Contents

In commemoration of the impending 10th anniversary of Microsoft's disastrous acquisition of Nokia, here is a list of major failed acquisitions by technology companies over the last 20 years. Due to our company's focus on presentations and pitch decks, we have only included deals for which we were able to locate relevant decks. As a result, we were unable to include such gems as News Corp's acquisition of Myspace, TimeWarner's acquisition of AOL, and Yahoo's acquisition of Tumblr.

1. eBay - Skype (2005)

Deal:

- In 2005, eBay agreed to acquire Skype for approximately US$2.5 billion in up-front cash and eBay stock, plus potential performance-based consideration.

Rationale:

- Accelerate commerce on eBay by making online trading easier particularly with transactions involving real estate, big-ticket purchases and services that require detailed conversations.

- Transaction was supposed to position eBay + PayPal + Skype as an “unparalleled e-commerce and communications engine”.

Aftermath:

- In 2007, eBay written down Skype value by $1.4bn admitting that acquisition failed to produce the sort of e-commerce and advertising revenues that eBay had hoped

- In 2009, 4 years after initial acquisition, eBay sold 65% of Skype for $1.9bn valuing the business at $2.9bn

2. Adobe - Macromedia (2005)

Deal:

- In 2005, Adobe acquired Macromedia (known for Flash, Dreamweaver) for $3.4 in stock for stock deal.

Rationale:

- Develop Flash into underlying technology for a broad range of apps and devices.

- Bolster Adobe's presence in the market for design tools for the Web and document management software for mobile phones and other wireless devices, markets in which Macromedia has gained an early lead.

Aftermath:

- Over the years use of Flash gradually declined with Adobe stating in 2015 that it is no longer has a meaningful impact on bottom line

3. Hewlett Packard - Autonomy (2011)

Deal:

- In 2011, H.P. announced acquisition of Autonomy, UK-based company focused on intelligent search and data analysis. H.P. acquired c. 87% stake in the company for $10bn valuing Autonomy at c. $11.7bn.

Rationale:

- Transform H.P. from a low-margin producer of printers, PCs and other hardware into a high-margin, cutting-edge software company.

- Together with Autonomy H.P. planed to reinvent how both structured and unstructured data is processed, analyzed, optimized, automated and protected.

- It was reported later that CEO believed that H.P.’s platform was sinking and appeared to be in a hurry to transform the company.

Aftermath:

- Within a month of the deal CEO was fired by the board.

- Within a year, HP had written off $8.8 billion of Autonomy's value claiming "serious accounting improprieties" and "outright misrepresentations" at Autonomy.

- In 2017, HP sold its Autonomy assets, as part of a wider deal, to the British software company Micro Focus.

- In 2018, Autonomy's ex-CFO Sushovan Hussain was charged in the US and found guilty in of accounting fraud.

- In 2023, 12 years (!) after transaction was announced, founder of Autonomy, Mike Lynch, has been extradited to the US to face criminal fraud charges in connection to HP acquisition.

4. Google - Motorola (2011)

Deal:

- In 2011, Google acquired Motorola Mobility for $12.5bn.

Rationale:

- Supercharge the Android ecosystem and enhance competition in mobile computing.

- Protect Android ecosystem with Motorola Mobility’s patent portfolio.

- Official press-release stated that “Google is great at software; Motorola Mobility is great at devices. The combination of the two makes sense and will enable faster innovation.”

Aftermath:

- In 2014, 19 months after acquisition, Google sold Motorola to Lenovo for $2.9bln in cash and stock with $1.5bn payment deferred for 3 years.

- Larry Page, CEO of Google at the time, stated that “smartphone market is super competitive, and to thrive it helps to be all-in when it comes to making mobile devices. […] This move will enable Google to devote our energy to driving innovation across the Android ecosystem, for the benefit of smartphone users everywhere.”

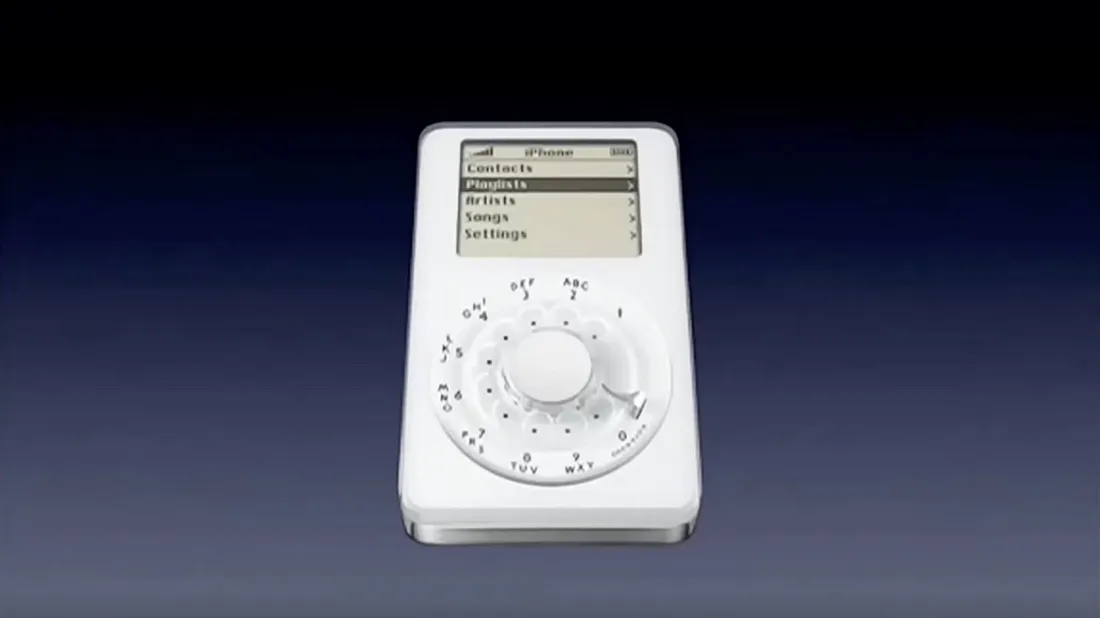

5. Microsoft - Nokia (2013)

Deal:

- In 2013, Microsoft announced acquisition of Nokia for $7.2bn. The deal was announced by Steve Ballmer, Microsoft’s CEO at the time.

Rationale:

- Accelerate the growth of Microsoft’s share and profit in mobile devices through faster innovation, increased synergies, and unified branding and marketing.

Aftermath:

- Following change of leadership, Microsoft gradually wrote off its investment in Nokia, divesting parts of the company. Finally in 2017, Microsoft announced that they will no longer develop new phone hardware and Windows Mobile OS abandoning mobile business.

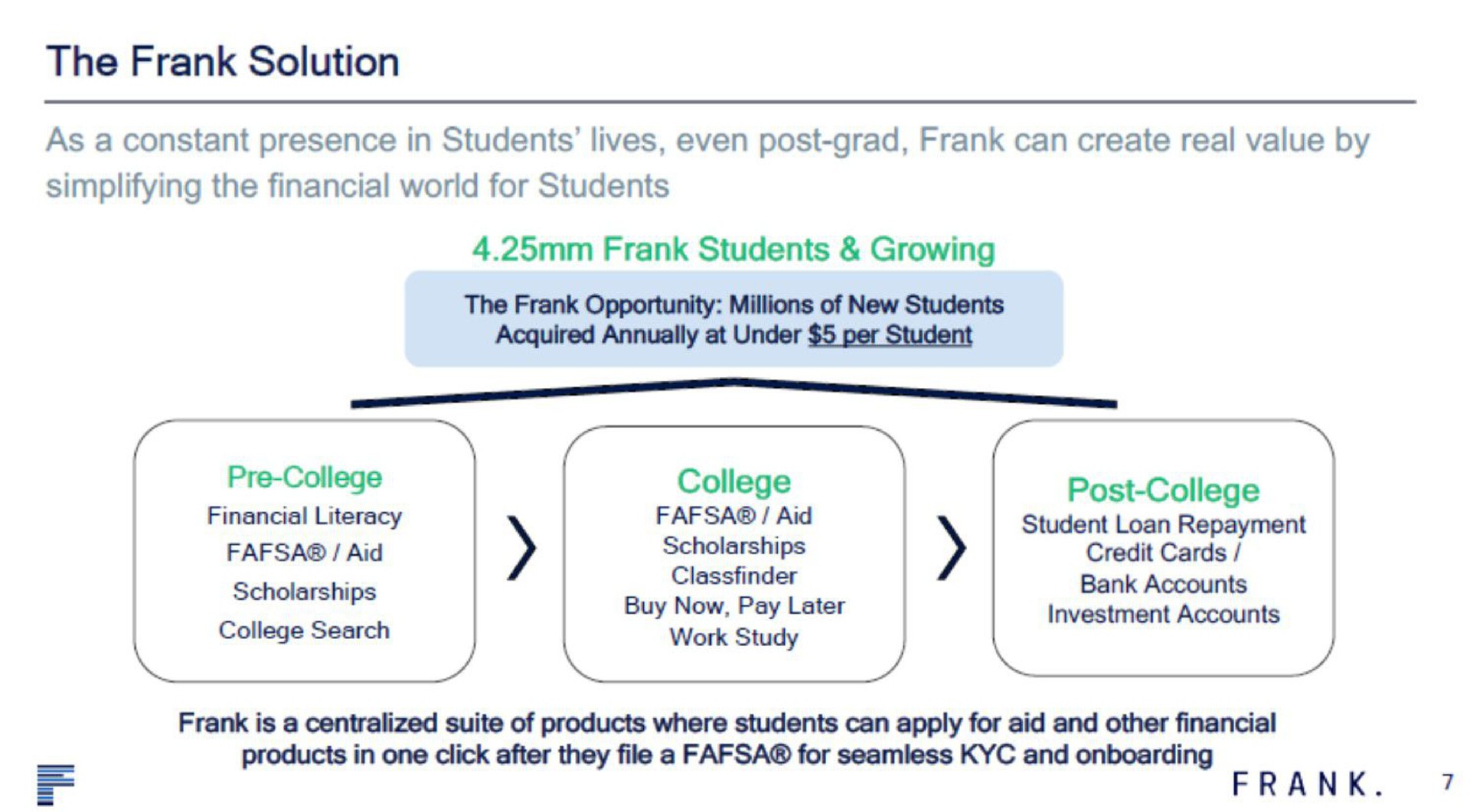

6. J.P. Morgan - Frank (2021)

Deal:

- In September 2021, JPMorgan Chase & Co announced that it had acquired Frank, a college financial planning platform used by over 5 million students in the United States for $175mn.

Rationale:

- The deal was expected to accelerate Chase’s strong foundation with students including products, content, and guidance for students of all ages.

- JPMorgan believed that Frank offered a unique opportunity for deeper engagement with students and would allow to expand JPMorgan’s capabilities for students and their families.

Aftermath:

- After the deal closed, Frank’s founder Charlie Javice joined JPMorgan as a managing director. However, the bank terminated her contract for cause later.

- In 2023, JPMorgan accused Javice and another Frank executive of claiming the company had 4.25mn users when in fact it had only 300,000 at the time.

- Javice has also been indicted separately on criminal fraud charges by US prosecutors who allege she falsified user numbers as part of the sale.

- Interestingly, in May 2023, JPMorgan was ordered by Delaware court to cover Javice’s legal fees as part of her agreement to sell her company, Frank, to the bank in 2021.

7. Bonus: Microsoft - Yahoo (2008)

Deal:

- In January 2008, Microsoft made an offer to acquire all outstanding shares by Yahoo at $31 per share valuing the company at $45bn.

Rationale:

- Combined company was supposed to have better chances to compete with Google in an advertising business.

- Merger was supposed to create a more efficient company with synergies in four areas: scale economics driven by audience critical mass and increased value for advertisers; combined engineering talent to accelerate innovation; operational efficiencies through elimination of redundant cost; and the ability to innovate in emerging user experiences such as video and mobile. Microsoft believed these four areas could generate at least $1 billion in annual synergy for the combined entity.

Aftermath:

- In February 2008, Yahoo board and then CEO Jerry Young, turned down the offer stating that it substantially undervalued the company.

- In May 2008, Carl Icahn launched ultimately unsuccessful campaign to replace Yahoo board with directors who would reopen talks with Microsoft.

- Negotiations between Microsoft and Yahoo continued for some time but eventually Microsoft abandoned the deal. However in July 2009, the companies announced a search and advertising deal. Prior to that Microsoft relaunched its own search engine, renaming it Bing.

- It took Yahoo another 4 years to reach market capitalization comparable to Microsoft offer (mostly on the back of the value of stake in Alibaba and Yahoo Japan).

- Eventually, in 2017, Yahoo sold its core business to Verizon for $4.8bn.

See More