Happy families are all alike; every unhappy family is unhappy in its own way.

Leo Tolstoy, 1873Achieving success in business is often a complex and challenging journey, marked by numerous hurdles. The path is uncertain, with a significant risk of failure. Entrepreneurs and business owners encounter a wide array of challenges in their efforts to create a profitable and lasting business. Moreover, the business landscape is not insulated from unethical conduct, including outright fraud, which is not rare. Such actions can greatly diminish trust within the business community, impacting not only potential investors and partners but also customers who could be subject to fraudulent practices. Here are pitch decks and presentations from those who did not make it.

1. Astra Space

Astra Space, Inc., commonly known as Astra, is a company that has positioned itself within the aerospace industry with a focus on small satellite launch vehicles. Founded in 2016 and headquartered in Alameda, California, Astra aims to simplify access to space by providing reliable, frequent launch opportunities for small satellites. The company’s strategy revolves around the development of small, cost-effective rockets designed to carry payloads weighing up to a few hundred kilograms into low Earth orbit (LEO), catering primarily to the burgeoning small satellite market.

Astra went public in 2021 via SPAC transaction at a valuation of $2.1 billion. However, Astra has struggled to achieve its ambitious launch cadence goals and faced a series of setbacks, including a failed sideways launch in 2021. The company never achieved the bi-weekly launch cadence it had promised investors.

Astra's new Rocket 4 program, intended to be more reliable and capable, has also faced delays and the company does not have enough funding to move the program forward as quickly as planned. Astra has had to reduce its workforce by 25% and shift resources to focus on its satellite propulsion business.

In March 2024, Astra announced it had entered into a definitive merger agreement to be taken private by its CEO and CTO at a price 99% below its peak. Astra warned that if the deal to go private does not go through, the only alternative would be to file for Chapter 7 bankruptcy and liquidate the company, as the company has exhausted other funding options.

Astra went public in 2021 via SPAC transaction at a valuation of $2.1 billion.

In March 2024, Astra announced it had entered into a definitive merger agreement to be taken private by its CEO and CTO at a price 99% below its peak.

2. Byju's

Byju's garnered global acclaim for its innovative learning platform, which offered personalized education through technology, catering to a vast audience of students across various age groups. The company's rapid expansion, fueled by a series of high-profile acquisitions and aggressive marketing strategies, positioned it as a leader in the global education technology market. However, this rapid growth came at a substantial financial cost, leading to a complex set of issues that have impacted its business operations.

Despite securing billions in funding and achieving a valuation that ranked it among the most valuable startups worldwide, the company faced criticism for its delayed financial reporting and for not being profitable over the years. The onset of the COVID-19 pandemic initially surged demand for online learning, which Byju's capitalized on to expand its user base significantly. However, as the world began to transition back to normalcy, the company struggled to maintain its growth momentum. The high customer acquisition costs, combined with the pressure to continuously innovate and adapt to a post-pandemic educational landscape, strained its financial resources. Moreover, the global economic downturn and tighter investment climate have further exacerbated these challenges, leading to layoffs, cost-cutting measures, and a reassessment of its aggressive expansion strategy.

The cash-starved startup, which has been hunting for new funding for over a year, late January 2024 launched a rights issue, where it seeks to raise about $200 million. The rights issue resets the startup’s valuation, once at $22 billion, to about $25 million.

Later in February 2024, a group of Byju’s investors voted to remove the edtech group’s founder and chief executive Byju Raveendran and separately filed an oppression and management suit against the leadership at the firm to block the recently launched rights issue in a surreal moment for the startup, once India’s most valuable.

Overview presentation given by Byju Raveendran back in 2017

3. Drizly

Drizly was an online platform that was founded in 2012 by Nick Rellas, Justin Robinson, and Spencer Frazier. It started its service in Boston in 2013 and expanded to several other cities including New York, Los Angeles, and Chicago. Drizly partners with local retailers to offer a wide range of alcoholic beverages for delivery. Customers can use Drizly's app or website to order beer, wine, and liquor, which are then delivered by local retail partners. The service aimed to provide deliveries within an hour, though this was subject to factors like traffic and weather.

In 2021, Uber acquired Drizly for $1.1 billion. However, in January 2024, Uber announced its decision to shut down Drizly and merge it with the Uber Eats app by March 2024. This move was part of Uber's strategy to consolidate its services and focus on delivering a range of products, including alcohol, through a single app. The integration was seen as a response to market shifts and consumer behavior changes post-pandemic. Before its acquisition by Uber, Drizly had faced a data breach in 2020 that affected 2.5 million customers, but it's unclear if this influenced Uber's decision to shut down the service

4. Hyperloop One

Hyperloop One, formerly known as Virgin Hyperloop, was a transportation technology company that aimed to commercialize high-speed transportation in near-vacuum tubes. The company used a 'near-vacuum' environment within a tube to enable high speeds, low power consumption, and almost completely remove aerodynamic drag. Inside the tube, battery-powered pods were designed to glide at speeds of up to 670 mph, providing a comfortable, quiet, and safe travel experience for passengers. However, the company has shut down, with its assets being sold off, offices closed, and employees laid off. Its intellectual property has shifted to its majority stakeholder, major Dubai port operator DP World. The original hyperloop concept was based on an idea by Elon Musk, proposing the use of magnetic levitation (maglev) technology to reduce friction and air resistance, allowing the train to travel at speeds of 700 mph.

5. Bird

Bird was founded in 2017 by former Lyft and Uber executive Travis VanderZanden. It has pioneered the short-term scooter rental business model. The company was backed by high-profile Silicon Valley investors, including Sequoia Capital and Accel Partners. Bird was the fastest startup ever to reach a "unicorn" valuation of over $1 billion.

The company went public in late 2021 via a SPAC merger, with a valuation of approximately $2 billion. However, the business was hit hard by COVID-19 lockdowns, with its market cap crashing to approximately $70 million just 12 months later. Higher interest rates and the end of the cheap money era put further pressure on the company's finances. Since 2018, Bird has racked up more than $1.6 billion in net losses. It had just $10.2 million in unrestricted cash and cash equivalents at the end of September 2023.

With its share price plummeting, CEO VanderZanden departed in June 2023. In September 2023, the company was delisted from the NYSE after it failed to maintain a market cap of above $15 million for 30 consecutive days.

In December 2023, Bird Global filed for Chapter 11 bankruptcy protection. Under the restructuring agreement announced on Wednesday, Bird will essentially be taken over by its creditors. Apollo and Bird's second-lien lenders have agreed to provide $25 million in financing to keep the company running while it restructures in court. Bird will sell its assets, which existing lenders have agreed to purchase.

The company went public in late 2021 via a SPAC merger

One of the latest investor decks (March 2023) prior to going bankrupt.

6. WeWork

WeWork, officially known as The We Company, is a commercial real estate company that provides flexible shared workspaces for technology startups and services for other enterprises. Founded in 2010 by Adam Neumann and Miguel McKelvey in New York City, the company gained significant attention for its innovative approach to office spaces, which emphasized community, shared amenities, and a focus on creating a collaborative environment.

WeWork's business model revolves around leasing large commercial spaces, transforming them into smaller offices and common areas, and then renting these spaces out to individuals and companies. These spaces often include perks like high-speed internet, office equipment, communal lounges, and sometimes more unique offerings like free beer and wellness activities.

The company rapidly expanded globally and was once one of the most valuable startups in the United States with valuation of c. $47 billion. However, it faced significant challenges. Its attempt to go public in 2019 brought intense scrutiny, revealing substantial losses, questionable corporate governance practices, and concerns about its long-term profitability. This scrutiny led to the resignation of co-founder Adam Neumann as CEO and a significant devaluation of the company.

After the failed IPO attempt, WeWork underwent significant restructuring. It reduced its global footprint and focused on achieving profitability by cutting costs and streamlining operations. The company's strategy shifted towards providing flexible workspace solutions to a broader range of clients, including larger enterprises, which now make up a significant portion of its customer base.

In November 2023, WeWork filed for WeWork filed for Chapter 11 bankruptcy protection in federal court .

In the end of 2014, WeWork raised Series D round at c. 5$ billion valuation. The round was lead by Goldman Sachs, T. Rowe Price, Wellington Management

In August 2019, The We Company submitted its S-1 form for the initial public offering (IPO). However, in the subsequent month, due to escalating concerns from investors triggered by the details revealed in the S-1, Adam Neumann, a co-founder of the company, stepped down from his role as CEO and relinquished his majority voting rights. The growing unease among investors regarding the company's corporate governance, valuation, and future prospects led to the formal retraction of its S-1 filing

In March 2021, the company reached a deal to become a public company via a special-purpose acquisition company with a $9 billion valuation and merge with BowX Acquisition Corp.

The Company was hit hard by the COVID-19 as well as higher interest rates. In March 2023, WeWork struck deals to cut debt by about $1.5 billion and extend the date of some maturities, in a bid to preserve cash as the flexible-workspace provider feels the heat of mass layoffs on its business

In November 2023, WeWork filed for Chapter 11 bankruptcy protection in federal court

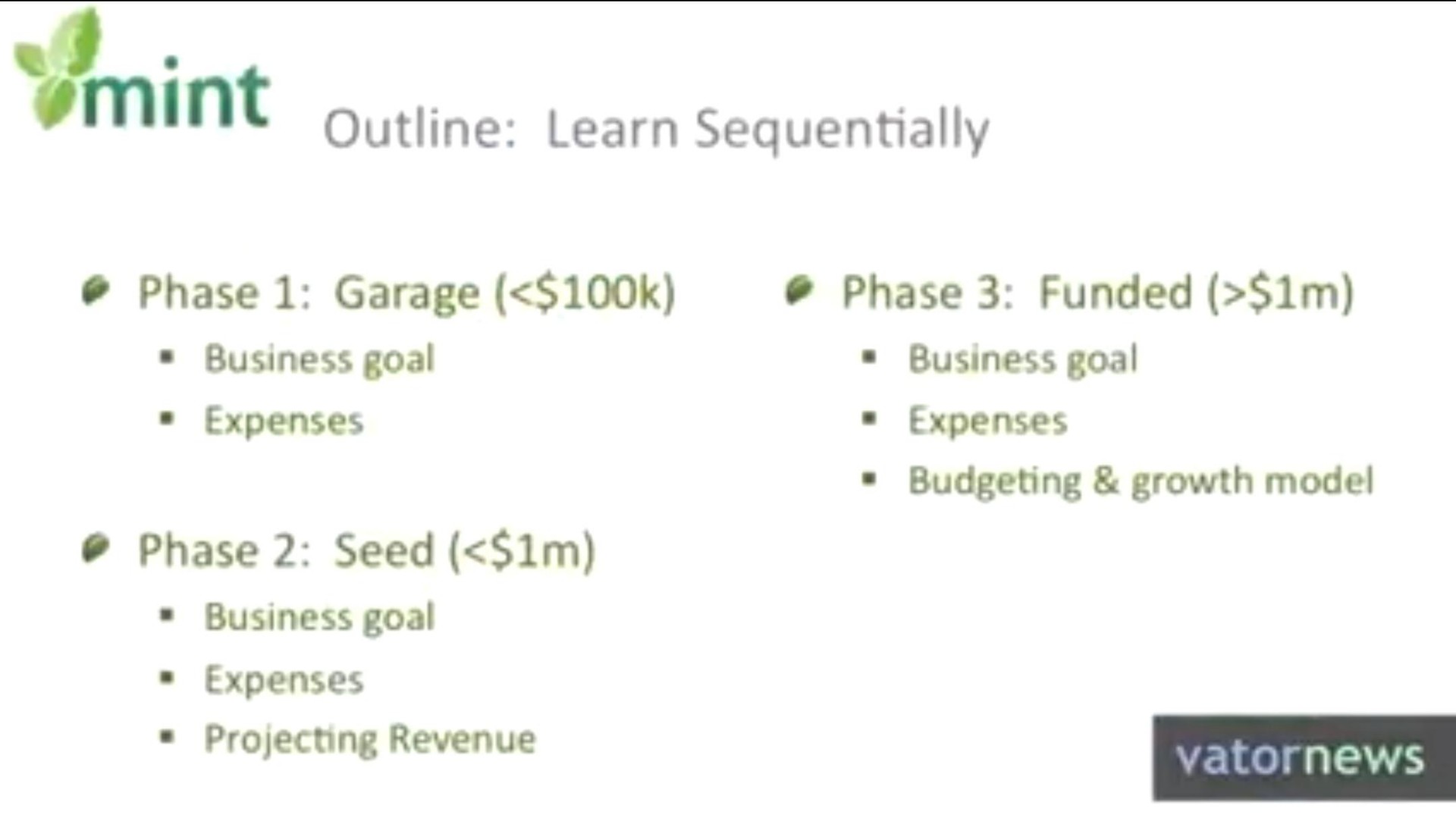

7. Mint.com

Mint.com, originally established by internet entrepreneur Aaron Patzer in 2007, was a well-known personal finance management service. Patzer, recognized for his significant contributions to the financial management sector, launched Mint.com when he was just 25 years old. The service quickly gained traction and, in a notable success story, was acquired by Intuit for around $170 million in 2009, only two years after its inception.

Following the acquisition, Patzer took on the role of vice president and general manager of Intuit's personal finance group. In this position, he oversaw Mint.com as well as the entire spectrum of Quicken's online, desktop, and mobile products. He remained with Intuit until December 2012.

Mint.com was celebrated as one of the top budgeting applications available, known for its extensive array of features. It allowed users to connect their financial accounts, monitor spending, assess net worth, and establish personalized financial goals and budget categories. However, as of January 1, 2024, Mint.com has ceased operations.

8. Convoy

Convoy was a digital freight network company based in Seattle, Washington, founded in 2015. The company developed software solutions to connect shippers and carriers, leveraging machine learning and automation. They aimed to optimize the freight marketplace and served various industries including food and beverage, automotive, retail, and manufacturing. Convoy's platform was designed to streamline the logistics process, making it more efficient for both shippers and carriers.

Despite its innovative approach and significant funding (totaling $825.5 million), in October 2023, the company unexpectedly ceased operations and laid off its staff, citing a freight recession and contraction in the capital markets as the main reasons for its downfall. This shutdown came as a surprise, especially given that Convoy had raised substantial investment and was valued at $3.8 billion just 18 months prior to its collapse. The company had also attracted prominent investors, including Bill Gates and Jeff Bezos.

Before closing, Convoy had attempted various strategies to navigate the difficult market conditions, including layoffs and considering a potential sale of the company. The sudden halt in operations left many in the industry surprised and raised questions about the future of digital freight marketplaces.

Pitch deck based on the original pitch Convoy used in 2014-2015

9. FaZe Clan

FaZe Clan, or simply FaZe, is a professional esports and entertainment organization headquartered in Los Angeles, California, United States. Founded on May 30, 2010, as FaZe Sniping, the organization has players from around the world, across multiple games, including Call of Duty, Counter-Strike 2, PlayerUnknown's Battlegrounds and others. In 2020, the organization expanded into the Asian market, acquiring a Thai PUBG Mobile and EA Sports FC (Online) roster.

In 2021, Faze announced it was merging with special purpose acquisition investors B. Riley Principal to become a public company listed on NASDAQ, with an expected initial valuation of about $1 billion. As part of this merge, FaZe would receive $291 million from B. Riley, and would be renamed to Faze Holdings Inc. and refocus itself as a brand for "the voice of youth culture". The merger was approved by the U.S. Securities and Exchange Commission, and the company went public on July 20, 2022, however with a lower than announced valuation of $725 million.

In July 2022, FaZe Clan became a publicly traded company. The company had only received a portion of the money they were promised by private investors ahead of their merge with B. Riley Principal 150 Merger Group. On January 20, 2023, the price of their stock fell below a dollar for the first time, which lead them to be at risk of being delisted. In March 2023, it was reported that they received a Notice of Delisting, which gave them 180 days to get the stock price back up above $1.

In October 2023, it was announced that FaZe Clan has been acquired by GameSquare Holdings Inc. in an all stock deal valuing company at $17 million.

In 2021, Faze announced it was merging with special purpose acquisition investors B. Riley Principal to become a public company listed on NASDAQ, with an expected initial valuation of about $1 billion.

In July 2022, FaZe Clan became a publicly traded company. The company had only received a portion of the money they were promised by private investors ahead of their merge

10. SmileDirectClub

SmileDirectClub was primarily recognized as a teledentistry enterprise, specializing in the provision of clear orthodontic aligners. Established in May 2014 by Jordan Katzman and Alex Fenkell, the company operated out of Nashville, Tennessee. Its services entailed offering clients either an at-home teeth impression kit or the option of 3D teeth scanning at its physical SmileShops. Based on these impressions or scans, SmileDirectClub crafted personalized clear aligners and managed the treatment process remotely via telehealth consultations.

The company's operational strategy revolved around a direct-to-consumer model, circumventing conventional dental office channels to deliver clear aligners straight to consumers. This approach enabled clients to choose between obtaining a 3D scan at a SmileShop or using a home impression kit. Following this, a treatment plan was formulated under the guidance of licensed dental professionals, and the bespoke aligners were dispatched directly to the client. This strategy was designed to offer cost savings and enhanced convenience over traditional orthodontic methods.

In September 2019, SmileDirectClub embarked on a public offering, entering the stock market with an approximate valuation of $8.9 billion. This IPO garnered significant attention, marking a notable event in the health technology and teledentistry sectors. Post-IPO, however, the company's stock was subject to market volatility, influenced by investor perceptions and responses to the firm's growth potential and various challenges.

Subsequent to its IPO, SmileDirectClub encountered several hurdles, including regulatory scrutiny, legal disputes, and inconsistent market performance. By September 2023, the company ceased its global operations and filed for bankruptcy. Consequently, its telehealth aligner treatment services were discontinued, and customer support operations were halted. Existing customers were left with limited information and may need to await the bankruptcy proceedings to learn about potential refunds. The company has recommended that these customers seek further treatment and advice from local dentists or orthodontists.

SmileDirectrClub went public in September 2019 with an approximate valuation of $8.9 billion.

By September 2023, the company ceased its global operations and filed for bankruptcy taking its customer by surprise

11. Vesttoo

Vesttoo is an Israeli insurance start up that connects the insurance industry and the capital markets by combining AI-powered technology with expertise in data science, insurance, and finance.

In August 2023, the company announced that it was laying off about 75% of its staff and closing some offices in Asia, as it tries to recover from a scandal over a fraudulent letter of credit used as collateral in a transaction with an insurer.

Vesttoo - partly backed by Banco Santander's fintech venture capital arm Mouro Capital - was in the process of raising around $200 million in a late stage funding round that would value the firm at near $2 billion, but the company said it was currently not moving ahead with the fundraising. Led by Mouro, Vesttoo last raised $80 million at a $1 billion value in October 2022. At the time it said it would use the funds to further expand its global presence.

The company was reportedly under an investigation by the FBI Financial Crimes team, which is looking into the alleged fraud.

12. Proterra

Proterra Inc., founded in 2004, is an American company that specializes in electric vehicle technology, specifically in the production of electric transit buses and battery systems for heavy-duty vehicles. The company gained prominence for its innovative approach in electric vehicle (EV) technology, launching its first battery-electric bus, the Proterra EcoRide, in 2010. This was followed by the Proterra Catalyst in 2014 and the ZX5 line in 2020. Proterra's electric buses featured advanced technology, such as fast-charging batteries and composite chassis, which enhanced their performance and efficiency.

Over the years, Proterra expanded its business to include not just electric buses but also battery systems for other heavy-duty EVs, such as cargo vans and construction equipment. The company also developed a charging infrastructure business to support commercial vehicle fleets. This diversification seemed to position Proterra well in the EV sector, and it went public in 2021 through a merger with a special purpose acquisition company, valued at $1.6 billion.

However, despite its early success and promising technology, Proterra faced financial challenges. In August 2023, Proterra filed for Chapter 11 bankruptcy. This development was attributed to several factors. The company faced difficulties scaling its three business lines (battery systems, transit unit, and charging infrastructure) simultaneously, which led to significant capital burn. The slow and budget-tight nature of deals with transit agencies, which often involved customized manufacturing for each contract, further strained Proterra's finances. Inflation and supply chain constraints added to these challenges, leading to delays and penalties.

Phoenix Motorcars acquired Proterra Transit business line for $10 million, while Volvo Group acquired Proterra Powered unit for $210 million.

Proterra went public in 2021 through a merger with a special purpose acquisition company, valued at $1.6 billion

By the summer of 2023 the company was in significant financial distress.

13. AppHarvest

AppHarvest, Inc. is an American company that grows food indoors in the Appalachian region of the United States. The founder, Jonathan Webb, wants to use Kentucky’s location to lower carbon emissions by delivering fresh produce to nearby markets in the Midwest and East Coast. The company went public in 2020 via SPAC transaction. However, in July 2023, AppHarvest filed for bankruptcy protection to restructure its debts. The company plans to continue its operations at the farms and supply its products to various grocery stores, restaurants and food service outlets.

14. VanMoof

VanMoof is a Dutch company known for designing and producing sleek, innovative electric bicycles. Founded in 2009 by brothers Taco and Ties Carlier, the company has gained a reputation for its focus on urban mobility, integrating technology and design in its products. Initially focused in Europe, VanMoof has expanded globally, with a significant presence in the United States and Asia. They have a growing network of brand stores and service hubs in major cities around the world, complemented by online sales.The brand has cultivated a loyal customer base, appealing to tech-savvy urban commuters and those looking for a stylish, efficient mode of transportation. VanMoof primarily sells its bikes directly to consumers through its website and brand stores. This direct-to-consumer model allows for better control over customer experience and pricing.

VanMoof's bikes are positioned in the higher price segment, which may not be accessible to all consumers. Some customers have reported issues with bike maintenance and customer service, although the company has been working to improve these areas.

In July 2023, VanMoof sought legal protection in the Dutch courts to address its financial challenges and subsequently filed for bankruptcy. VanMoof faced financial difficulties due to a combination of factors, including quality issues that required costly warranty repairs, missed interest payments on loans from retail investors, and the company's inability to pay its bills. The company reportedly posted losses of about €78 million over each of the last two years. VanMoof's custom design also meant that its bikes required specialized service and custom parts, which made repairs difficult for regular bike shops. The bankruptcy of VanMoof has resulted in closed shops, unfulfilled orders, and stalled repairs, which have been a source of frustration for VanMoof owners.

Following the bankruptcy, the court appointed trustees to explore the sale of VanMoof's assets to a third party to keep the company running. Several companies expressed interest in acquiring the bankrupt e-bike brand, with Lavoie, an e-scooter maker, ultimately acquiring VanMoof.

15. Lordstown Motors

Lordstown Motors, an American electric truck manufacturer, was founded in Ohio in 2019 with the goal of producing the Endurance, an electric pickup truck with in-wheel drive and hub motor technology. The company filed for Chapter 11 bankruptcy protection on June 27, 2023, after selling fewer than 10 vehicles. It also sued Foxconn for allegedly breaching an investment agreement and misleading the company about plans to collaborate on vehicle development. According to the complaint filed by Lordstown in bankruptcy court, Foxconn agreed to invest up to $170 million in Lordstown in exchange for a 10% stake and a seat on the board. Foxconn also promised to collaborate with Lordstown on developing future vehicles, such as a van and an SUV. However, Lordstown claims that Foxconn failed to fulfill its commitments and instead attempted to renegotiate the terms of the agreement.

In August 2020, Lordstown Motors merged with DiamondPeak Holdings, a special purpose acquisition company (SPAC). This transaction made Lordstown Motors a publicly traded company in October 2020, with a valuation of $1.6 billion. The deal was one of the quickest SPAC deals of the year.

In November 2021, Lordstown Motors and Foxconn signed an agreement in which Lordstown would sell its production facility to Foxconn for $230 million and Foxconn would invest $50 million in Lordstown Motors in exchange for a 10% stake in the company.

By the end of 2022, the company produced only approx. 30 units of the Endurance pick-up

16. IRL (In Real Life)

IRL (In Real Life) was a social media company founded in 2017 and headquartered in San Francisco, California. It was designed as a social planning application to help users stay connected in real life. The app focused on allowing users to track events, manage social calendars, and stay in touch through invitations. IRL gained significant traction, reaching a market valuation of $1.2 billion as of June 2021, with total funding amounting to $197 million.

The company aimed to connect users through in-person events, promoting social interactions outside of digital platforms. It was founded with the vision of countering the disconnection often felt through traditional social media apps. IRL offered various features like two-way sync for Google Calendar, group chats, user profiles, and categorization of events, which facilitated the organization of in-person gatherings.

However, despite its promising start and substantial user growth, IRL faced challenges. The company was significantly impacted by the COVID-19 pandemic, which led to a pivot towards marketing virtual livestreamed events in partnership with companies like Live Nation, Ticketmaster, and Twitch, among others.

In 2023, a major setback occurred when it was revealed that a large portion of IRL's user base was not genuine. An investigation by the board of directors discovered that 95% of the reported twenty million accounts were automated bots, drastically reducing the actual user count to around one million. This revelation led to the decision to shut down IRL, with the app formally closing in June 2023.

From the lawsuit by SoftBank against IRL: On April 5, 2021, in an email to an early investor in IRL, Abraham Shafi stated that “due to a ton of inbound demand,” IRL was in a “Series C fundraising process.” Abraham Shafi’s email set forth a list of “Highlights,” touting IRL’s successes with active user growth and retention, and it embedded a graphic listing figures of Daily Active Users and Weekly Active Users (respectively, “DAU” and “WAU”)

17. Cyxtera

Cyxtera provides data center colocation and interconnection services to various customers, including enterprises, service providers, and government agencies. It has a global footprint of more than 60 data centers in over 30 markets. Cyxtera went public in 2021 thorugh merger with SPAC and is listed on the Nasdaq stock exchange under the symbol CYXT. In June 2023, Cyxter filed for U.S. bankruptcy protection as it struggles to pay down debt and faces a severe funding crunch. Cyxtera shares have dropped more than 90% since it listed on the Nasdaq.

Cyxtera went public via merger with SPAC and listed on NASDAQ in 2021

In June 2023, Cyxtera filed for U.S. bankruptcy protection. The company plans to continue operations through the restructuring process.

18. Virgin Orbit

Virgin Orbit was a company within the Virgin Group that provided launch services for small satellites. The company was formed in 2017 as a spin-off of Richard Branson's Virgin Galactic space tourism venture to develop and market the LauncherOne rocket. On December 30, 2021, Virgin Orbit underwent a SPAC merger with NextGen Acquisition Corp, and became a publicly traded company (symbol VORB) at the NASDAQ stock exchange. At the SPAC merger Virgin Orbit was valued at $3.7 billion in equity. LauncherOne made six flights from 2020 to 2023, resulting in four successes and two failures. After the second failure, in January 2023, and an inability to secure additional financing, the company laid off 675 people, or approximately 85% of the staff and suspended operations in March 2023, filing for Chapter 11 bankruptcy on May 22, 2023.The company's remaining assets were sold off to various aerospace companies for a total of $36 million, less than 1% of the company's valuation upon IPO.

19. Plastiq

Plastiq is a San Francisco-based lending and payments startup that allows small businesses to pay their bills with a credit card. In the end of May 2023, it filed in Delaware to continue operating under Chapter 11 of the federal bankruptcy code. In early 2021, Plastiq hoped to go public through a special purpose acquisition company (SPAC), but the deal did not go through. Plastiq laid off 85 employees and contractors in February 2023, and it had to pause its payment services briefly in March 2023 when Silicon Valley Bank collapsed. Since 2014, Plastiq had raised over $140 million in funding from Valar Ventures, Khosla Ventures and Top Tier Capital Advisors among others.

20. Vice Media Group

Vice Media Group is an American-Canadian digital media and broadcasting company that was founded in 1994 in Montreal, Quebec, Canada. It started as a magazine called Voice of Montreal that covered music, art, trends and drug culture. Before bankruptcy Vice Media Group had five main business areas: Vice.com (digital content), Vice Studios (film and TV production), Vice TV (also known as Viceland), Vice News, and Virtue (an agency offering creative services). Vice Media Group claimed to be the world’s largest independent youth media company, with offices in 35 cities across the globe and content in 25 languages.

The company was valued at $5.7bn (£4.5bn) in 2017 and was once heralded as part of vanguard of companies set to disrupt the traditional media landscape with edgy, youth-focused content spanning print, events, music, online, TV and feature films.

In May 2023, Vice filed for Chapter 11 bankruptcy as part of a plan to sell itself to a consortium of companies and was later acquired by Fortress Investment Group.

In February 2024, Vice announced that it will cut hundreds of jobs as will stop publishing on Vice.com

21. BuzzFeed News

BuzzFeed News was an American news website published by BuzzFeed from 2011 to 2023. It won the George Polk Award, The Sidney Award, the National Magazine Award, the National Press Foundation award, and the Pulitzer Prize for International Reporting.

BuzzFeed News was founded in 2011 by Jonah Peretti, the founder of BuzzFeed. BuzzFeed News was known for its innovative use of social media and its focus on digital storytelling. The website also had a strong reputation for investigative journalism. In 2017, BuzzFeed News published the Steele dossier, a collection of intelligence reports that alleged that Russia had interfered in the 2016 United States presidential election to help Donald Trump win.

BuzzFeed News was shut down in April 2023 as part of a 15% workforce cut at BuzzFeed. The decision was reportedly made due to changes to news-related policies of social media platforms such as Facebook.

Early BuzzFeed pitch deck, prior to BuzzFeed News creation in 2011

BuzzFeed went public through SPAC in December 2021, whith BuzzFeed News positioned as core of the news vertical and "A leading news brand for yound readers" boasting 24 million monthly unique visitors

In April 2023, Buzzfeed News was shut down part of the strategy to reduce fixed cost structure and re-focus flagship BuzzFeed brand on entertainment aiming to grow a significant direct audience at HuffPost

22. Bed Bath & Beyond

Bed Bath & Beyond was a leading retailer of home goods in North America. Founded in 1971 and listed on the stock market in 1992, the company achieved a market value of approximately $17 billion in 2013. However, the company faced several challenges in the following years, such as increased online competition, shifting consumer tastes, lack of innovation, inefficient capital allocation and the impact of the COVID-19 pandemic. Despite several attempts to revive the business, the company could not sustain its profitability and growth.

In 2023, the company became involved in a speculative trading frenzy driven by online platforms such as Reddit, which caused its stock price to fluctuate significantly. Eventually, the company filed for bankruptcy protection in April 2023 and announced its intention to liquidate its assets and close its stores.

Under a Bankruptcy Court supervised process, the Bed Bath & Beyond brand was acquired by Overstock in June for $21.5 million. Following this acquisition, Overstock is being rebranded as Bed Bath & Beyond – an ecommerce only retailer. The Overstock brand will sunset over time.

Legion Partners, an activist investor, bought a stake in the company in 2019 and demanded changes. It issued a strategic plan that outlined how to boost performance and profitability. It also succeeded in getting several of its nominees on the board of directors.

In August 2022, the company made one of the last attempts to turn around the business, announcing sweeping changes focused on liquidity, store traffic and assortment, among other things.

Bed Bath & Beyond brand was acquired by Overstock in June 2023 for $21.5 million.

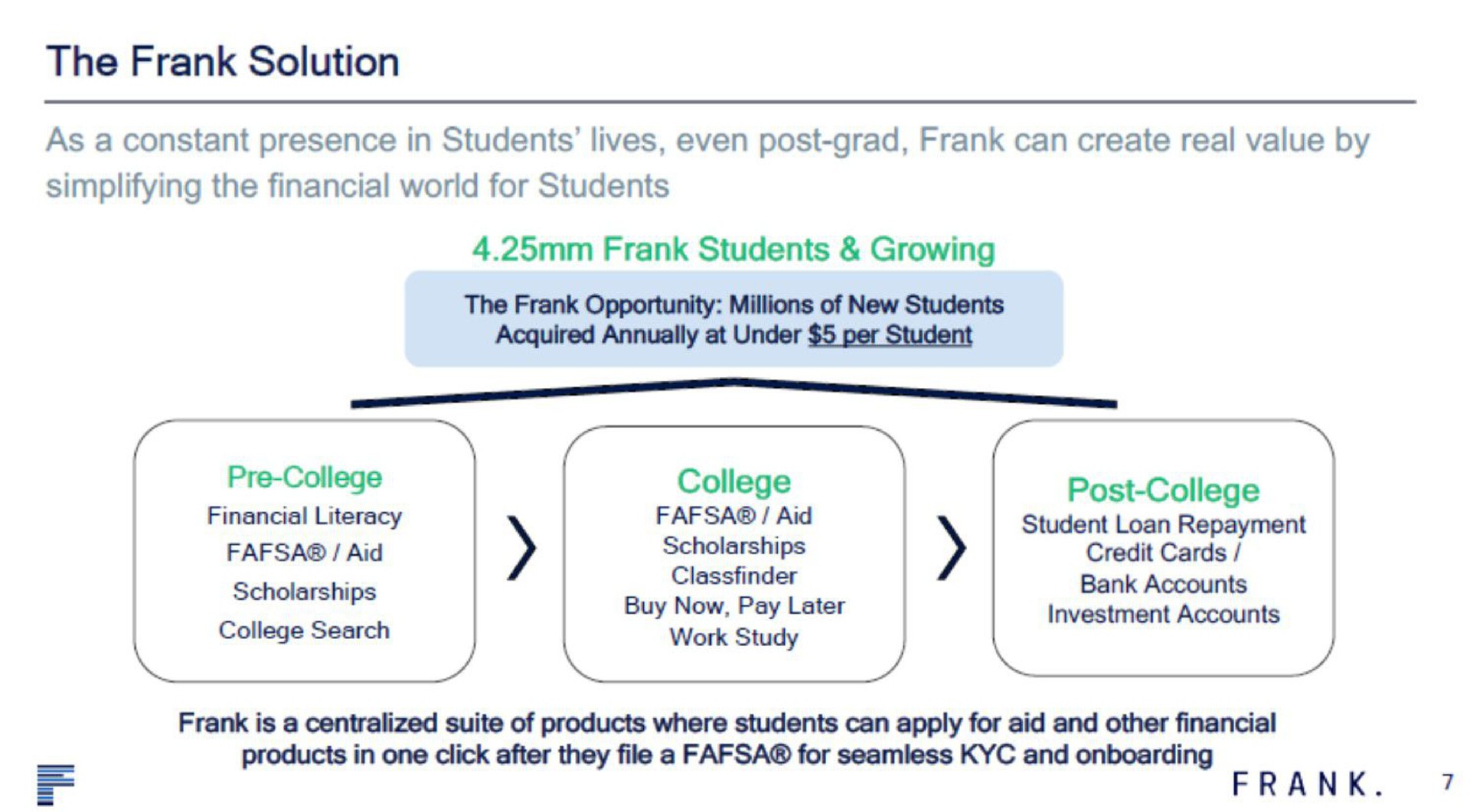

23. Frank

Frank was a software startup that claimed to help students get the most out of the student loan process by simplifying the application forms and finding the best options for them. Frank was founded by Charlie Javice, fintech entrepreneur who was featured on Forbes 30 under 30 list in 2019. Frank was acquired by JPMorgan Chase in September 2021 for $175 million. In 2023, JPMorgan Chase sued Frank and Javice for fraud, accusing them of inventing millions of fake customers to boost their value and lying about their scale and success. Javice also sued JPMorgan Chase for undermining Frank's value and firing her before paying her $28 million as part of the acquisition deal. In April 2023, Javice was charged by the Department of Justice with defrauding JPMorgan Chase.

Partial pitch deck used by Frank during sale process to JPMorgan Chase (taken from complaints by JPMorgan and US Justice Department)

24. First Republic Bank

First Republic Bank was a commercial bank and provider of wealth management services headquartered in San Francisco, California. It catered to high-net-worth individuals and operated 93 offices in 11 states, primarily in New York, California, Massachusetts, and Florida. On May 1, 2023, as part of the 2023 global banking crisis, the FDIC announced that First Republic had been closed and sold to JPMorgan Chase.

25. Credit Suisse

Credit Suisse was a leading global financial services company headquartered in Zurich, Switzerland. It was founded in 1856 and offered a range of services, including investment banking, private banking, wealth management, and asset management. It had over 50,000 employees and 1.3 trillion Swiss francs in assets under management by 2022. However, Credit Suisse collapsed in March 2023 after suffering huge losses from its involvement in several scandals and risky bets. The bank was hit by the collapse of Greensill Capital, a supply chain finance firm that it had invested in and sold to its clients. It also faced massive losses from the implosion of Archegos Capital Management, a family office that defaulted on its margin calls. In addition, Credit Suisse faced legal troubles from its role in the Mozambique debt scandal and the 1MDB corruption case. These events eroded the bank’s capital, reputation, and confidence, and led to the resignation of several senior executives and board members. Credit Suisse filed for bankruptcy in March 2023 and was bought by rival UBS for 3 billion CHF (about $3.3 billion USD).

26. Silicon Valley Bank

Silicon Valley Bank (SVB), a subsidiary of SVB Financial Group, was the 16th largest bank in the United States. The bank had assets of about $209 billion in December 2022. Silicon Valley Bank provided business banking services for companies at every stage, but it was particularly well-known for serving startups and venture-backed firms. Silicon Valley Bank saw massive growth between 2019 and 2022, which resulted in it having a significant amount of deposits and assets. In March 2023 SVB was shut down after its investments greatly decreased in value (mostly due to rapid increase of interest rates by the Federal Reserve Bank) and its depositors withdrew large amounts of money, among other factors. Later in March, First Citizens Bank bought up all deposits and loans of the failed bank.

By the end of 2021, SVB reached peak results demonstrating “outstanding earnings” and “exceptional growth” on the back of historically low rates and rapid growth of tech sector

Rising rates put extreme pressure on SVB’s balance sheet, which to a large degree consisted of rapidly depreciating treasuries, and led company to announce unexpected capital raise on March 8, 2023. Transaction was poorly communicated and led to wide-spread panic among clients.

On March 10, 2023, SVB was take over by FDIC with core assets later sold to First Citizens Bank.

27. Signature Bank

Signature Bank was an American full-service commercial bank headquartered in New York City and with 40 private client offices in the states of New York, Connecticut, California, Nevada, and North Carolina. At the end of 2022, the bank had total assets of $110.4 billion and deposits of $82.6 billion. For most of its history, it had offices only in the New York City area. In the late 2010s, it began to expand geographically and in terms of services, though it was most noted for its 2018 decision to open itself to the cryptocurrency industry. By 2021, cryptocurrency businesses had represented 30 percent of its deposits. Banking officials in the state of New York closed the bank on March 12, 2023, two days after the failure of Silicon Valley Bank (SVB). After SVB failed and in light of the closure of the cryptocurrency-friendly Silvergate Bank earlier in the week, nervous customers withdrew more than $10 billion in deposits. It was the third-largest bank failure in U.S. history. On March 19, a week after the bank closure, the FDIC sold the resulting bridge bank, most of its deposits, and its 40 branches to New York Community Bancorp to be absorbed by its Flagstar Bank subsidiary. Some $4 billion in digital asset banking deposits and $60 billion in loans were excluded from the transaction.

28. Silvergate Bank

Silvergate Bank was a California bank that specialized in providing services for cryptocurrency users and businesses. The bank was founded in 1988 and started serving the crypto sector in 2016. It conducted an IPO in 2019 and became one of the leading banks for crypto innovation. It offered a platform called the Silvergate Exchange Network (SEN) that enabled fast and secure transactions between crypto exchanges and institutional investors. However, Silvergate Bank collapsed in March 2023 after being hit by a series of shocks in the crypto market. The bank suffered a massive run on deposits after the bankruptcy of FTX, one of its major customers and partners. The bank also faced losses from the fall in cryptocurrency prices and the regulatory crackdown on crypto activities. The bank announced that it was shutting down and liquidating its assets after failing to secure a bailout or a buyer. The collapse of Silvergate Bank triggered a wave of panic and uncertainty in the crypto sector, as many customers and businesses lost access to their funds and services. The bank’s failure also raised questions about the viability and sustainability of crypto banking and innovation.

29. BlockFi

BlockFi is a digital asset lender founded by Zac Prince and Flori Marquez in 2017. It is based in Jersey City, New Jersey. It was once valued at $3 billion. In July 2022, it was announced that the cryptocurrency exchange FTX made a deal with an option to buy BlockFi for up to $240 million. The deal included a $400 million credit facility for the company. In November 2022, after the declaration of bankruptcy by FTX, the company halted withdrawals on its platform. On November 28, BlockFi officially filed for Chapter 11 bankruptcy protection with more than 100,000 creditors, according to filings. In March 2023, following the collapse of Silicon Valley Bank, the U.S. Trustee watchdog overseeing BlockFi's bankruptcy revealed that BlockFi had around $227 million in uninsured funds at the bank.

30. FTX

FTX was a centralized cryptocurrency exchange specializing in derivatives and leveraged products. It was founded by Sam Bankman-Fried in 2019 and was one of the world’s largest cryptocurrency exchanges. It enabled customers to trade digital currencies for other digital currencies or traditional money, and vice versa. FTX collapsed in November 2022 and filed for bankruptcy protection in the U.S. The collapse was triggered by a news report that revealed that Alameda Research, the quantitative trading firm behind FTX, had been manipulating the crypto market by using fake trades and bots. This led to a loss of trust and a massive sell-off of FTX tokens, which plunged by more than 90% in value. FTX also faced legal actions from regulators and investors who accused it of fraud, market manipulation, and violating securities laws.

FTX pitch deck which reportedly was used to taise over $1bn in 2021.

31. Voyager Digital

Voyager was a cryptocurrency brokerage firm that enabled customers to buy, sell, trade and store cryptocurrency. At its peak, the company boasted 3.5 million active customers and over 100 unique crypto assets available for trading. Voyager filed for bankruptcy protection in July 2022, citing volatility in cryptocurrency markets and a default on a large loan to crypto hedge fund Three Arrows Capital (3AC). The company had more than 100,000 creditors and liabilities of between $1 billion and $10 billion. It also had a large customer base among do-it-yourself crypto investors. The company tried to sell its assets to FTX and Binance.US, but both deals fell through due to regulatory issues and market volatility.

Voyager Digital was founded in 2018 by ex-Uber CTO Oscar Salazar and others. The company went public on the Toronto stock exchange in 2019 through a reverse merger. Later, Voyager completed a string of acquisitions to speed up growth. By the end of 2020, Voayger had 120k accounts.

By the end of Q1 2022, Voyager claimed to have 3.5 million unique customers

In July 2022, Voyager filed for bankruptcy protection citing volatility in cryptocurrency markets and a default on a large loan made to crypto hedge fund Three Arrows Capital (3AC).

32. Nikola

Nikola Corporation is an American manufacturer of heavy-duty commercial battery-electric vehicles, fuel-cell electric vehicles, and energy solutions. It was founded in 2014 by Trevor Milton and went public on June 4, 2020, at one point becoming the most valuable car stock in the world by market cap.

Nikola has faced several challenges and controversies in its history, such as accusations of fraud, delays in production, partnership disputes, and executive departures. In September 2020, Trevor Milton resigned as executive chairman amid allegations of misleading investors and making false claims about the company’s technology. In February 2021, Nikola agreed to pay $125 million to settle a class-action lawsuit by shareholders who claimed they were defrauded by the company.

Despite these setbacks, Nikola has also made some progress and achievements in its business, such as launching new products, securing orders, expanding its presence, and improving its financials. In September 2022, Nikola launched its first battery-electric truck, the Tre BEV, in Europe and began taking orders from customers. In February 2023, Nikola announced that it had delivered 400 vehicles in 2022 and projected to deliver between 600 and 800 vehicles in 2023. Nikola also reported a revenue of $79 million and a net loss of $383 million for 2022.

33. Celsius Network

Celsius Network was a cryptocurrency lending company that allowed users to deposit, earn, borrow, and send various digital assets. The company was founded in 2017 by Alex Mashinsky, a serial entrepreneur and inventor of Voice over IP (VoIP). Celsius claimed to have over 1 million users and $20 billion in assets under management by 2021. However, Celsius faced regulatory scrutiny, legal challenges, and security breaches that undermined its credibility and solvency. In July 2022, Celsius filed for bankruptcy after suffering a massive withdrawal of funds by its customers and creditors. The company revealed a $1.2 billion deficit in its bankruptcy filings and faced multiple lawsuits from investors and regulators. In February 2023, Celsius chose NovaWulf Digital Management, an asset manager, as the winning bidder for its bankruptcy exit. NovaWulf will take over the operations of a new company that will honor the claims of Celsius customers and creditors.

34. Terraform Labs

Terraform Labs was a South Korean-based company that developed the Terra blockchain protocol and its associated cryptocurrency ecosystem, including the algorithmic stablecoin TerraUSD (UST) and its reserve asset Luna. Founded in 2018 by Do Kwon and Daniel Shin, the company aimed to build a decentralized financial system, attracting significant investment and achieving notable success before facing a catastrophic collapse in May 2022.

Early promise and rapid growth: Launched in 2019, UST aimed to maintain a stable value of $1 through an algorithm that dynamically adjusted the supply of Luna based on demand. The Terra ecosystem attracted various decentralized applications (dApps) and users, leading to significant growth in the value of Luna and UST. Terraform Labs secured funding from prominent venture capital firms, raising over $200 million.

The downfall: In May 2022, a series of events triggered a depeg of UST from $1, causing a death spiral as Luna's value plummeted and UST further lost its peg. The Terra blockchain was halted, and the company subsequently filed for bankruptcy in January 2024. Do Kwon, the co-founder, became subject to an Interpol Red Notice. He was later arrested in Montenegro after a six-month manhunt.

Aftermath: The Terra ecosystem collapse sent shockwaves through the cryptocurrency industry, raising concerns about the stability of algorithmic stablecoins. A new version of the Terra blockchain, Terra 2.0, launched in May 2022, attempting to revive the project with a revised economic model.

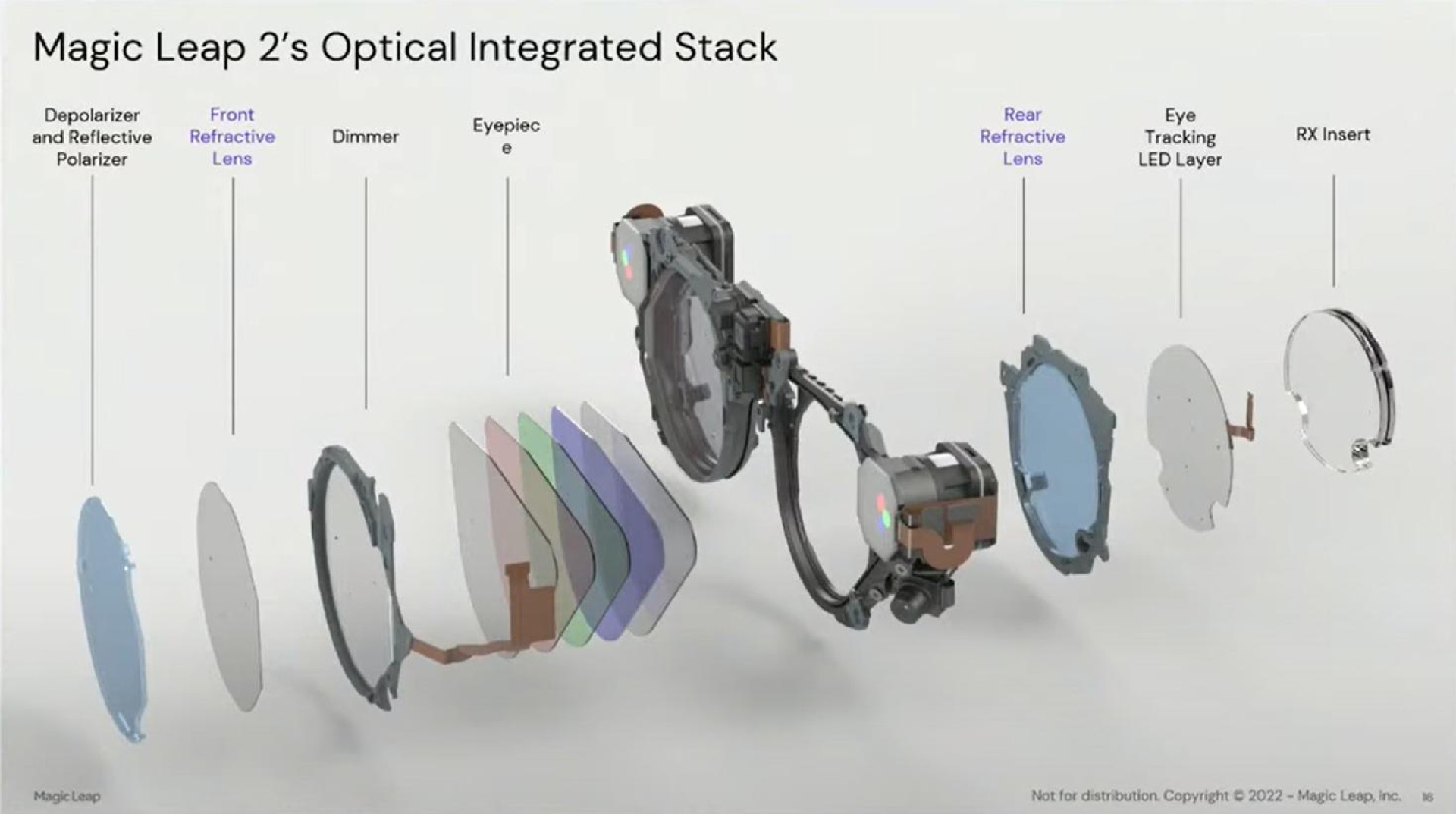

35. Magic Leap

Magic Leap was founded by Rony Abovitz in 2010. In October 2014, when the company was still operating in stealth mode (but already reported to be working on projects relating to augmented reality and computer vision), it raised more than $540 million of venture funding from Google, Qualcomm, Andreessen Horowitz and Kleiner Perkins, among other investors. On December 9, 2015, Forbes reported on documents filed in the state of Delaware, indicating a Series C funding round of $827m. This funding round could bring the company's total funding to $1.4 billion, and its post-money valuation to $3.7 billion. On February 2, 2016, Financial Times reported that Magic Leap further raised another funding round of close to $800m, valuing the startup at $4.5 billion On July 1, 2018, the device was finally demoed, the general reaction was of disappointment with what was shown, based on what had been promised up to that point. On May 28, 2020, Rony Abovitz announced that Magic Leap had raised $350 million in new funding and that he would be stepping down as CEO. In September 2020, The Information reported that the company valuation was $6.4 billion in 2019 and by June 2020 it dropped to $450 million, by 93 percent in six months. In October 2021, Magic Leap's CEO announced Magic Leap 2 would be the "industry’s smallest and lightest device" for business uses, with a significantly larger field of view, and include a dimming feature to be used in brightly lit settings. On September 30th, 2022, Magic Leap officially released its latest AR Headset, the Magic Leap 2.

36. MoviePass

MoviePass, Inc. is an American subscription-based movie ticketing service. It was launched in 2011 and allowed subscribers to purchase up to a movie ticket a day for a monthly fee. In 2017, the service was acquired by Helios and Matheson Analytics (HMNY) and the subscription cost was significantly lowered to $9.95 per month. Membership ballooned to over three million subscribers by June 2018, but the service began to suffer from financial issues, which ultimately caused the service to shut down in September 2019. On January 28, 2020, MoviePass' parent company HMNY filed for Chapter 7 bankruptcy and announced that it had ceased all business operations. On November 10, 2021, MoviePass co-founder Stacy Spikes was approved ownership of the company by a New York bankruptcy court judge. Spikes—who was fired from the company in 2018, shortly after it was acquired by HMNY—announced a relaunch of the service in 2022.

37. Wirecard

Wirecard was a German payment processor and financial services provider that was founded in 1999 and became part of the DAX index. The company claimed to offer innovative solutions for electronic payments, risk management, and card issuing. It had over 5,000 employees and 300,000 customers in 200 countries by 2019. However, Wirecard was involved in a massive accounting fraud that led to its insolvency in 2020. The company was accused of inflating its revenues, profits, and cash balances by falsifying its accounts and transactions. It admitted that €1.9 billion of its cash was missing and could not be traced. The fraud was exposed by whistleblowers, journalists, and auditors after years of allegations and investigations. The scandal resulted in the arrest and resignation of several executives and board members, including former CEO Markus Braun. It also triggered a series of lawsuits, inquiries, and reforms involving its investors, creditors, customers, regulators, auditors, and banks.

38. Fyre Festival

Fyre Festival was a fraudulent luxury music festival that was supposed to take place in the Bahamas in April and May 2017. The festival was founded by Billy McFarland, a con artist, and Ja Rule, a rapper, and was promoted by celebrities and influencers on social media. The festival promised a glamorous experience with top musical acts, gourmet food, luxury villas, and yachts. However, the festival turned out to be a complete disaster, as the organizers failed to deliver on any of their promises. The festival-goers arrived to find a chaotic and unsafe site with no music, no food, no accommodation, and no transportation. Many of them were stranded on the island for days, facing hunger, dehydration, and theft. The festival was widely mocked and criticized by the media and the public, and became the subject of two documentaries and several lawsuits. McFarland was arrested and convicted of fraud and sentenced to six years in prison.

Infamous pitch deck contains many of the exaggerated claims and outright lies, touting festivals lineup of more than 60 "Fyre Starters," social-media influencers who were enlisted to promote the festival Pitch deck leans heavily on Fyre's partnership with Kendall Jenner who reportedly received $250k for a single Instagram post, which she has since deleted

39. 1MDB

1MDB is a Malaysian state fund that was set up in 2009 to promote development in the country. However, it became the center of a corruption, bribery and money laundering scandal that involved the former prime minister Najib Razak and his associates. It is estimated that billions of dollars were embezzled from 1MDB and diverted to various accounts and assets around the world, including luxury real estate, art, jewelry, yachts and even a Hollywood movie. The scandal sparked investigations in several countries, including Malaysia, the US, Singapore, Switzerland and Australia. Najib Razak was convicted of abuse of power and money laundering in 2020 and sentenced to 12 years in prison, but he is appealing the verdict. Several other individuals and entities have also been charged or fined in relation to the 1MDB scandal, including Goldman Sachs, which agreed to pay $3 billion to settle the case. Goldman Sachs was a key player in the 1MDB scandal, as it helped the fund raise $6.5 billion through three bond offerings in 2012 and 2013.

40. Greensill Capital

Greensill Capital was a financial services company based in the United Kingdom and Australia. It focused on the provision of supply chain financing and related services. The company was founded in 2011 by Lex Greensill, a former banker and adviser to the UK government. It claimed to have revolutionized the way businesses pay their suppliers and access working capital. It had over 1,000 clients and 5 million suppliers in 175 countries by 2020. However, Greensill Capital collapsed in March 2021 after losing its main insurer and facing a liquidity crisis. The company was accused of misrepresenting its assets, overexposing itself to a single client (GFG Alliance), and engaging in questionable practices such as reverse factoring and future receivables. The company filed for insolvency protection on 8 March 2021 and was sold to Apollo Global Management for $60 million134. The collapse of Greensill Capital triggered a series of investigations, lawsuits, and scandals involving its investors (such as Credit Suisse and SoftBank), its customers (such as GFG Alliance and Sanjeev Gupta), its regulators (such as the UK Financial Conduct Authority and the Swiss Financial Market Supervisory Authority), and its lobbyists (such as former UK Prime Minister David Cameron).

41. uBiome

uBiome was a biotechnology company founded in 2012 that focused on the analysis of the human microbiome, the collection of microbes living in and on the human body. They provided services that allowed individuals to sequence their microbiome for health insights, primarily through at-home sampling kits. The company aimed to give consumers and researchers insights into the role of the microbiome in health and disease.

uBiome's services involved analyzing the genetic material of bacteria and other microorganisms in samples provided by customers, like stool, to understand the composition and diversity of their microbiome. This information was used to offer insights into various aspects of health, including digestion, immunity, and the potential for certain diseases.

uBiome faced several challenges and controversies. The company's scientific methods and the validity of its health claims were subjects of debate within the scientific community. In addition, there were legal and regulatory challenges.

In 2019, the FBI raided uBiome's offices, investigating issues related to billing practices and insurance fraud. Following these legal challenges and financial difficulties, uBiome filed for bankruptcy in September 2019 and ceased operations.

42. Theranos

Theranos was an American health technology company that claimed to have developed a revolutionary blood testing device that could perform hundreds of tests with a single drop of blood. The company was founded in 2003 by Elizabeth Holmes, who was hailed as a visionary and a billionaire by the media and investors. However, Theranos was exposed as a massive fraud in 2015, when it was revealed that its device was unreliable, inaccurate, and often used conventional blood testing machines from other companies. Theranos faced multiple lawsuits, investigations, and sanctions from regulators, customers, investors, and former employees. The company dissolved in 2018, and Holmes was convicted of four counts of fraud and four counts of conspiracy in 2022. She was sentenced to 11 years in prison, but has appealed the verdict and delayed the start of her sentence.

Early Theranos pitch deck used by the company while seeking to raise $30 million for what it referred to as a "pre-IPO transaction" and claiming that blood testing accuracy is comparable to "gold standards", whith business model aimed at clinical and preclinical trials for pharma companies, rather than at broader consumer market.

Presentation outlining the science, technology and key “inventions” underpinning the Theranos mini-lab. It was made in August 2016, a year after the scandal began to unravel in 2015 when a whistleblower raised concerns about Theranos’ flagship testing device.

43. Jawbone

Founding and early success: Founded in 1997 by Hosain Rahman and Alexander Asseily, the company initially focused on developing military-grade noise-canceling technology. In 2004, Jawbone, as it was commonly known, released its first product, a Bluetooth headset known for its stylish design and innovative features. The company gained popularity for its high-quality wireless speakers and Bluetooth headsets, becoming a major player in the audio technology market.

Shift to wearables and decline: In 2011, Jawbone entered the wearable technology market with the UP fitness tracker, one of the first commercially available wristbands that tracked steps, sleep, and other health metrics. The UP series achieved initial success, but the company faced increasing competition from Fitbit and other rivals. Jawbone struggled financially in its later years, despite attempts to diversify its product line and secure additional funding.

Closure and aftermath: In 2017, Jawbone was forced to shut down its operations and liquidate its assets. Some of Jawbone's intellectual property was acquired by Fitbit, while other assets were sold to various buyers. The company's founder, Hosain Rahman, went on to establish Jawbone Health, a venture focused on subscription-based health monitoring services.

Legacy: Jawbone is credited with playing a significant role in popularizing wireless headsets and fitness trackers. The company's innovative designs and focus on user experience influenced the development of wearables in the early 2010s. Jawbone's story also serves as a cautionary tale for startups, highlighting the challenges of competing in a rapidly evolving market.While Jawbone is no longer an active company, its impact on the wearables and audio technology industries continues to be felt today.

44. Kmart / Sears

Sears and Kmart used to be among the biggest retailers in the world. In 1973, when the Sears Tower was completed, it was the highest building on the planet with 110 floors.

Even after they joined forces as part of the Sears Holdings Corp. in 2005, they still had a remarkable number of 3,500 stores in the U.S. and more than 300,000 employees.

The Sears Kmart deal was a merger of two struggling retail giants in 2005, valued at $11 billion. The deal was led by Edward Lampert, a hedge fund manager who owned stakes in both companies and became the chairman of the new company, Sears Holdings. The transaction rationale was to create a stronger and more profitable retailer that could compete with Wal-Mart and Home Depot, by leveraging the brands, operations, and real estate of both Sears and Kmart. However, the deal did not deliver the expected results, and the company faced many challenges and eventually filed for bankruptcy in 2018. The Sears Tower, which had been renamed Willis Tower in 2009, was no longer the tallest building in the world, nor the symbol of Sears’ success.

45. Toys "R" Us

Toys "R" Us is an American toy, clothing, and baby product retailer. Established in 1957 the company capitalized on the baby boom making Toys ‘R’ Us a retail juggernaut. However, the rise of mass merchants and online retailers cost Toys "R" Us its share of the toy market. The company was further hampered after 2005 by a significant debt load, the result of a leveraged buyout organized by private equity firms. The company filed for bankruptcy in 2017 and 2018, closing all of its US, British, and Australian locations, with the last US stores closing by 2021. In August 2021, WHP Global announced that Toys "R" Us would be opening over 400 stores within Macy's starting in 2022.

In 2014, Toys "R" Us announced its "TRU Transformation" strategy, which concentrated on efforts to fix foundational issues affecting future growth, including making stores less cluttered, improving the customer experience, clearer pricing strategies and promotions, and tighter integration of its retail and online businesses.

By 2015, the company had refinanced its debt and improved its in-store and online experience.

Despite its efforts to improve, the company was unable to keep up with its debt payments of $400 million per year. This prevented it from investing in in-store improvements to compete with Amazon and Walmart. In September 2017, Toys "R" Us filed for Chapter 11 bankruptcy

46. Blockbuster Video

Blockbuster Video was an American company that rented videos and games. It was once the largest movie and game retailer in the world. However, it began to decline in the early 2000s due to competition from online streaming services such as Netflix, as well as poor management by activist investors. The company filed for bankruptcy in 2010 and closed all of its stores in 2014. Despite its downfall, Blockbuster Video remains a popular cultural icon. The company has been featured in movies, television shows, and video games. It has also been the subject of several documentaries.

In 2004, Blockbuster was controlled by Viacom and was on course to post historical revenue of ~$6bn under management of John Antioco. Viacom decided to sell its stake, positioning Blockbuster as “the largest movie and game retailer in the world”

In early 2005, Carl Ichan made a move initiating a proxy battle for the board of director seats. Blockbuster management rolled out a new strategy aimed to reassure shareholders.

Ultimately, Ichan was successful in appointing two directors and later gaining effective control of the board. Previous CEO, John Antioco continued to lead the company until 2007 working to expand the company into DVDs, VOD, etc.

However in 2007 Ichan and Antioco had a blow out over Antioco’s compensation (Ichan was famously stingy and didn’t want to pay). As a result Antioco left the company and the board appointed a retail specialist Jim Keyes (former CEO of 7-eleven) who chose to shift focus from online to the stores and tried to improve the company's finances through moves such as restoring late fees.

In 2008 Blockbuster made an attempt to buy a failing electronic retailer Circuit City to create a “global retail enterprise”. This move was badly received by investors and ultimately failed

By 2009 Blockbuster was in deep trouble, however Keyes continued pushing for improvement of stores as a way to save the company, with other channels appearing to be an afterthought

47. Lehman Brothers

Lehman Brothers was an American global financial services firm founded in 1847 by three German brothers who emigrated to the United States. It was one of the largest investment banks in the world, with about 25,000 employees and operations in more than 40 countries. It provided various services such as investment banking, trading, investment management, private banking, research, brokerage, private equity and more. However, Lehman Brothers collapsed in 2008 after filing for bankruptcy, becoming the largest bankruptcy in U.S. history. The main cause of its failure was its heavy involvement in the subprime mortgage market, which exposed it to huge losses when the housing bubble burst and the financial crisis began. Lehman Brothers could not find a buyer or a government bailout to save it from insolvency, and its collapse triggered a global panic and a credit crunch that worsened the economic downturn.

48. Bear Stearns

Bear Stearns was a New York City-based global investment bank and financial company that was founded in 1923. It was one of the largest and most respected firms on Wall Street, with a reputation for innovation and risk-taking. It offered various services such as securities trading, brokerage, investment banking, asset management, private equity and more. However, Bear Stearns collapsed in 2008 as part of the global financial crisis and recession. The main cause of its failure was its heavy exposure to the subprime mortgage market, which led to huge losses and liquidity problems when the housing bubble burst and the credit markets froze. Bear Stearns could not find enough funding to stay afloat, and faced a run on the bank by its clients and creditors. It was rescued by a government-backed sale to JPMorgan Chase at the shockingly low price of $2 per share, down from $170 a year earlier. Bear Stearns’ collapse was a stunning and dramatic event that marked the beginning of the worst financial crisis since the Great Depression. It also exposed the fragility and interconnectedness of the global financial system, and raised questions about the role of regulation and oversight.

49. Enron

The Enron scandal was an accounting scandal involving Enron Corporation, an American energy company based in Houston, Texas. Upon being publicized in October 2001, the company declared bankruptcy and its accounting firm, Arthur Andersen – then one of the five largest audit and accountancy partnerships in the world – was effectively dissolved.

The scandal involved Enron's executives employing accounting practices that falsely inflated the company's revenues and profits, while hiding its debts and losses. Enron also engaged in fraudulent trading activities that manipulated the energy markets and caused blackouts in California. The scandal resulted in one of the biggest bankruptcy filings in the history of the United States, with more than $60 billion in assets.

Several Enron executives, including former CEO Jeffrey Skilling and former chairman Kenneth Lay, were convicted of various crimes, such as conspiracy, fraud, insider trading and obstruction of justice. Skilling received the harshest sentence of anyone involved in the scandal, with 24 years in prison. Lay died of a heart attack before he could be sentenced.

Presentation to major creditors of Enron, which was given after the scandal and outlined the situation and action plan. A couple of weeks later, Enron filed for Chapter 11 bankruptcy protection.

50. Worldcom

WorldCom was the USA's second-largest long-distance telephone company. From 1999 to 2002, senior executives at WorldCom led by founder and CEO Bernard Ebbers orchestrated a scheme to inflate earnings in order to maintain WorldCom's stock price and avoid potential takeover bids. They did this by improperly recording $3.8 billion in expenses as capital expenditures, which boosted their reported profits and cash flow. The fraud was uncovered by an internal audit and resulted in WorldCom filing for bankruptcy in July 2002, the largest bankruptcy in U.S. history at the time. The SEC charged WorldCom with civil fraud and reached a $2.25 billion settlement. Several executives and the CEO were indicted on charges of securities fraud, conspiracy, and filing false documents with regulators. Ebbers was convicted and sentenced to 25 years in prison, but was released on compassionate grounds in 2020 due to his deteriorating health.

Presentation by Arthur Andersen (auditor of Worldcom and leading auditing firm at the time) to the audit committee of the company. Arthur Andersen collapsed by mid-2002, as details of its questionable accounting practices for energy company Enron and Worldcom were revealed amid the two high-profile bankruptcies.