. Linkedin (2004)

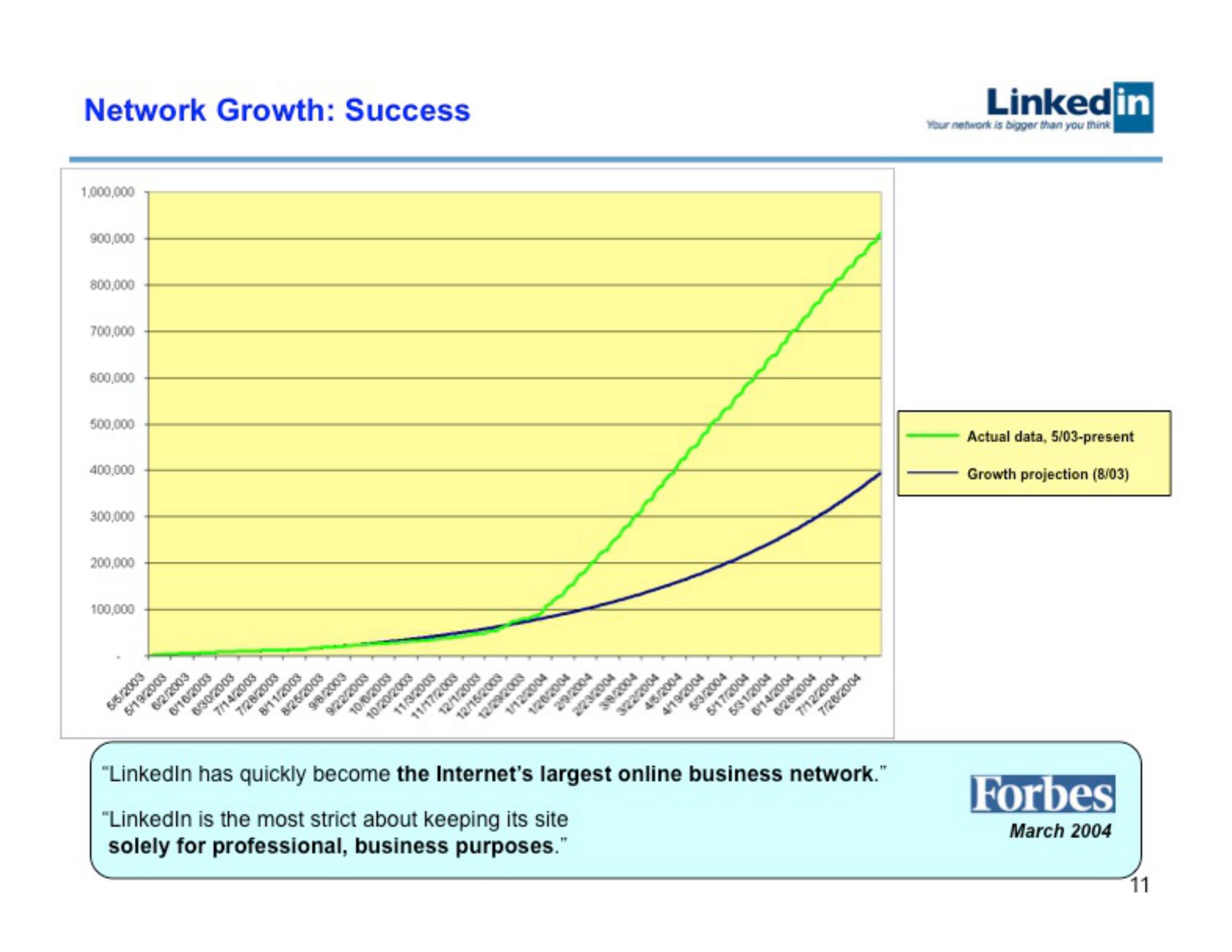

As of 2004, LinkedIn was still in its early stages of development and had been founded in December 2002. It was primarily focused on providing a professional networking platform for individuals and businesses. LinkedIn's core mission was to connect professionals and facilitate networking, job searches, and business development in a digital environment.

At that time, LinkedIn was gradually gaining popularity among professionals and job seekers, but it had not yet reached the massive user base it has today. It was primarily used by professionals to create online profiles, connect with colleagues and industry peers, and showcase their work experience and skills. The platform was already starting to establish itself as a valuable tool for professional networking and career development, foreshadowing its future success as a leading social media platform for professionals.

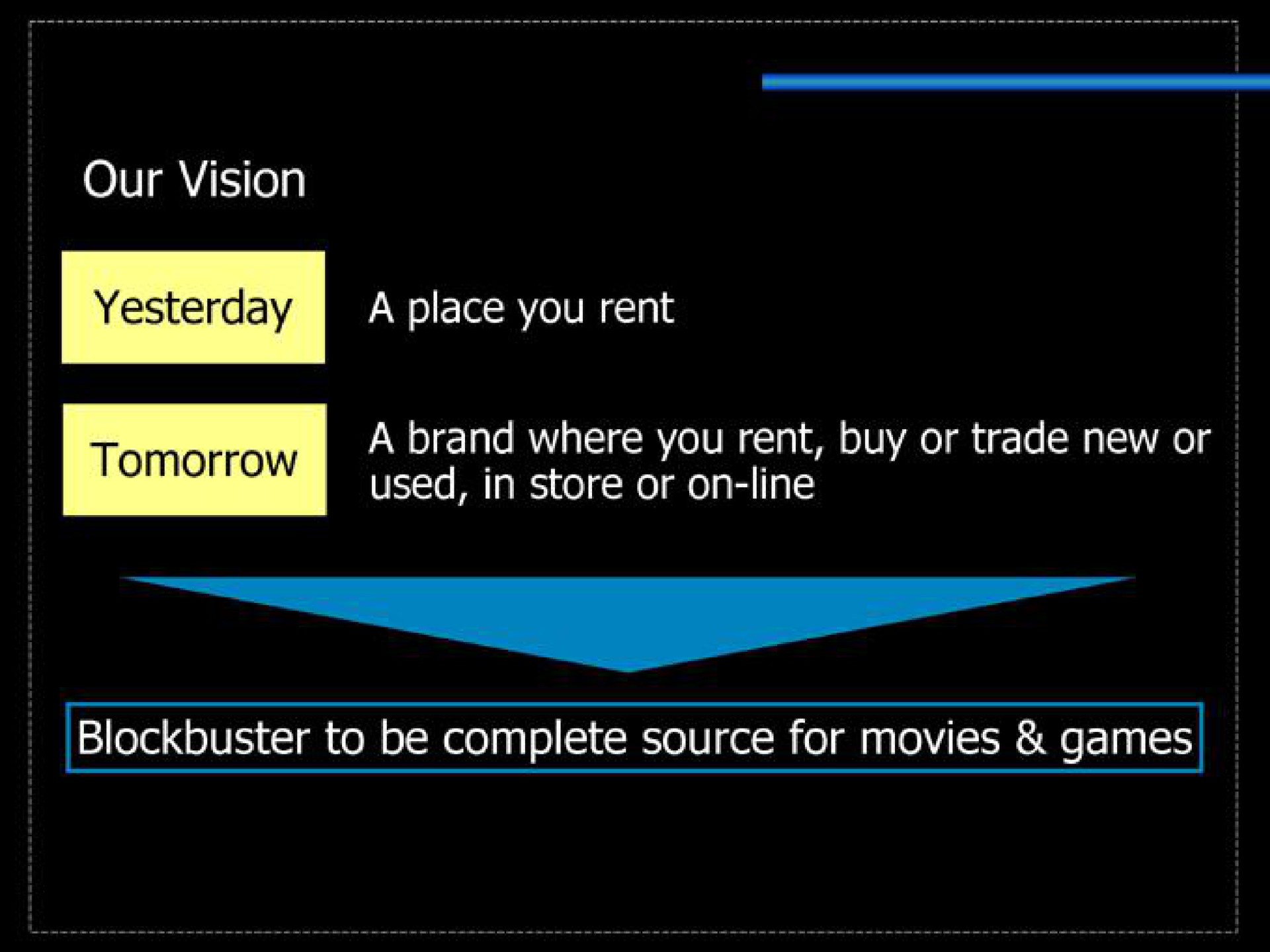

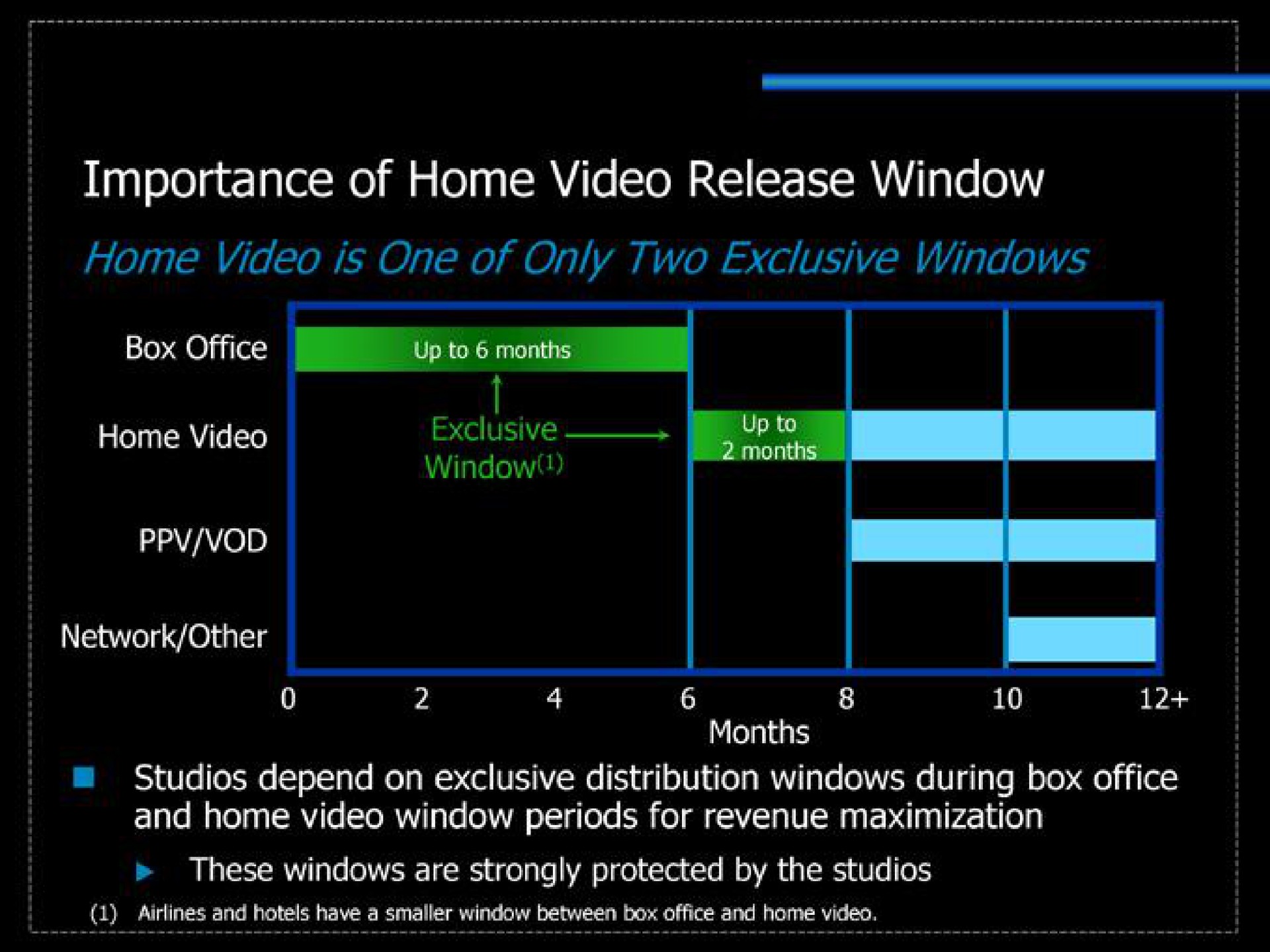

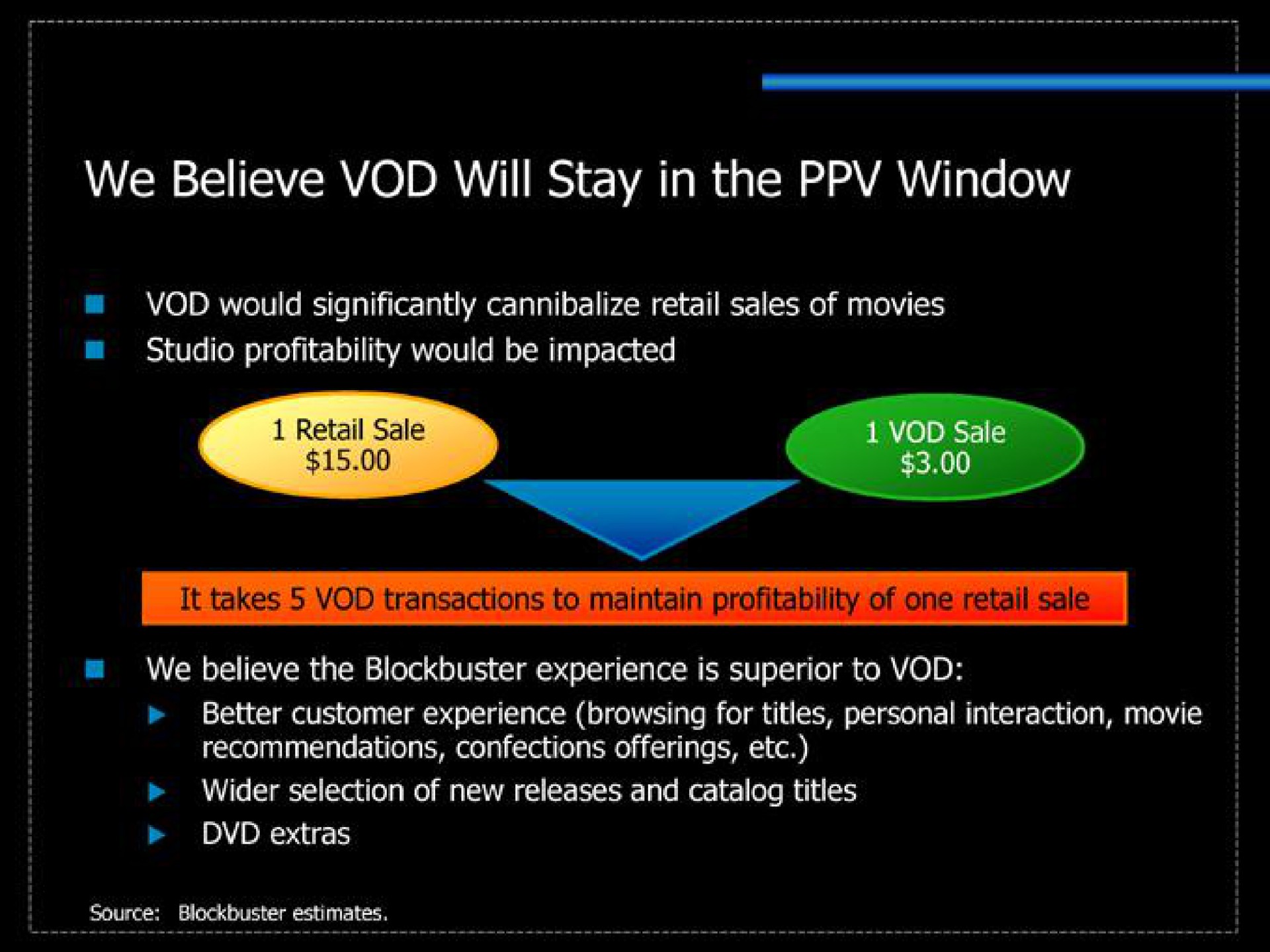

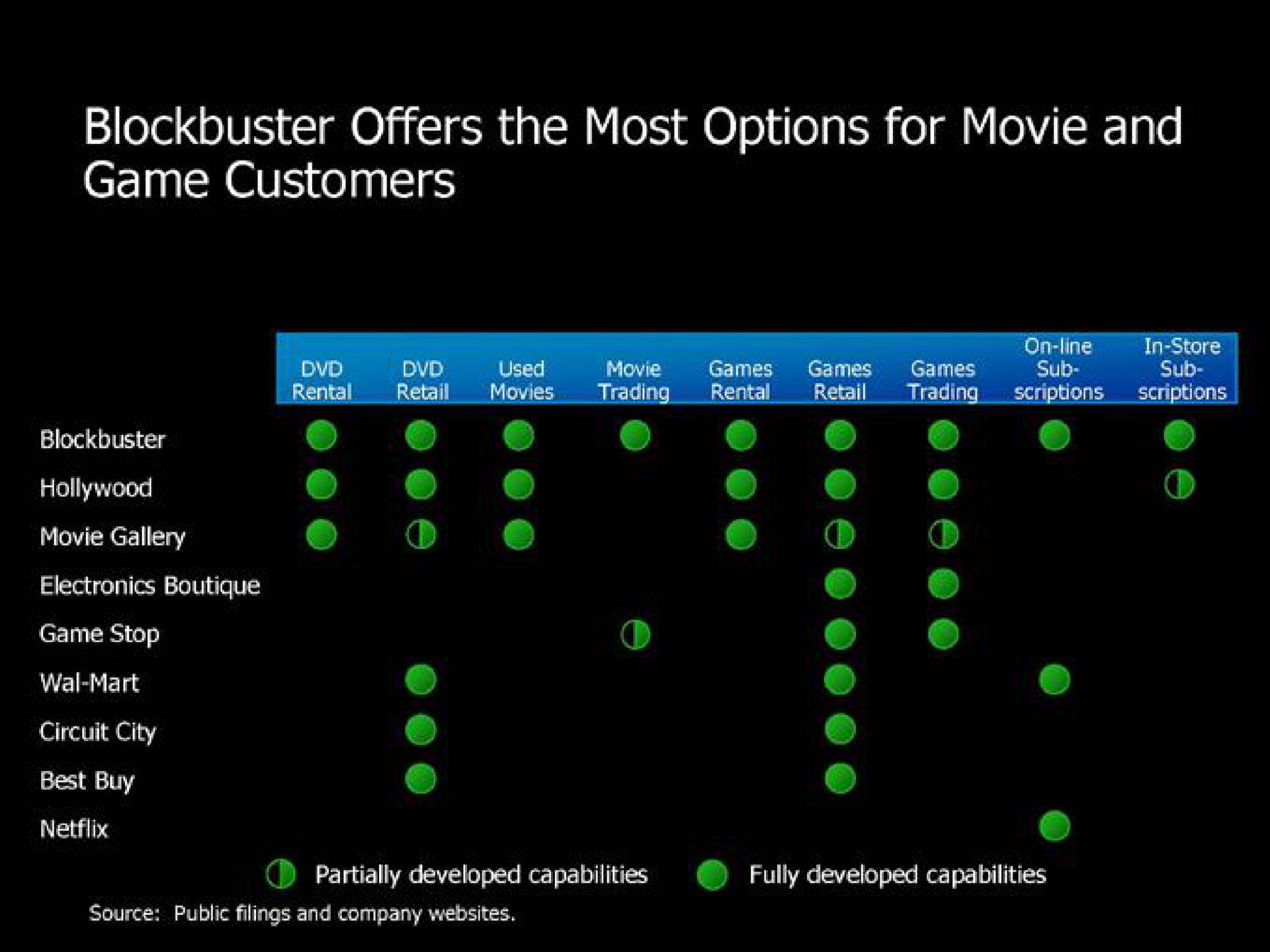

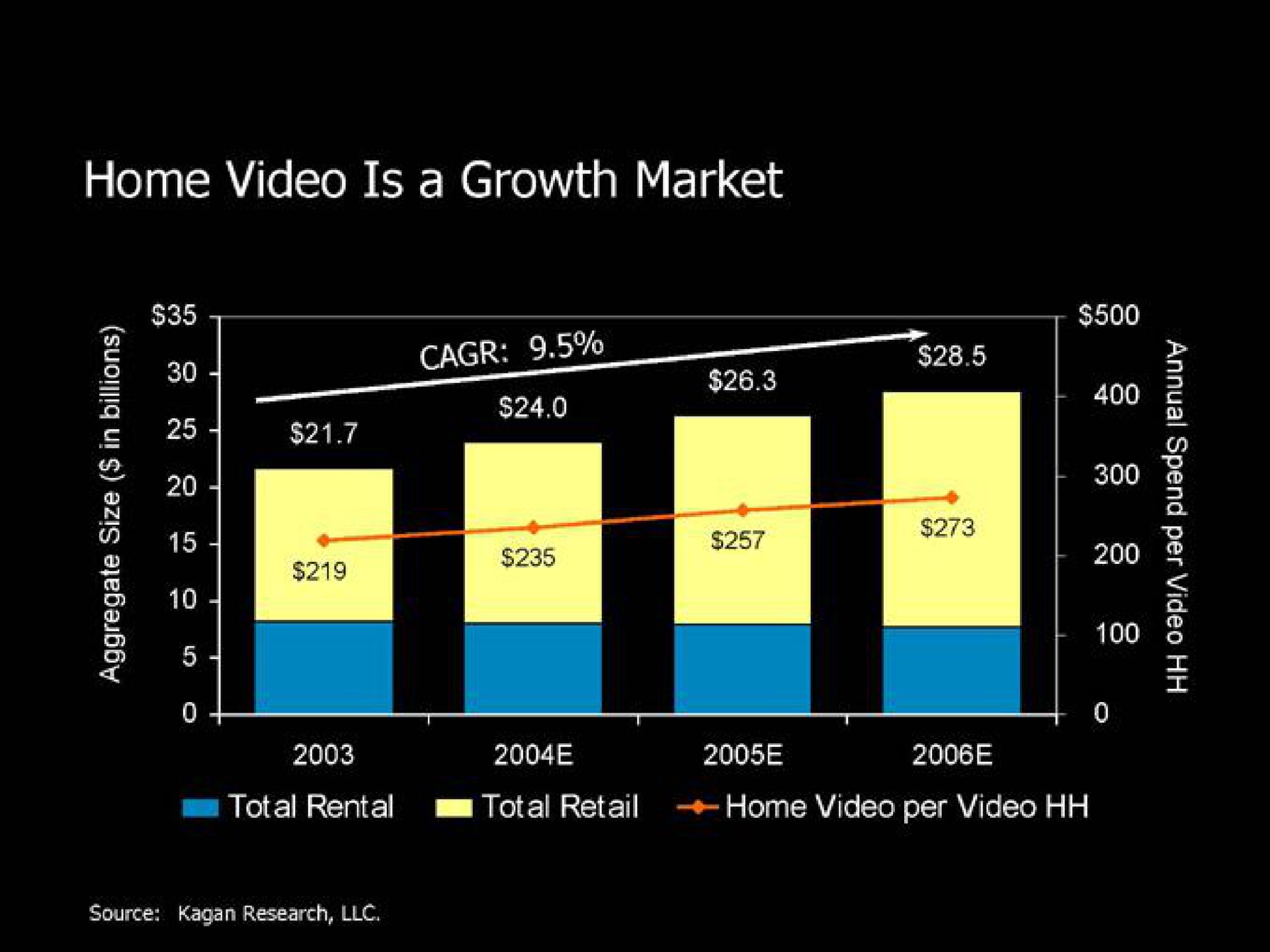

10. Viacom - Blockbuster (2004)

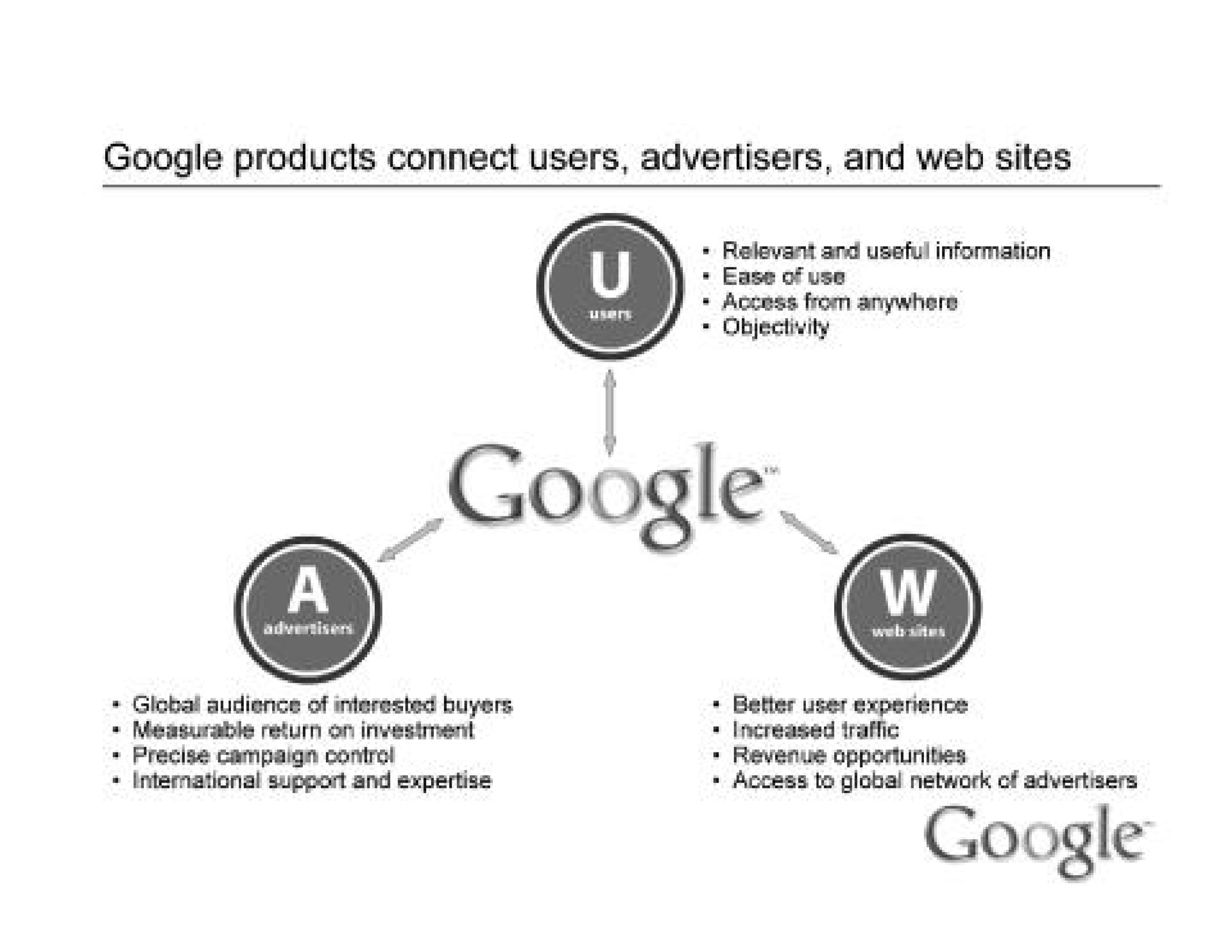

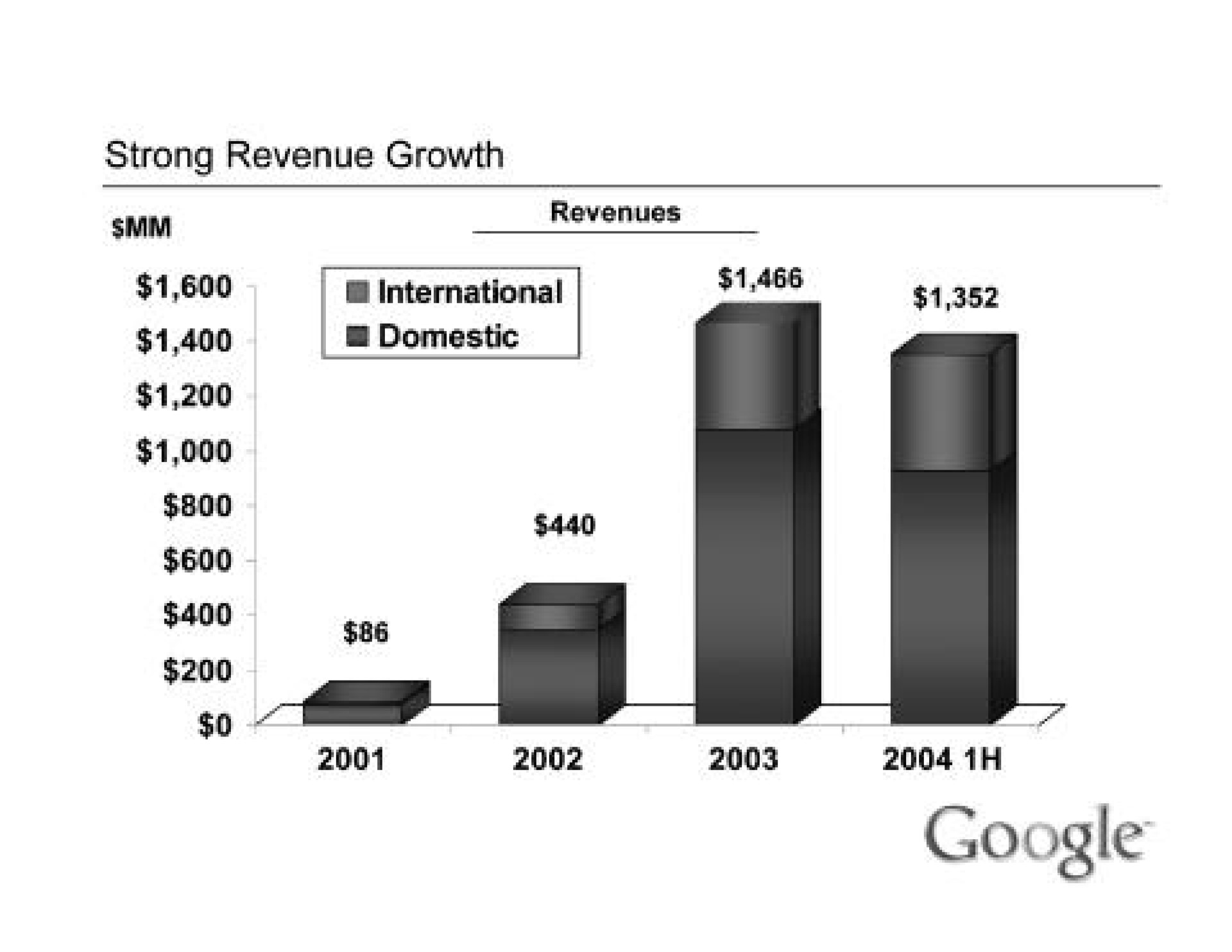

11. Google IPO (2004)

12. Adobe + Flash (2005)

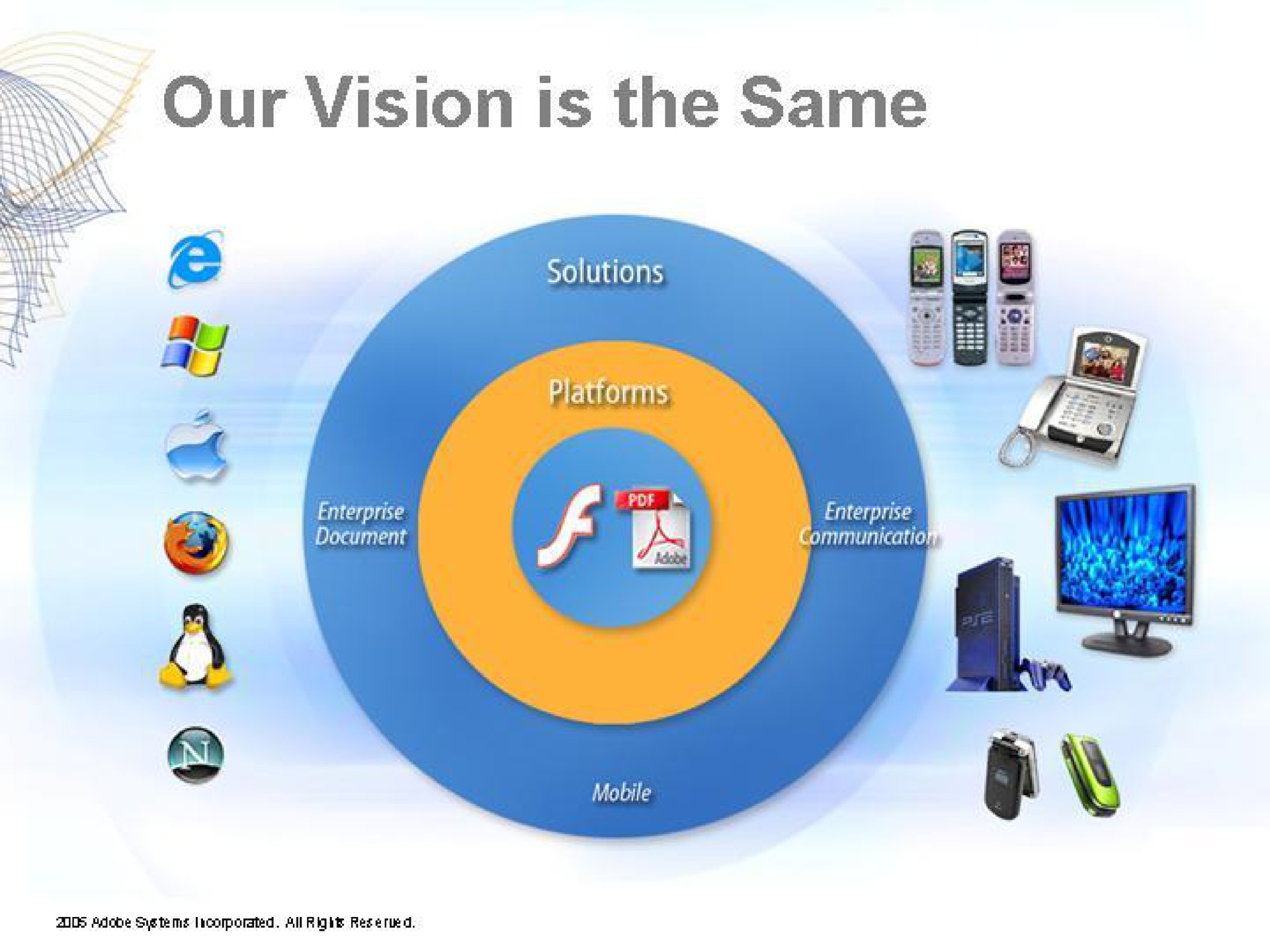

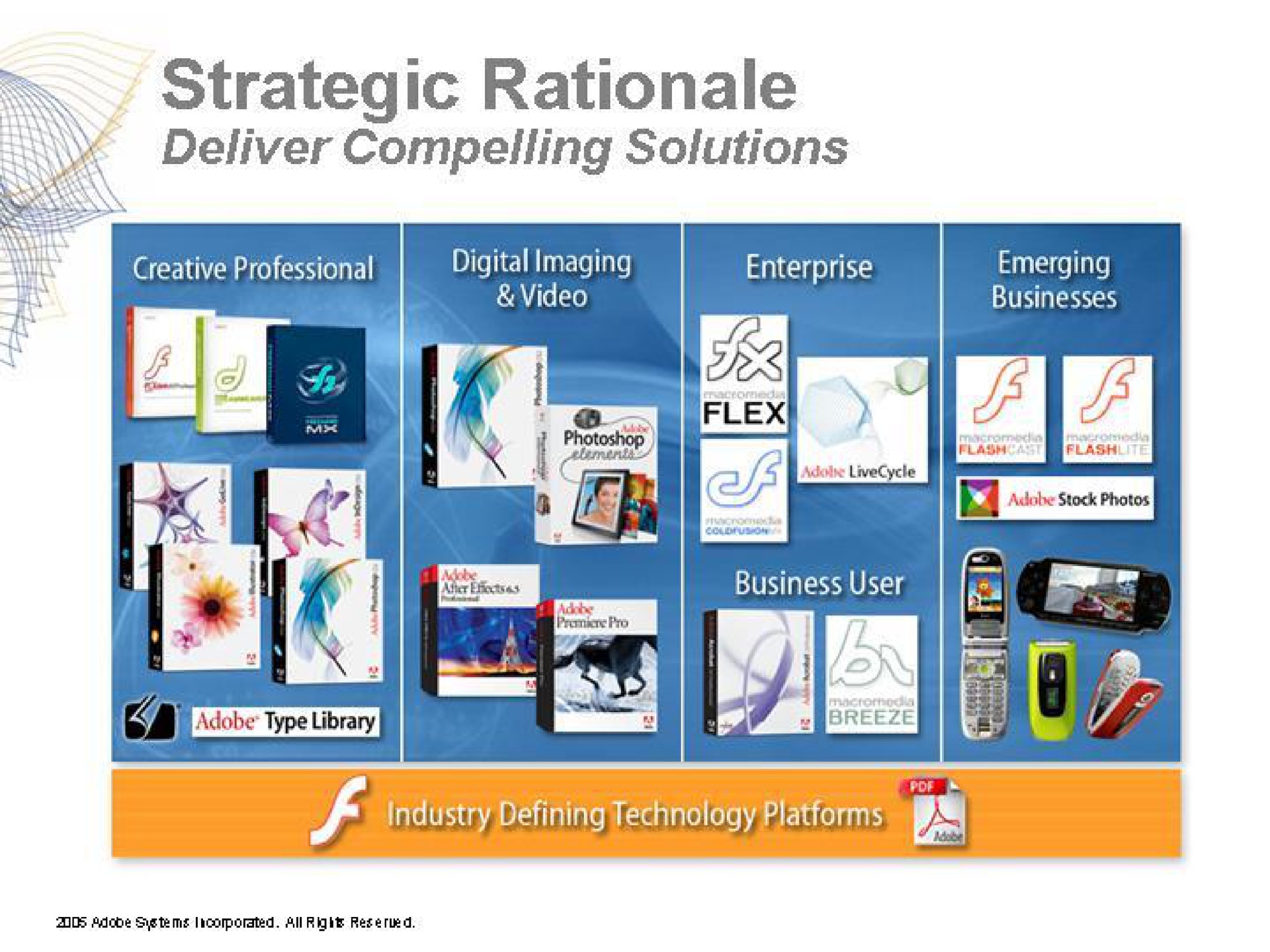

In 2005, Adobe Systems acquired Macromedia, a major player in the multimedia and web development software industry. This acquisition was a significant move that brought together two industry leaders, allowing Adobe to expand its software portfolio and strengthen its position in areas such as web design, animation, and multimedia development.

Following the acquisition, Adobe faced challenges related to the decline of Flash technology, which was a significant product in Macromedia's portfolio. Over the years, Flash lost its prominence due to security issues, limited mobile device support, and the rise of alternative technologies like HTML5. Adobe eventually discontinued Flash Player and shifted its focus to other areas of digital content creation, marking the end of an era for Flash as a web development platform.

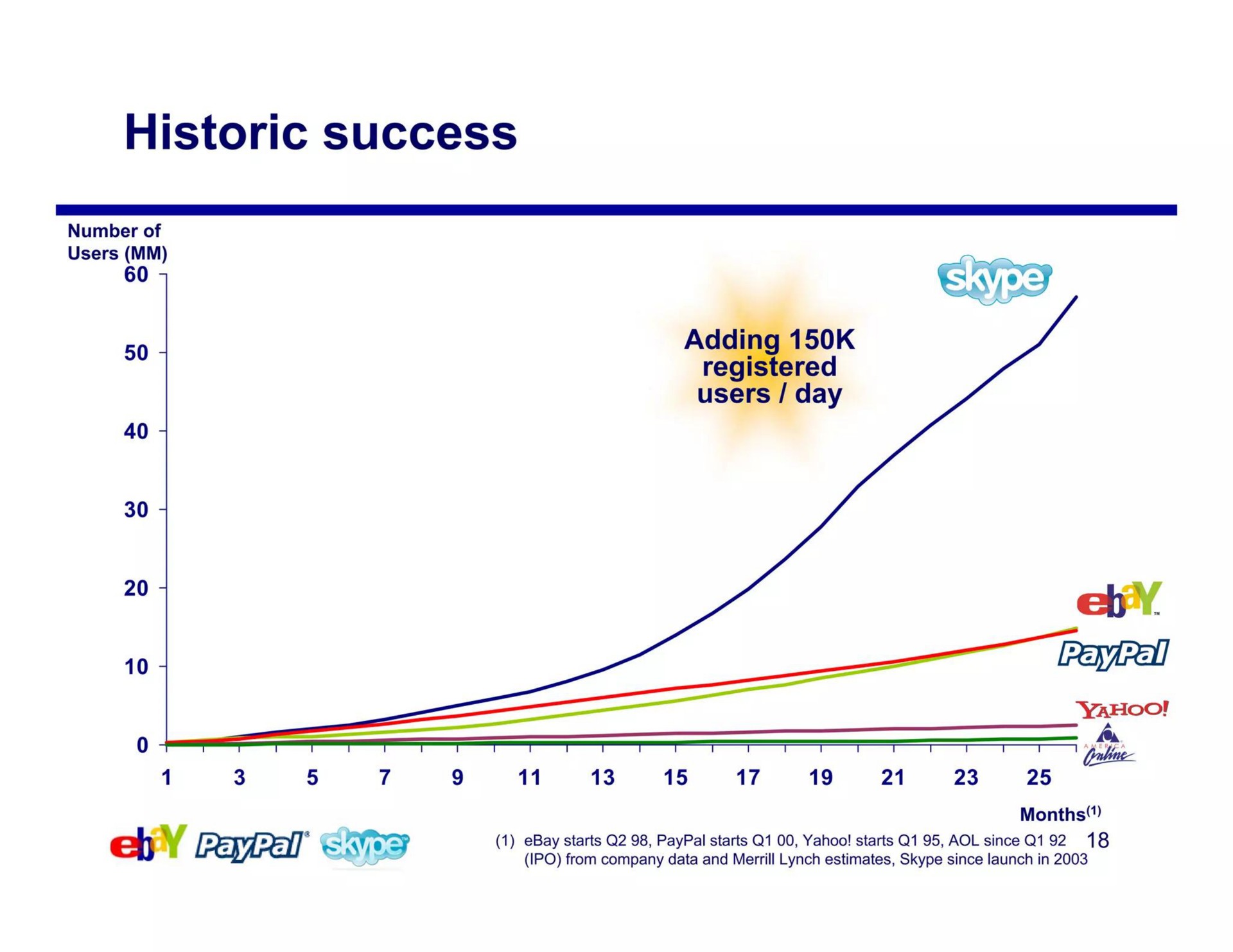

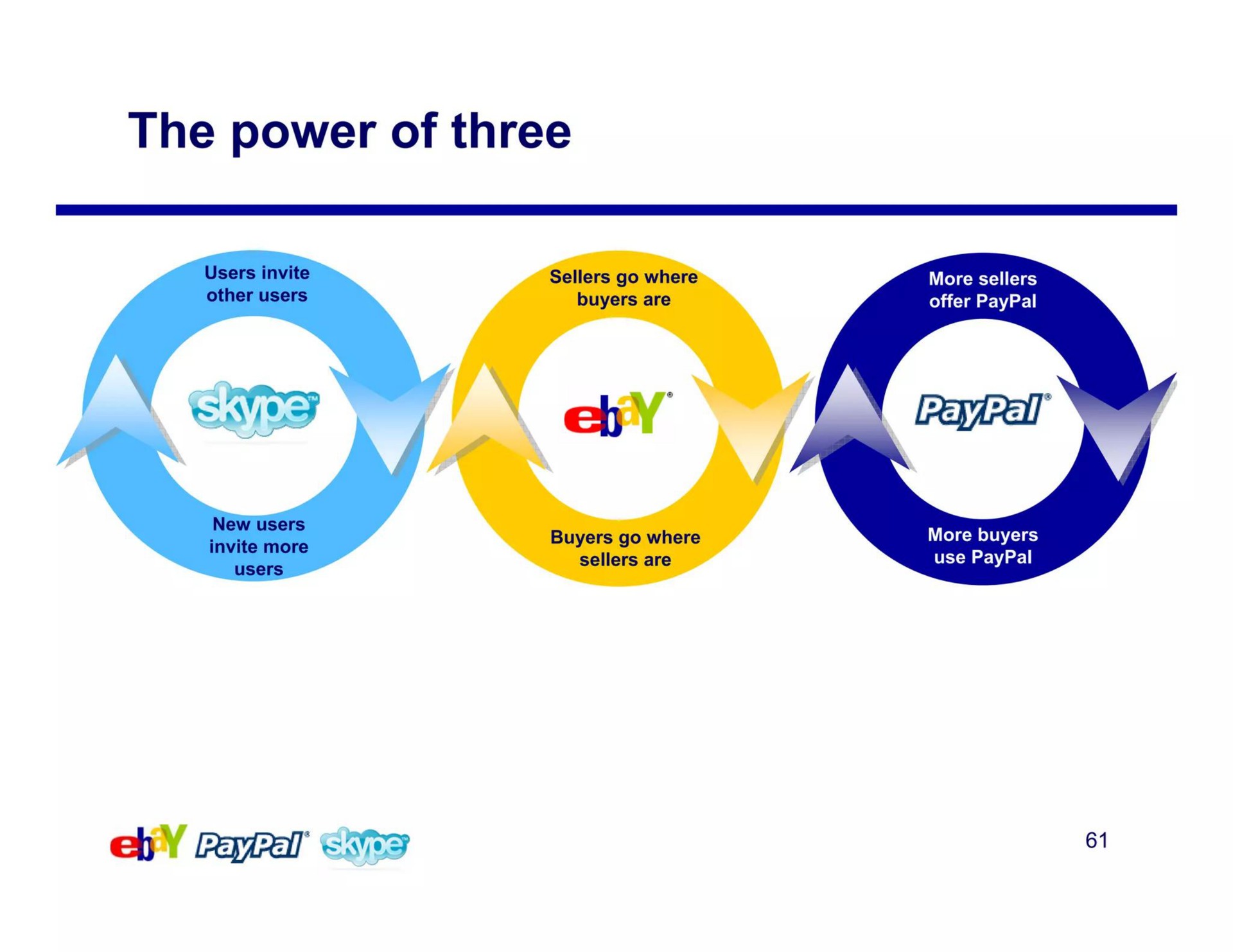

13. eBay + Skype (2005)

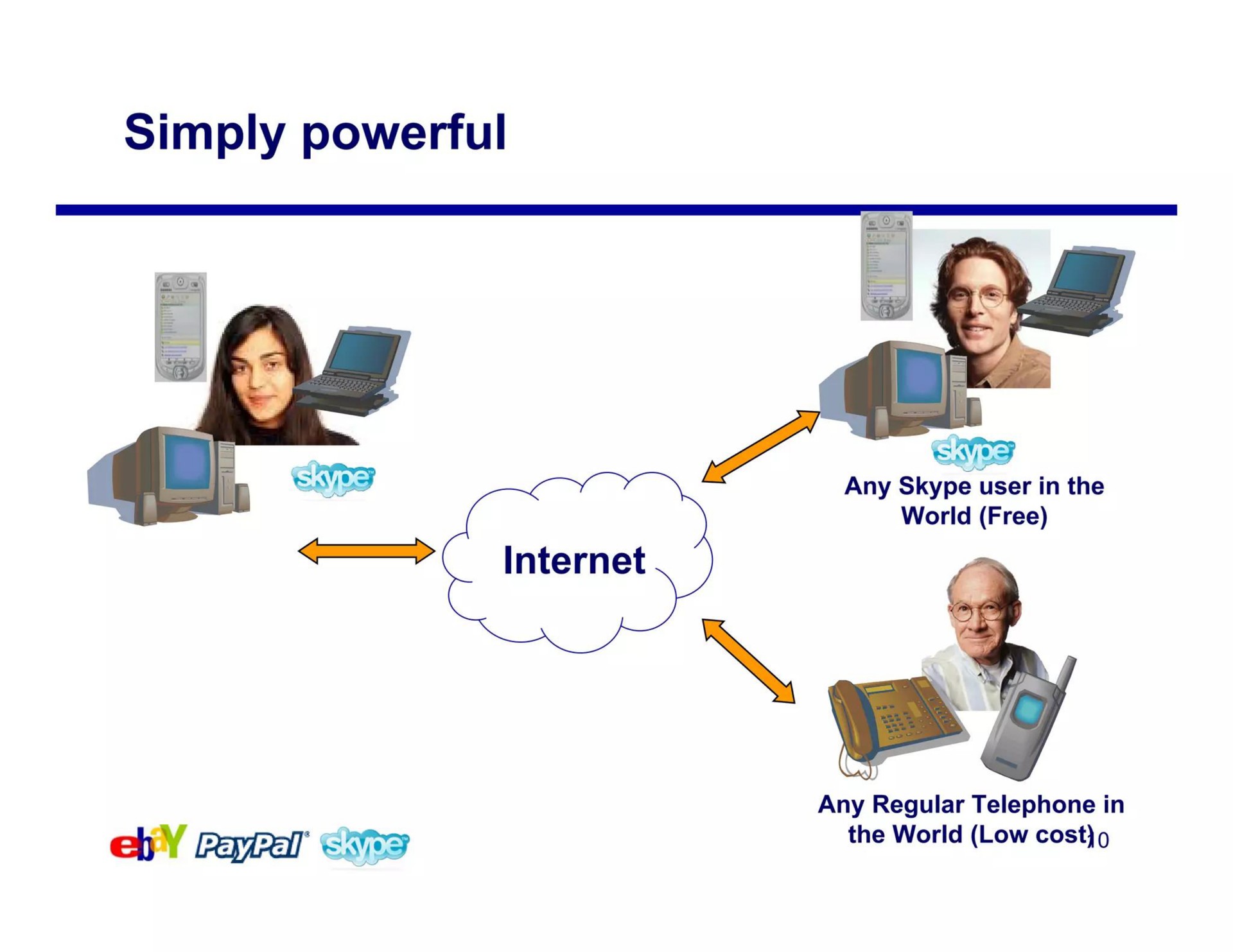

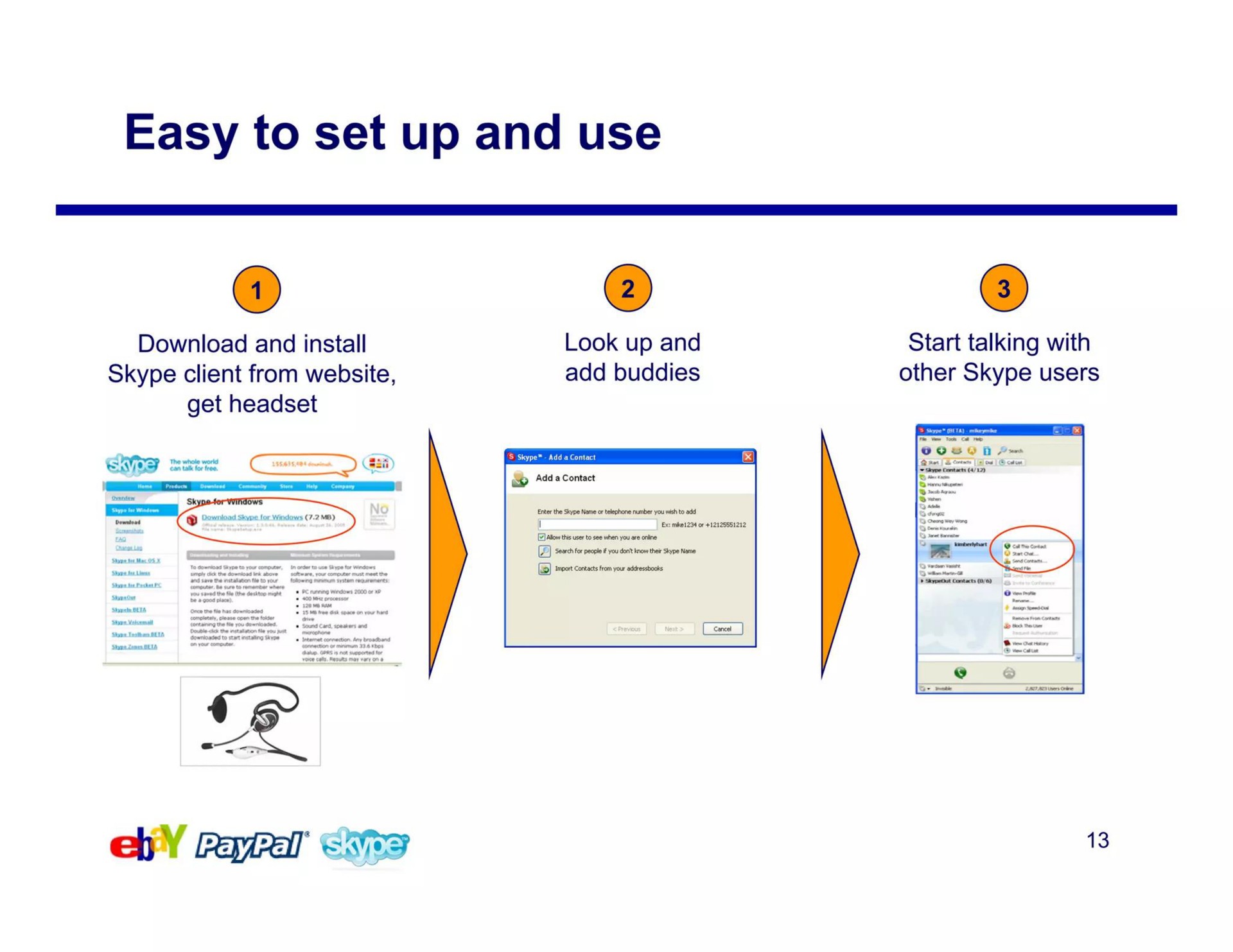

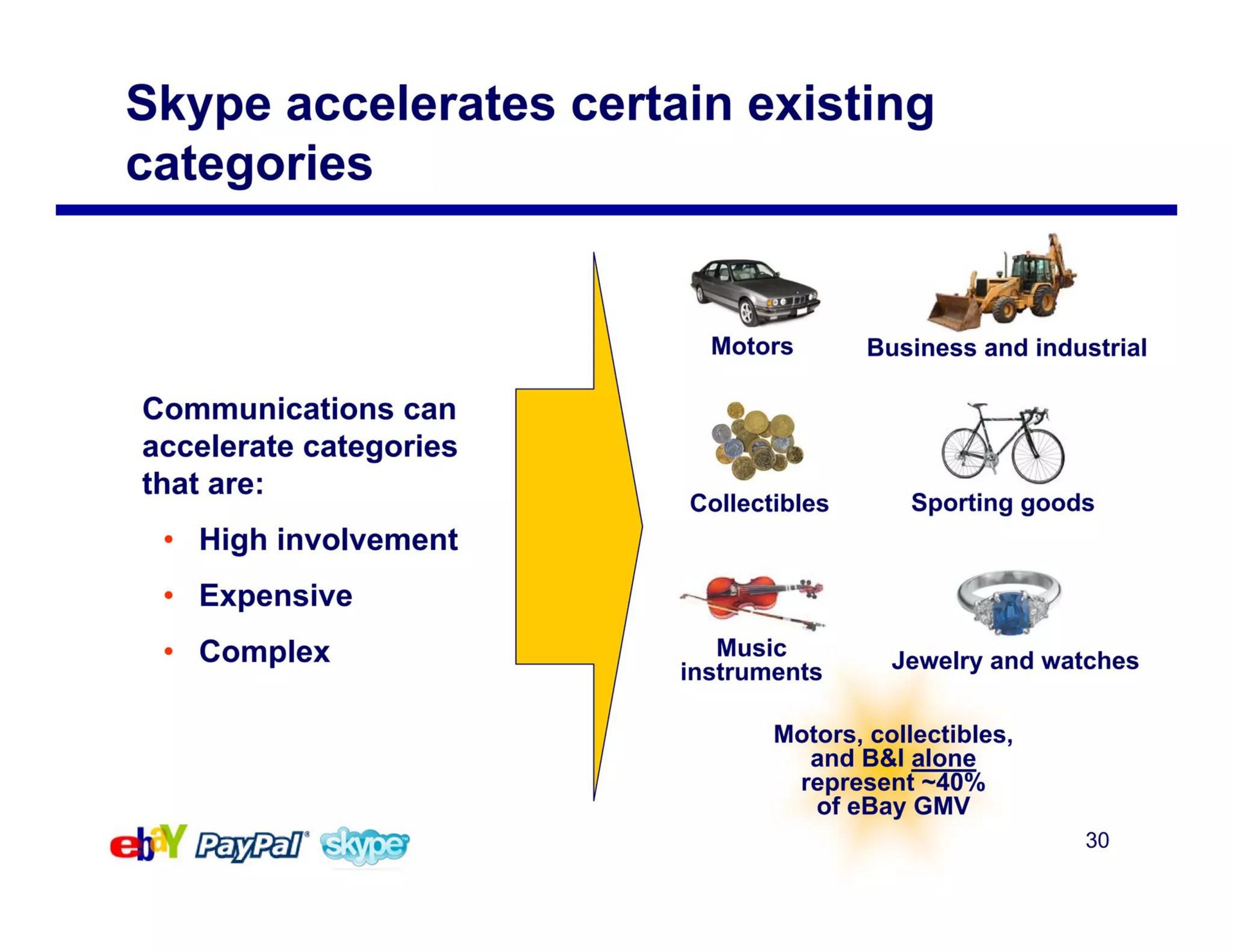

In 2005, eBay acquired Skype, a popular voice-over-IP (VoIP) and video conferencing service, with the intention of enhancing communication between buyers and sellers on its e-commerce platform. This acquisition aimed to provide eBay users with a more interactive and real-time communication channel to improve their online shopping experience.

However, the integration of Skype into eBay's core e-commerce business faced challenges, and the expected synergies between the two services did not materialize as anticipated. eBay later sold a majority stake in Skype in 2009 and ultimately divested itself of the service entirely in 2011 by selling it to Microsoft. The acquisition and subsequent sale of Skype showcased the complexities of integrating technology companies with different business models and raised questions about the strategic fit between an e-commerce platform and a communication service.

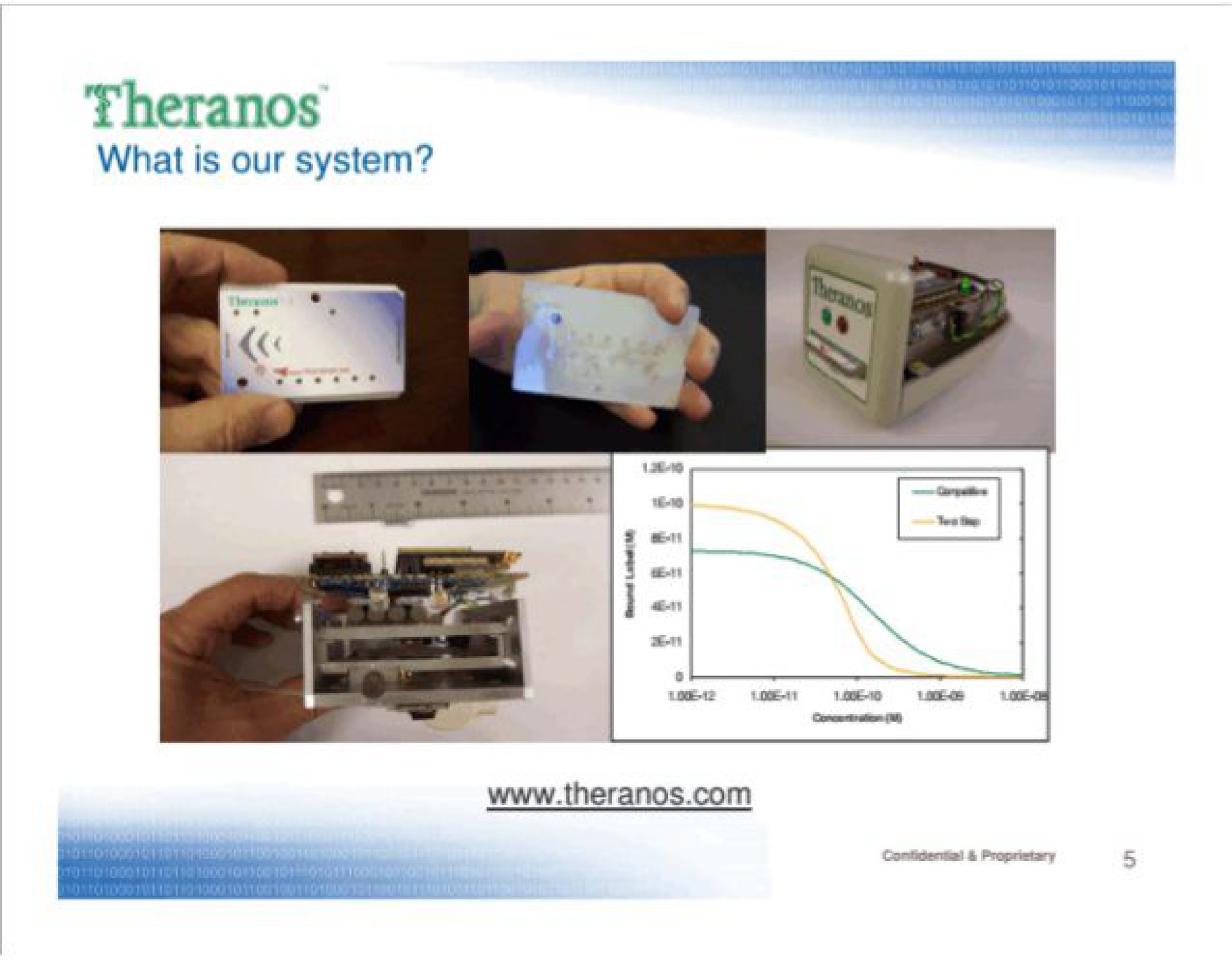

14. Theranos (2006)

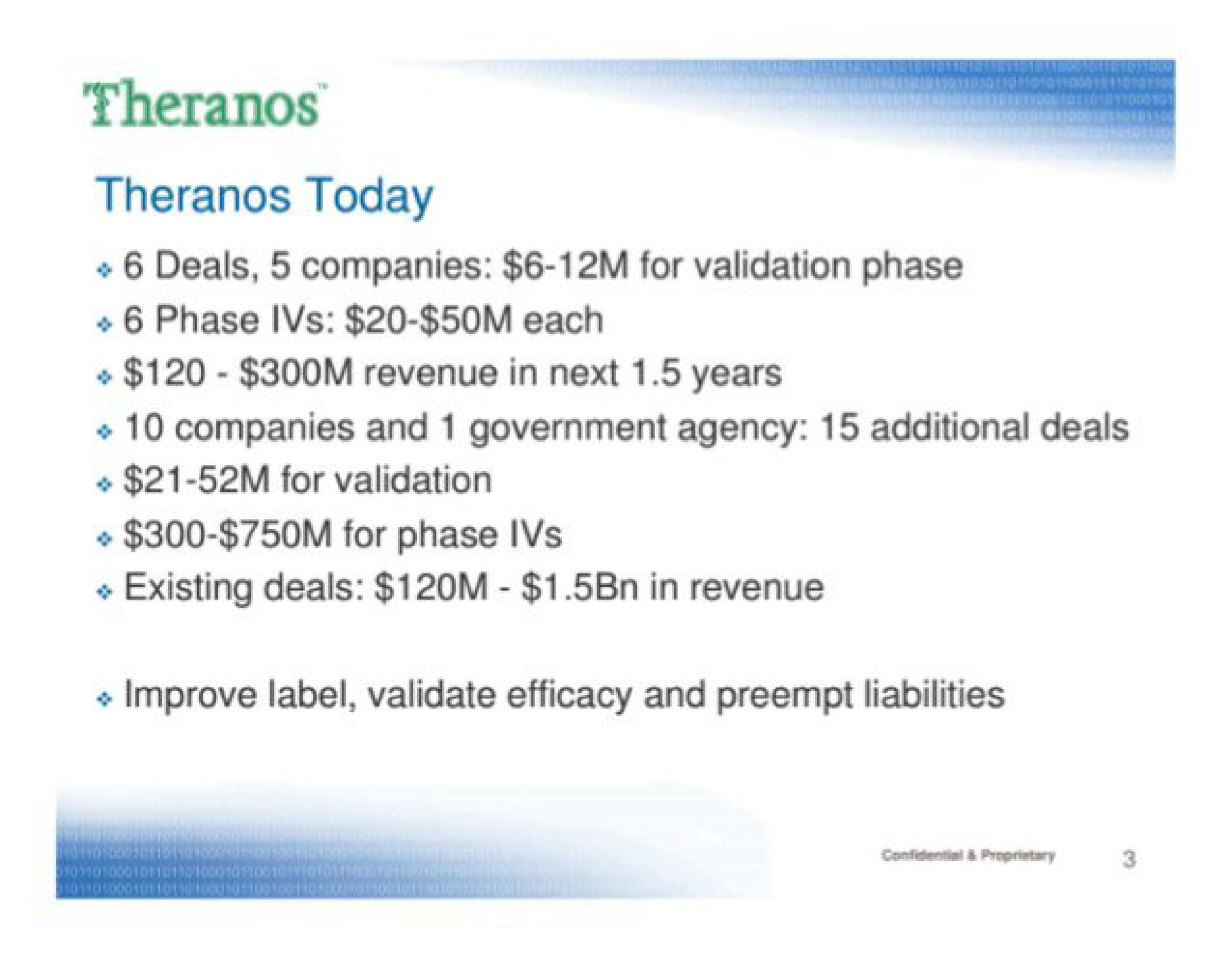

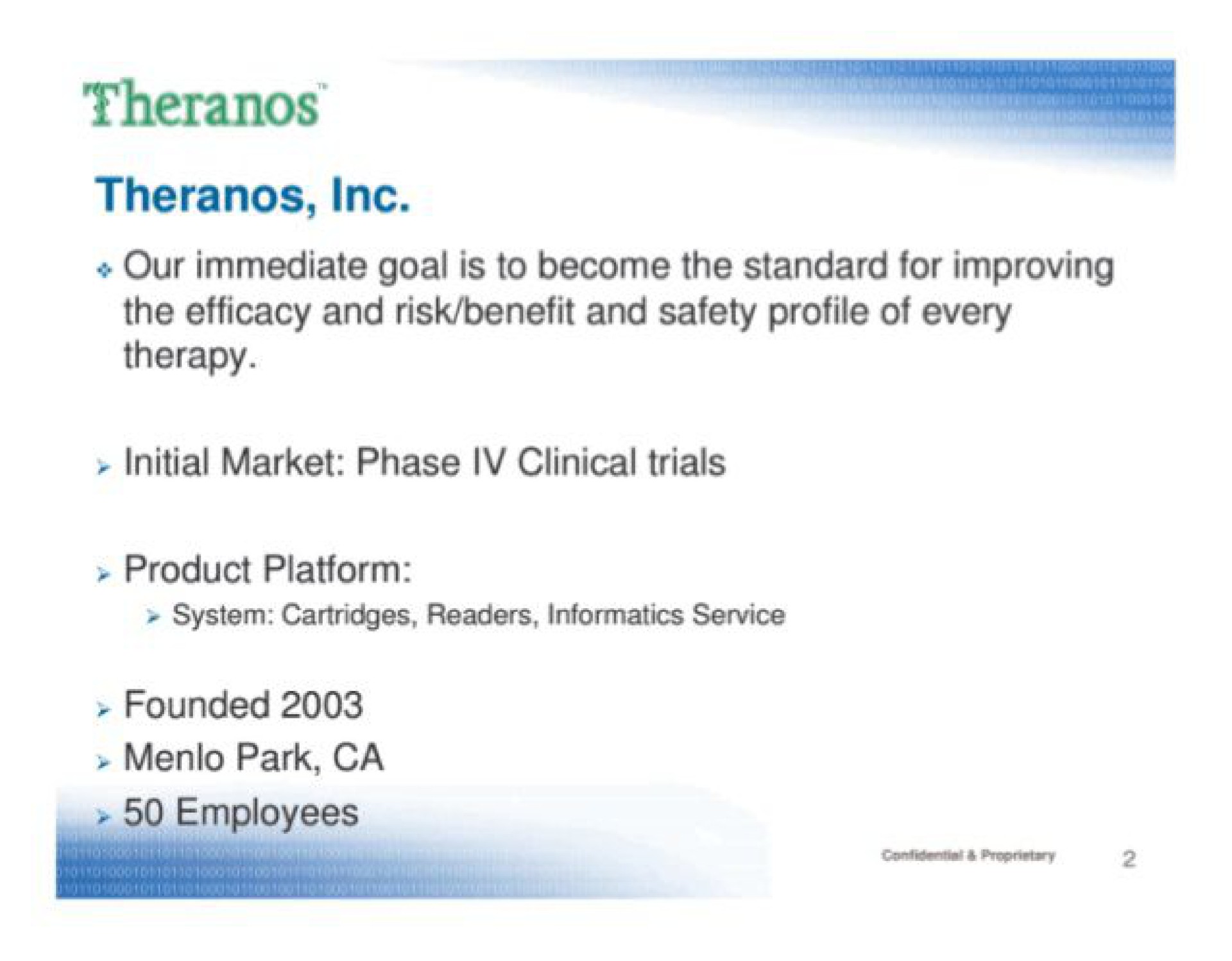

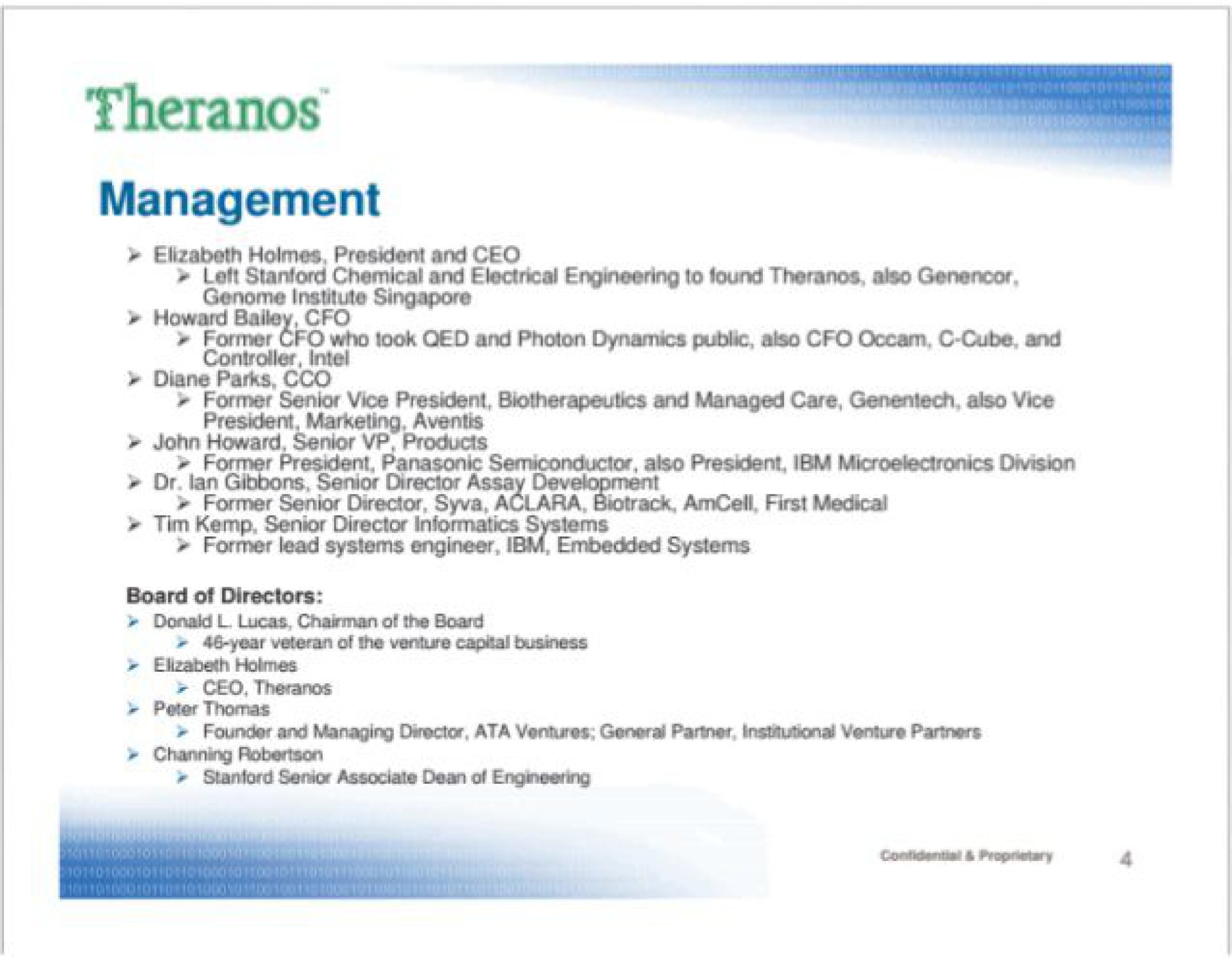

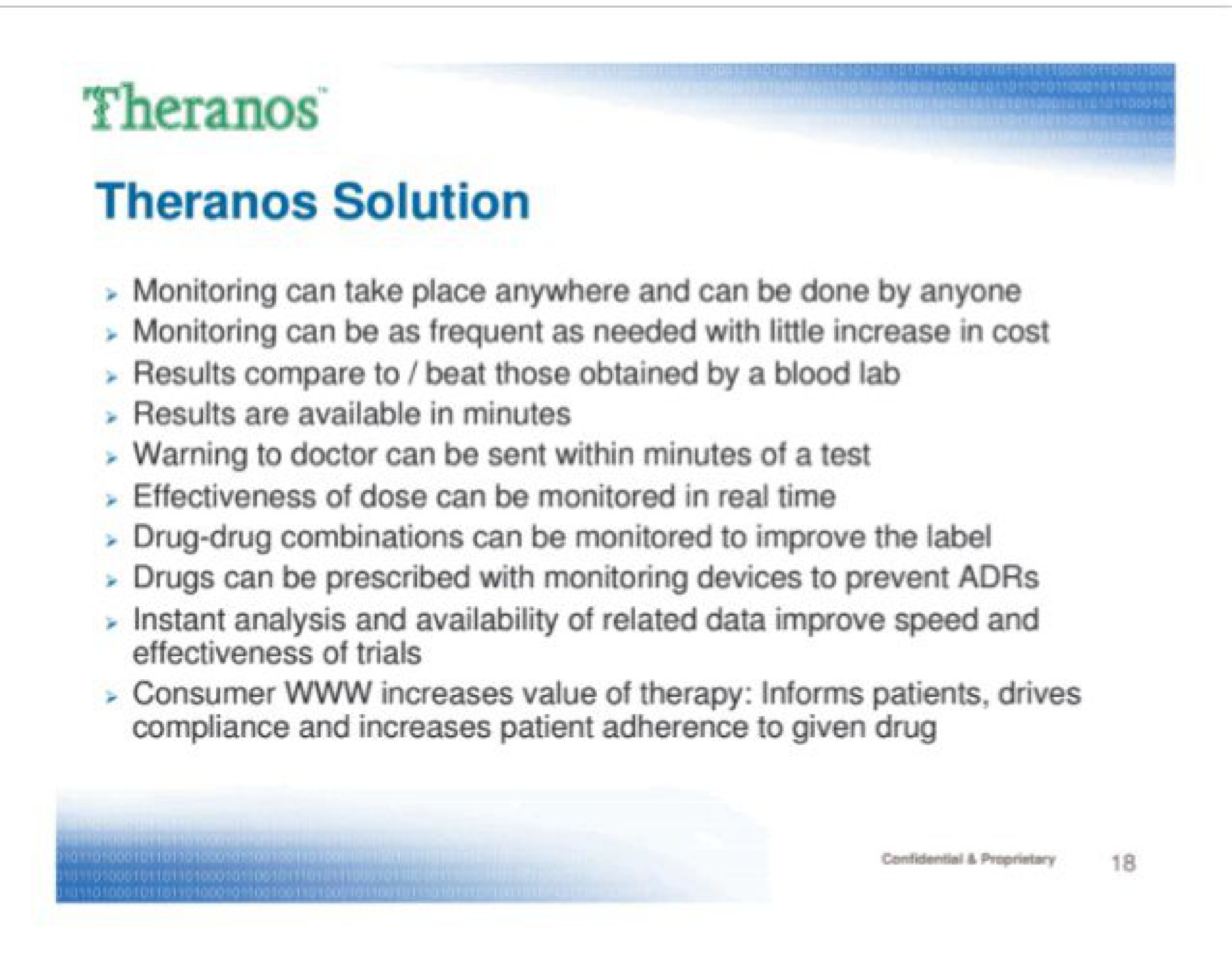

As of 2006, Theranos was a biomedical technology company founded by Elizabeth Holmes that aimed to revolutionize the medical testing industry by offering quick and low-cost blood tests using a few drops of blood from a finger prick. It generated significant attention and investment due to its ambitious claims of disrupting the healthcare sector and making diagnostic testing more accessible.

However, investigations revealed that the company had misled investors, patients, and healthcare professionals about the capabilities of its testing devices. By 2016, Theranos faced legal actions, regulatory scrutiny, and a loss of trust, ultimately leading to its downfall and dissolution.

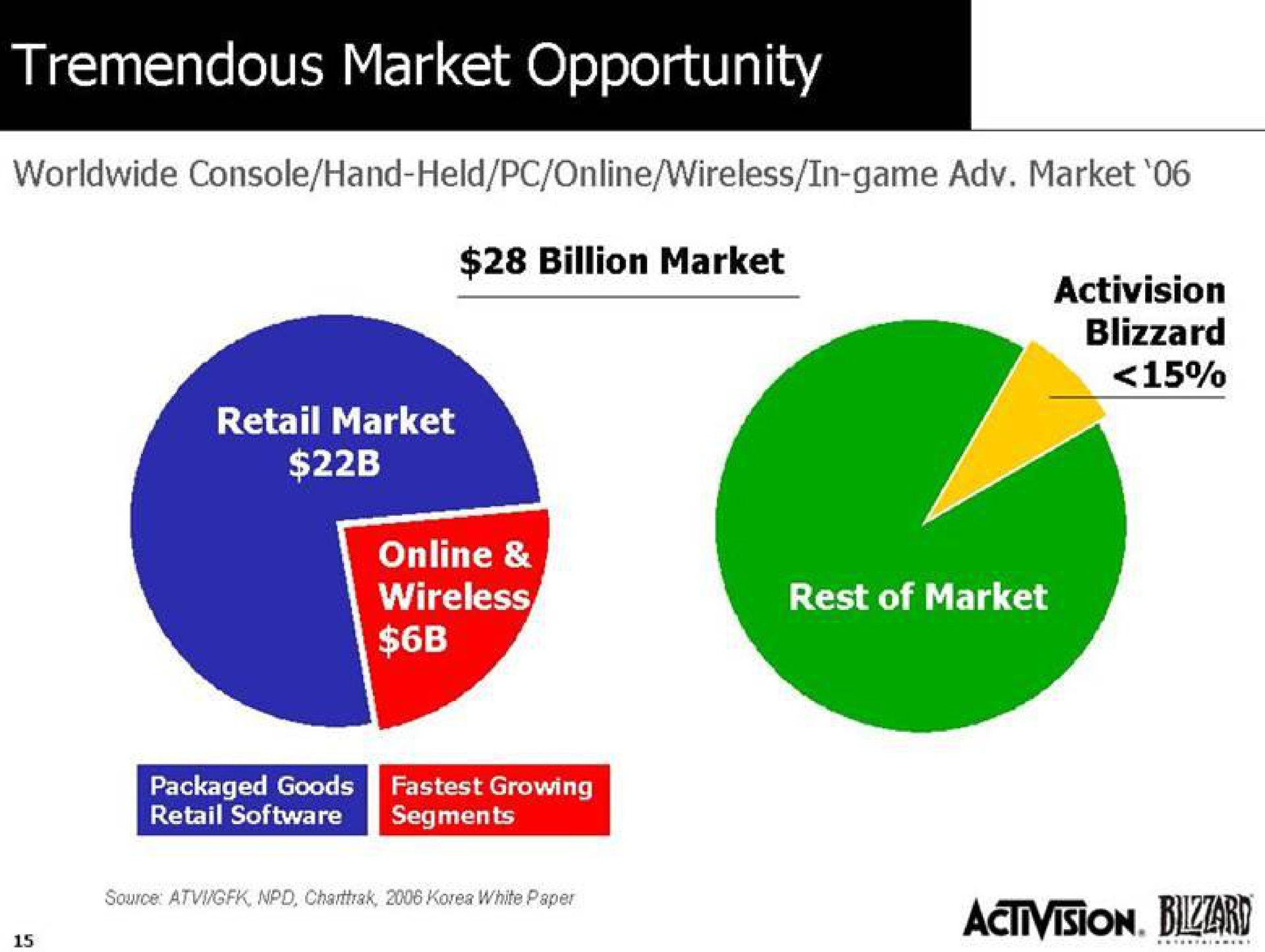

15. Activision + Blizzard (2007)

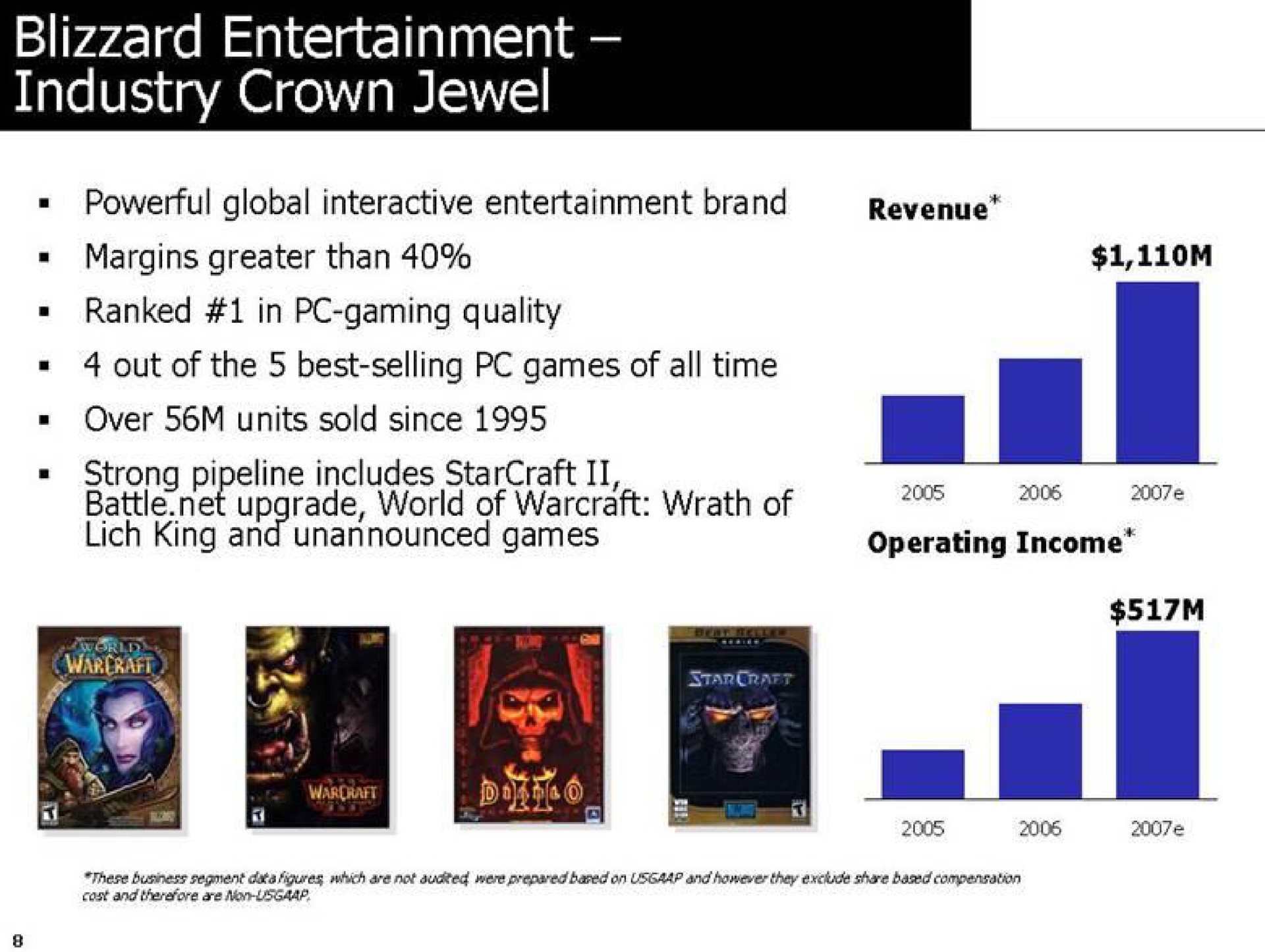

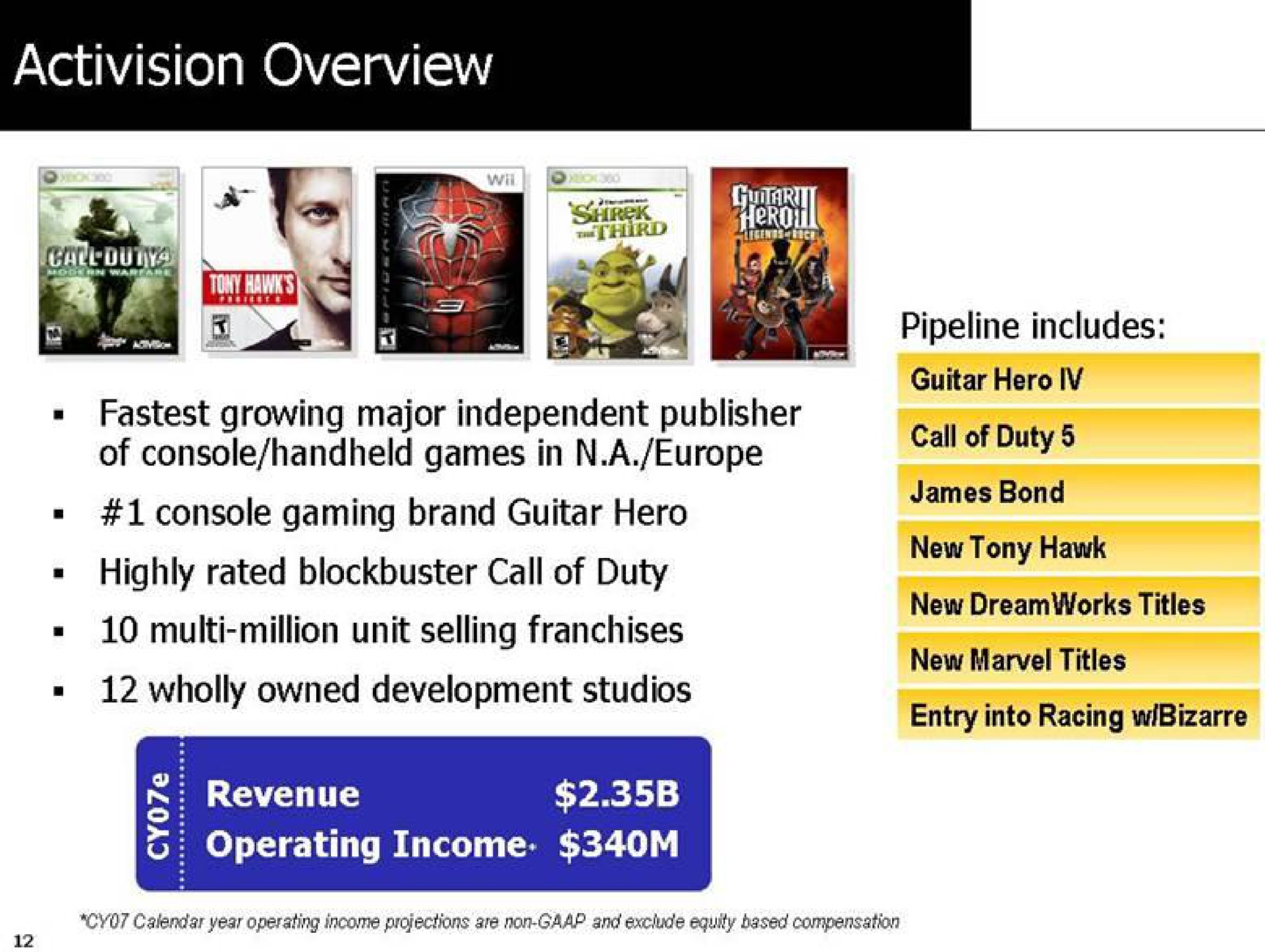

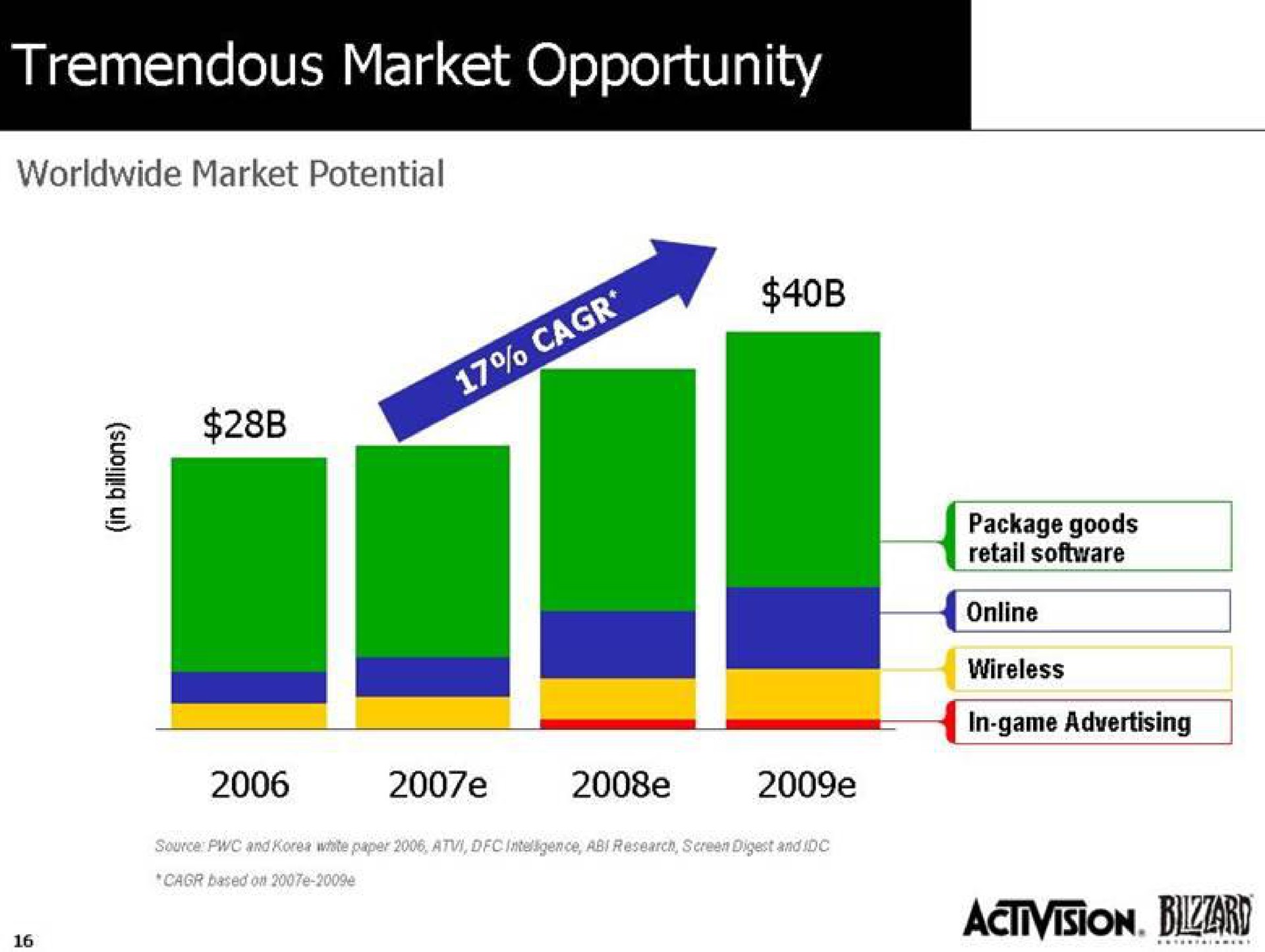

In 2007, Activision and Blizzard Entertainment merged to create Activision Blizzard, one of the world's largest and most influential video game publishers. This merger brought together two major players in the gaming industry, combining Activision's expertise in console gaming with Blizzard's success in PC gaming and its highly popular franchises like World of Warcraft, Diablo, and StarCraft.

The aftermath of the merger saw the newly formed Activision Blizzard continue to thrive and expand its portfolio, becoming a powerhouse in the video game industry. The company continued to release successful titles and franchises, and its influence extended into esports, mobile gaming, and other gaming-related ventures. This merger significantly reshaped the landscape of the gaming industry and had a lasting impact on the development and publishing of video games.

16. Apple / iPhone (2007)

As of 2007, Apple Inc. was a renowned tech company celebrated for its Macintosh computers, which were known for their sleek design and user-friendly Mac OS X operating system. Additionally, Apple had made a significant mark in the digital music industry with the iPod and iTunes, offering a revolutionary way for people to listen to and purchase music. The company had also established a growing network of retail stores, providing a unique shopping experience for customers and offering technical support. Apple's influence extended beyond its products, as its design and marketing strategies were shaping the consumer electronics and computing industries.

However, the most transformative moment was yet to come in 2007 with the introduction of the iPhone, which would redefine the company's direction and further solidify its position as a major player in the tech world.